Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Report<br />

Management Report (CONTINUED)<br />

Asset quality in the bank as a whole has not yet improved to any<br />

significant extent, but the pace <strong>of</strong> deterioration slowed in the course<br />

<strong>of</strong> the past few quarters. Expressed as a percentage <strong>of</strong> the gross<br />

volume <strong>of</strong> loans to customers, impaired loans rose from 4.8% at the<br />

end <strong>of</strong> 2008 to 7.3% at the end <strong>of</strong> 2009 and 8.7% in the middle <strong>of</strong><br />

<strong>2010</strong>. In the last two quarters <strong>of</strong> <strong>2010</strong>, the impaired loans ratio did<br />

not rise as strongly, reaching 9.0% and 9.1%, respectively. Additions<br />

to impaired loans are tapering <strong>of</strong>f. Moreover, the increase in impaired<br />

loans was seen in the “relatively better” risk categories (past-due,<br />

restructured and doubtful exposures). Having become impaired more<br />

recently, writedowns on such loans represent a lower proportion <strong>of</strong><br />

the gross amount than for “old” impaired loans and non-performing<br />

loans. Moreover, restructuring activities made good progress and<br />

some writedowns were thereby avoided. As a result <strong>of</strong> this structural<br />

effect, the coverage ratio <strong>of</strong> total impaired loans declined from<br />

51.9% at the end <strong>of</strong> 2009 to 48.4% at the end <strong>of</strong> <strong>2010</strong>. The NPL<br />

ratio, i.e. non-performing loans as a percentage <strong>of</strong> loans to customers,<br />

was 4.6% at the end <strong>of</strong> December <strong>2010</strong>, higher than a year<br />

earlier (3.5%), but only slightly above the ratio at the end <strong>of</strong> June<br />

<strong>2010</strong> (4.1%). Continued net additions to loan loss provisions resulted<br />

in 62.6% <strong>of</strong> NPLs (without taking collateral into account) being covered<br />

by specific writedowns most recently (compared with 69.8% at<br />

the end <strong>of</strong> 2009). It is not unusual for the coverage ratio to decline in<br />

a post-crisis period, this indicates that the situation will improve.<br />

The other “non-operating” items between operating pr<strong>of</strong>it and<br />

pr<strong>of</strong>it before tax reflect the strong impact <strong>of</strong> valuation adjustments in<br />

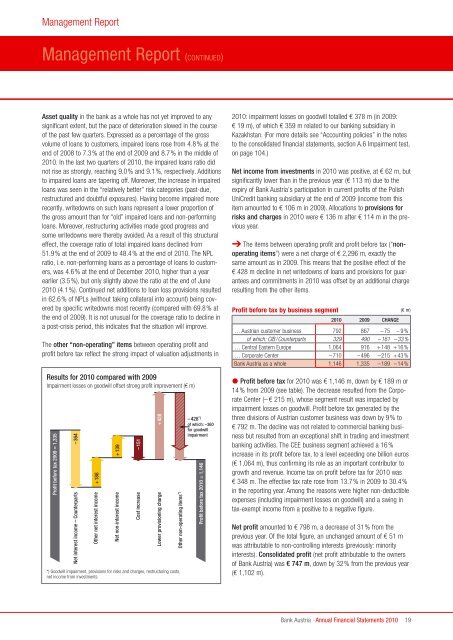

Results for <strong>2010</strong> compared with 2009<br />

Impairment losses on goodwill <strong>of</strong>fset strong pr<strong>of</strong>it improvement (€ m)<br />

Pr<strong>of</strong>it before tax 2009 = 1,335<br />

–364<br />

Net interest income – Counterparts<br />

+188<br />

Other net interest income<br />

+139<br />

Net non-interest income<br />

–151<br />

Cost increase<br />

+428<br />

Lower provisioning charge<br />

*) Goodwill impairment, provisions for risks and charges, restructuring costs,<br />

net income from investments<br />

Other non-operating items *)<br />

–428 *)<br />

<strong>of</strong> which: –360<br />

for goodwill<br />

impairment<br />

Pr<strong>of</strong>it before tax <strong>2010</strong> = 1,146<br />

<strong>2010</strong>: impairment losses on goodwill totalled € 378 m (in 2009:<br />

€ 19 m), <strong>of</strong> which € 359 m related to our banking subsidiary in<br />

Kazakhstan. (For more details see “Accounting policies” in the notes<br />

to the consolidated financial statements, section A.6 Impairment test,<br />

on page 104.)<br />

Net income from investments in <strong>2010</strong> was positive, at € 62 m, but<br />

significantly lower than in the previous year (€ 113 m) due to the<br />

expiry <strong>of</strong> <strong>Bank</strong> <strong>Austria</strong>’s participation in current pr<strong>of</strong>its <strong>of</strong> the Polish<br />

UniCredit banking subsidiary at the end <strong>of</strong> 2009 (income from this<br />

item amounted to € 106 m in 2009). Allocations to provisions for<br />

risks and charges in <strong>2010</strong> were € 136 m after € 114 m in the previous<br />

year.<br />

➔ The items between operating pr<strong>of</strong>it and pr<strong>of</strong>it before tax (“nonoperating<br />

items”) were a net charge <strong>of</strong> € 2,296 m, exactly the<br />

same amount as in 2009. This means that the positive effect <strong>of</strong> the<br />

€ 428 m decline in net writedowns <strong>of</strong> loans and provisions for guarantees<br />

and commitments in <strong>2010</strong> was <strong>of</strong>fset by an additional charge<br />

resulting from the other items.<br />

Pr<strong>of</strong>it before tax by business segment (€ m)<br />

<strong>2010</strong> 2009 ChANgE<br />

… <strong>Austria</strong>n customer business 792 867 –75 –9%<br />

<strong>of</strong> which: CIB/Counterparts 329 490 –161 –33%<br />

… Central Eastern Europe 1,064 916 +148 +16%<br />

… Corporate Center –710 –496 –215 +43%<br />

<strong>Bank</strong> <strong>Austria</strong> as a whole 1,146 1,335 –189 –14%<br />

� Pr<strong>of</strong>it before tax for <strong>2010</strong> was € 1,146 m, down by € 189 m or<br />

14% from 2009 (see table). The decrease resulted from the Corporate<br />

Center (– € 215 m), whose segment result was impacted by<br />

impairment losses on goodwill. Pr<strong>of</strong>it before tax generated by the<br />

three divisions <strong>of</strong> <strong>Austria</strong>n customer business was down by 9% to<br />

€ 792 m. The decline was not related to commercial banking business<br />

but resulted from an exceptional shift in trading and investment<br />

banking activities. The CEE business segment achieved a 16%<br />

increase in its pr<strong>of</strong>it before tax, to a level exceeding one billion euros<br />

(€ 1,064 m), thus confirming its role as an important contributor to<br />

growth and revenue. Income tax on pr<strong>of</strong>it before tax for <strong>2010</strong> was<br />

€ 348 m. The effective tax rate rose from 13.7% in 2009 to 30.4%<br />

in the reporting year. Among the reasons were higher non-deductible<br />

expenses (including impairment losses on goodwill) and a swing in<br />

tax-exempt income from a positive to a negative figure.<br />

Net pr<strong>of</strong>it amounted to € 798 m, a decrease <strong>of</strong> 31% from the<br />

previous year. Of the total figure, an unchanged amount <strong>of</strong> € 51 m<br />

was attributable to non-controlling interests (previously: minority<br />

interests). Consolidated pr<strong>of</strong>it (net pr<strong>of</strong>it attributable to the owners<br />

<strong>of</strong> <strong>Bank</strong> <strong>Austria</strong>) was € 747 m, down by 32% from the previous year<br />

(€ 1,102 m).<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

19