Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report<br />

Management Report (CONTINUED)<br />

Credit demand in <strong>Austria</strong> remained weak in <strong>2010</strong>. Adjusted for the<br />

translation effect associated with the strong Swiss franc, lending<br />

volume in <strong>Austria</strong> in <strong>2010</strong> declined slightly. Demand for housing<br />

loans was very weak, though somewhat higher than in the previous<br />

year. Repayments <strong>of</strong> consumer loans and SME loans exceeded new<br />

business, leading to a slight decrease in total volume. Loans to corporate<br />

customers remained constant until the middle <strong>of</strong> <strong>2010</strong> and<br />

increased in the course <strong>of</strong> the second half <strong>of</strong> the year, in parallel<br />

with the recovery in investment activity. Although lending rates and<br />

deposit rates rose slightly towards the end <strong>of</strong> the year, bank customers<br />

in <strong>Austria</strong> saw interest rate levels in <strong>2010</strong> which were<br />

among the lowest in history. These developments reflected low<br />

money market rates and the flat yield curve. Moreover, the average<br />

period for which interest rates are locked in has shortened significantly<br />

over the past years.<br />

Although the <strong>Austria</strong>n economy recovered strongly in the course<br />

<strong>of</strong> <strong>2010</strong>, the repercussions <strong>of</strong> the sharp economic downturn in<br />

2008/2009 still had an impact on business insolvencies. While the<br />

total number <strong>of</strong> business insolvencies declined by about 8%, the<br />

total liabilities <strong>of</strong> insolvent businesses rose by 17%. Insolvencies <strong>of</strong><br />

private individuals also increased in <strong>2010</strong>, though not dramatically.<br />

As income trends were moderate and consumer demand was relatively<br />

robust, financial assets held by <strong>Austria</strong>n private households in<br />

the first nine months <strong>of</strong> <strong>2010</strong> increased at only half the growth rate<br />

seen in 2009. This development also reflects repayments <strong>of</strong> consumer<br />

loans. Deposits showed a particularly weak trend, hardly<br />

rising year-on-year. Somewhat stronger demand was again seen for<br />

mutual funds, but this did not yet compensate for the outflows in<br />

the period from mid-2007 to early 2009. New investments in<br />

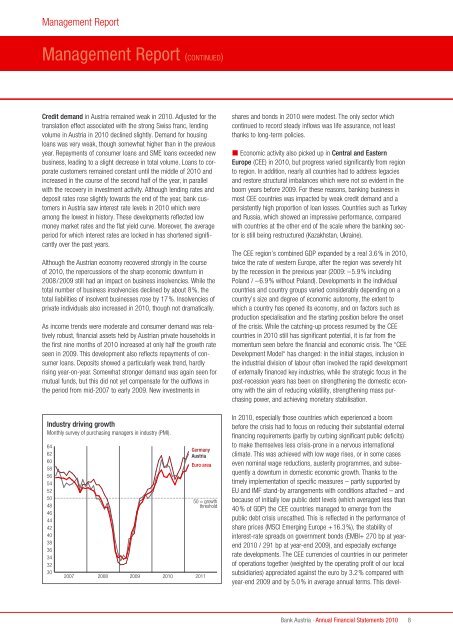

Industry driving growth<br />

Monthly survey <strong>of</strong> purchasing managers in industry (PMI).<br />

64<br />

62<br />

60<br />

58<br />

56<br />

54<br />

52<br />

50<br />

48<br />

46<br />

44<br />

42<br />

40<br />

38<br />

36<br />

34<br />

32<br />

30<br />

Germany<br />

<strong>Austria</strong><br />

Euro area<br />

50 = growth<br />

threshold<br />

2007 2008<br />

2009 <strong>2010</strong> 2011<br />

shares and bonds in <strong>2010</strong> were modest. The only sector which<br />

continued to record steady inflows was life assurance, not least<br />

thanks to long-term policies.<br />

� Economic activity also picked up in Central and Eastern<br />

Europe (CEE) in <strong>2010</strong>, but progress varied significantly from region<br />

to region. In addition, nearly all countries had to address legacies<br />

and restore structural imbalances which were not so evident in the<br />

boom years before 2009. For these reasons, banking business in<br />

most CEE countries was impacted by weak credit demand and a<br />

persistently high proportion <strong>of</strong> loan losses. Countries such as Turkey<br />

and Russia, which showed an impressive performance, compared<br />

with countries at the other end <strong>of</strong> the scale where the banking sector<br />

is still being restructured (Kazakhstan, Ukraine).<br />

The CEE region’s combined GDP expanded by a real 3.6% in <strong>2010</strong>,<br />

twice the rate <strong>of</strong> western Europe, after the region was severely hit<br />

by the recession in the previous year (2009: –5.9% including<br />

Poland / –6.9% without Poland). Developments in the individual<br />

countries and country groups varied considerably depending on a<br />

country’s size and degree <strong>of</strong> economic autonomy, the extent to<br />

which a country has opened its economy, and on factors such as<br />

production specialisation and the starting position before the onset<br />

<strong>of</strong> the crisis. While the catching-up process resumed by the CEE<br />

countries in <strong>2010</strong> still has significant potential, it is far from the<br />

momentum seen before the financial and economic crisis. The “CEE<br />

Development Model“ has changed: in the initial stages, inclusion in<br />

the industrial division <strong>of</strong> labour <strong>of</strong>ten involved the rapid development<br />

<strong>of</strong> externally financed key industries, while the strategic focus in the<br />

post-recession years has been on strengthening the domestic economy<br />

with the aim <strong>of</strong> reducing volatility, strengthening mass purchasing<br />

power, and achieving monetary stabilisation.<br />

In <strong>2010</strong>, especially those countries which experienced a boom<br />

before the crisis had to focus on reducing their substantial external<br />

financing requirements (partly by curbing significant public deficits)<br />

to make themselves less crisis-prone in a nervous international<br />

climate. This was achieved with low wage rises, or in some cases<br />

even nominal wage reductions, austerity programmes, and subsequently<br />

a downturn in domestic economic growth. Thanks to the<br />

timely implementation <strong>of</strong> specific measures – partly supported by<br />

EU and IMF stand-by arrangements with conditions attached – and<br />

because <strong>of</strong> initially low public debt levels (which averaged less than<br />

40% <strong>of</strong> GDP) the CEE countries managed to emerge from the<br />

public debt crisis unscathed. This is reflected in the performance <strong>of</strong><br />

share prices (MSCI Emerging Europe +16.3%), the stability <strong>of</strong><br />

interest-rate spreads on government bonds (EMBI+ 270 bp at yearend<br />

<strong>2010</strong> / 291 bp at year-end 2009), and especially exchange<br />

rate developments. The CEE currencies <strong>of</strong> countries in our perimeter<br />

<strong>of</strong> operations together (weighted by the operating pr<strong>of</strong>it <strong>of</strong> our local<br />

subsidiaries) appreciated against the euro by 3.2% compared with<br />

year-end 2009 and by 5.0% in average annual terms. This devel-<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

8