Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report<br />

Management Report (CONTINUED)<br />

according to restated figures – grew by only € 38 m or 3%. In CEE,<br />

operating expenses rose by € 177 m or 9%; at constant exchange<br />

rates, the increase was 5.5%. Cost trends in CEE reflect the targeted<br />

expansion <strong>of</strong> sales channels and the cross-regional bundling <strong>of</strong><br />

product development and back-<strong>of</strong>fice functions. Initiatives in mobile<br />

banking services and the opening <strong>of</strong> new branches frequently involve<br />

eliminating inefficiencies and restructuring branch networks which<br />

have grown over many years, e.g. in Russia, and redimensioning<br />

administrative structures which are too large, e.g. in Kazakhstan and<br />

Ukraine. Operating expenses in Turkey rose by 15% in euro terms or<br />

6% in local currency; this cost increase is justified because the operations<br />

in Turkey achieved the strongest business expansion (average<br />

risk-weighted assets up by 19% in euro terms/up by 10% in local<br />

currency) and it also reflects investment in expanding the branch<br />

network, for which the bank has to pay a tax on branches. Hungary<br />

is a special case with cost growth <strong>of</strong> 29%. Without the local levy on<br />

banks, which is included in other administrative expenses, costs<br />

would have increased by 5.4%, or by 3.5% in local currency.<br />

In Russia, currency appreciation was the main factor (+16%, in<br />

rouble terms +6%). In Ukraine (+13%/+7%) training costs related<br />

to IT modernisation were a significant item, and costs in Kazakhstan<br />

(+9% / +3%) also reflected special effects resulting from the<br />

reform <strong>of</strong> the deposit guarantee scheme. The expansion <strong>of</strong> the CEE<br />

sub-holding functions and Vienna-based divisional head <strong>of</strong>fices for<br />

the CEE subsidiaries (+9%) had no significant impact on costs. The<br />

cost/income ratio in CEE (45.8%) continued to be below the average<br />

for the bank as a whole. In the Corporate Center, which also comprises<br />

services for Global <strong>Bank</strong>ing Services and internal administrative<br />

expenses as well as settlement <strong>of</strong> accounts with near-shoring<br />

service providers, operating expenses were reduced by 7%.<br />

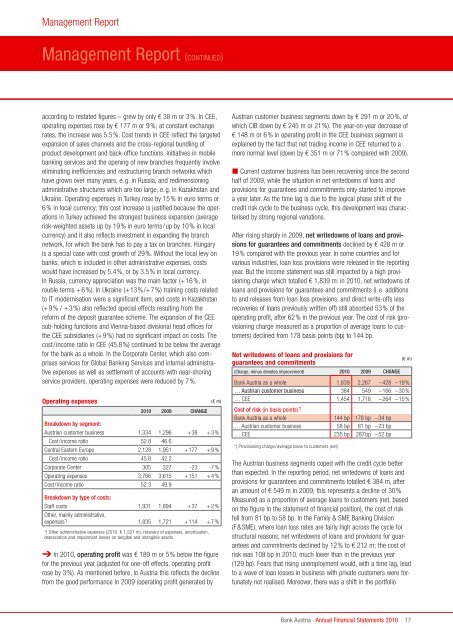

Operating expenses (€ m)<br />

<strong>2010</strong> 2009 ChANgE<br />

Breakdown by segment:<br />

<strong>Austria</strong>n customer business 1,334 1,296 +38 +3%<br />

Cost/income ratio 52.8 46.6<br />

Central Eastern Europe 2,128 1,951 +177 +9%<br />

Cost/income ratio 45.8 42.2<br />

Corporate Center 305 327 -23 -7%<br />

Operating expenses 3,766 3,615 +151 +4%<br />

Cost/income ratio 52.3 49.9<br />

Breakdown by type <strong>of</strong> costs:<br />

Staff costs 1,931 1,894 +37 +2%<br />

Other, mainly administrative,<br />

expenses *) 1,835 1,721 +114 +7%<br />

*) Other administrative expenses (<strong>2010</strong>: € 1,527 m), recovery <strong>of</strong> expenses, amortisation,<br />

depreciation and impairment losses on tangible and intangible assets.<br />

➔ In <strong>2010</strong>, operating pr<strong>of</strong>it was € 189 m or 5% below the figure<br />

for the previous year (adjusted for one-<strong>of</strong>f effects, operating pr<strong>of</strong>it<br />

rose by 3%). As mentioned before, in <strong>Austria</strong> this reflects the decline<br />

from the good performance in 2009 (operating pr<strong>of</strong>it generated by<br />

<strong>Austria</strong>n customer business segments down by € 291 m or 20%, <strong>of</strong><br />

which CIB down by € 245 m or 21%). The year-on-year decrease <strong>of</strong><br />

€ 148 m or 6% in operating pr<strong>of</strong>it in the CEE business segment is<br />

explained by the fact that net trading income in CEE returned to a<br />

more normal level (down by € 351 m or 71% compared with 2009).<br />

� Current customer business has been recovering since the second<br />

half <strong>of</strong> 2009, while the situation in net writedowns <strong>of</strong> loans and<br />

provisions for guarantees and commitments only started to improve<br />

a year later. As the time lag is due to the logical phase shift <strong>of</strong> the<br />

credit risk cycle to the business cycle, this development was characterised<br />

by strong regional variations.<br />

After rising sharply in 2009, net writedowns <strong>of</strong> loans and provisions<br />

for guarantees and commitments declined by € 428 m or<br />

19% compared with the previous year. In some countries and for<br />

various industries, loan loss provisions were released in the reporting<br />

year. But the income statement was still impacted by a high provisioning<br />

charge which totalled € 1,839 m: in <strong>2010</strong>, net writedowns <strong>of</strong><br />

loans and provisions for guarantees and commitments (i.e. additions<br />

to and releases from loan loss provisions, and direct write-<strong>of</strong>fs less<br />

recoveries <strong>of</strong> loans previously written <strong>of</strong>f) still absorbed 53% <strong>of</strong> the<br />

operating pr<strong>of</strong>it, after 62% in the previous year. The cost <strong>of</strong> risk (provisioning<br />

charge measured as a proportion <strong>of</strong> average loans to customers)<br />

declined from 178 basis points (bp) to 144 bp.<br />

Net writedowns <strong>of</strong> loans and provisions for<br />

guarantees and commitments<br />

(Charge, minus denotes improvement) <strong>2010</strong> 2009 ChANgE<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

(€ m)<br />

<strong>Bank</strong> <strong>Austria</strong> as a whole 1,839 2,267 –428 –19%<br />

… <strong>Austria</strong>n customer business 384 549 –166 –30%<br />

… CEE 1,454 1,718 –264 –15%<br />

Cost <strong>of</strong> risk (in basis points) *)<br />

<strong>Bank</strong> <strong>Austria</strong> as a whole 144 bp 178 bp –34 bp<br />

… <strong>Austria</strong>n customer business 58 bp 81 bp –23 bp<br />

… CEE 235 bp 287bp –52 bp<br />

*) Provisioning charge/average loans to customers (net)<br />

The <strong>Austria</strong>n business segments coped with the credit cycle better<br />

than expected. In the reporting period, net writedowns <strong>of</strong> loans and<br />

provisions for guarantees and commitments totalled € 384 m, after<br />

an amount <strong>of</strong> € 549 m in 2009; this represents a decline <strong>of</strong> 30%.<br />

Measured as a proportion <strong>of</strong> average loans to customers (net, based<br />

on the figure in the statement <strong>of</strong> financial position), the cost <strong>of</strong> risk<br />

fell from 81 bp to 58 bp. In the Family & SME <strong>Bank</strong>ing Division<br />

(F&SME), where loan loss rates are fairly high across the cycle for<br />

structural reasons, net writedowns <strong>of</strong> loans and provisions for guarantees<br />

and commitments declined by 12% to € 212 m; the cost <strong>of</strong><br />

risk was 108 bp in <strong>2010</strong>, much lower than in the previous year<br />

(129 bp). Fears that rising unemployment would, with a time lag, lead<br />

to a wave <strong>of</strong> loan losses in business with private customers were fortunately<br />

not realised. Moreover, there was a shift in the portfolio<br />

17