Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

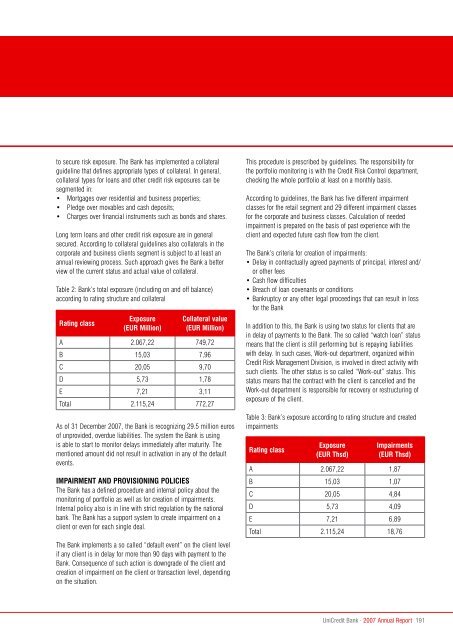

to secure risk exposure. The Bank has implemented a collateralguideline that defines appropriate types of collateral. In general,collateral types for loans and other credit risk exposures can besegmented in:• Mortgages over residential and business properties;• Pledge over movables and cash deposits;• Charges over financial instruments such as bonds and shares.Long term loans and other credit risk exposure are in generalsecured. According to collateral guidelines also collaterals in thecorporate and business clients segment is subject to at least anannual reviewing process. Such approach gives the Bank a betterview of the current status and actual value of collateral.Table 2: Bank’s total exposure (including on and off balance)according to rating structure and collateralRating classExposure(EUR Million)Collateral value(EUR Million)A 2.067,22 749,72B 15,03 7,96C 20,05 9,70D 5,73 1,78E 7,21 3,11Total 2.115,24 772,27As of 31 December <strong>2007</strong>, the Bank is recognizing 29.5 million eurosof unprovided, overdue liabilities. The system the Bank is usingis able to start to monitor delays immediately after maturity. Thementioned amount did not result in activation in any of the defaultevents.Impairment and provisioning policiesThe Bank has a defined procedure and internal policy about themonitoring of portfolio as well as for creation of impairments.Internal policy also is in line with strict regulation by the nationalbank. The Bank has a support system to create impairment on aclient or even for each single deal.The Bank implements a so called “default event” on the client levelif any client is in delay for more than 90 days with payment to theBank. Consequence of such action is downgrade of the client andcreation of impairment on the client or transaction level, dependingon the situation.This procedure is prescribed by guidelines. The responsibility forthe portfolio monitoring is with the Credit Risk Control department,checking the whole portfolio at least on a monthly basis.According to guidelines, the Bank has five different impairmentclasses for the retail segment and 29 different impairment classesfor the corporate and business classes. Calculation of neededimpairment is prepared on the basis of past experience with theclient and expected future cash flow from the client.The Bank’s criteria for creation of impairments:• Delay in contractually agreed payments of principal, interest and/or other fees• Cash flow difficulties• Breach of loan covenants or conditions• Bankruptcy or any other legal proceedings that can result in lossfor the BankIn a<strong>dd</strong>ition to this, the Bank is using two status for clients that arein delay of payments to the Bank. The so called “watch loan” statusmeans that the client is still performing but is repaying liabilitieswith delay. In such cases, Work-out department, organized withinCredit Risk Management Division, is involved in direct activity withsuch clients. The other status is so called “Work-out” status. Thisstatus means that the contract with the client is cancelled and theWork-out department is responsible for recovery or restructuring ofexposure of the client.Table 3: Bank’s exposure according to rating structure and createdimpairmentsRating classExposure(EUR Thsd)Impairments(EUR Thsd)A 2.067,22 1,87B 15,03 1,07C 20,05 4,84D 5,73 4,09E 7,21 6,89Total 2.115,24 18,76<strong>UniCredit</strong> Bank · <strong>2007</strong> Annual Report 191