Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

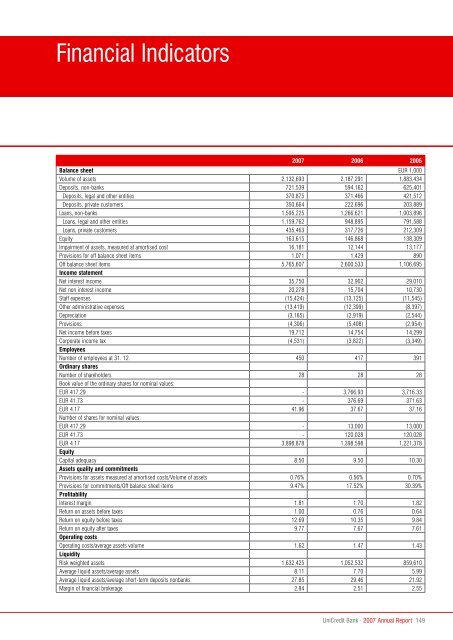

Financial Indicators<strong>2007</strong> 2006 2005Balance sheet EUR 1,000Volume of assets 2,132,693 2,187,291 1,883,434Deposits, non-banks 721,539 594,162 625,401Deposits, legal and other entities 370,875 371,466 421,512Deposits, private customers 350,664 222,696 203,889Loans, non-banks 1,595,225 1,266,621 1,003,896Loans, legal and other entities 1,159,762 948,895 791,588Loans, private customers 435,463 317,726 212,309Equity 163,615 146,868 138,309Impairment of assets, measured at amortised cost 16,181 12,144 13,177Provisions for off balance sheet items 1,071 1,429 890Off balance sheet items 5,765,607 2,600,533 1,106,695Income statementNet interest income 35,750 32,902 29,010Net non interest income 20,278 15,704 10,730Staff expenses (15,424) (13,125) (11,545)Other administrative expenses (13,419) (12,399) (8,397)Depreciation (3,165) (2,919) (2,544)Provisions (4,306) (5,408) (2,954)Net income before taxes 19,712 14,754 14,299Corporate income tax (4,531) (3,822) (3,349)EmployeesNumber of employees at 31. 12. 450 417 391Ordinary sharesNumber of shareholders 28 28 28Book value of the ordinary shares for nominal values:EUR 417.29 - 3,766.93 3,716.33EUR 41.73 - 376.69 371.63EUR 4.17 41.96 37.67 37.16Number of shares for nominal values:EUR 417.29 - 13,000 13,000EUR 41.73 - 120,028 120,028EUR 4.17 3,898,878 1,398,598 1,221,378EquityCapital adequacy 8.50 9.50 10.30Assets quality and commitmentsProvisions for assets measured at amortised costs/Volume of assets 0.76% 0.56% 0.70%Provisions for commitments/Off balance sheet items 9.47% 17.52% 30.39%ProfitabilityInterest margin 1.81 1.70 1.82Return on assets before taxes 1.00 0.76 0.64Return on equity before taxes 12.69 10.35 9.84Return on equity after taxes 9.77 7.67 7.61Operating costsOperating costs/average assets volume 1.62 1.47 1.43LiquidityRisk weighted assets 1,632,425 1,052,532 859,610Average liquid assets/average assets 8.11 7.70 5.99Average liquid assets/average short-term deposits nonbanks 27.85 29.46 21.92Margin of financial brokerage 2.84 2.51 2.55<strong>UniCredit</strong> Bank · <strong>2007</strong> Annual Report 149