Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated <strong>Financial</strong> <strong>Statements</strong> in accordance with IFRSs<br />

E – Risk report (CoNTINuED)<br />

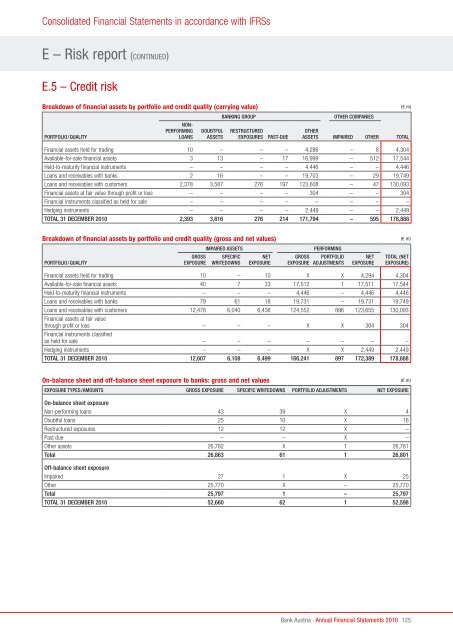

E.5 – Credit risk<br />

Breakdown <strong>of</strong> financial assets by portfolio and credit quality (carrying value) (€ m)<br />

pOrtfOliO/quality<br />

NONperfOrmiNg<br />

lOaNs<br />

dOubtful<br />

assets<br />

baNKiNg grOup Other cOmpaNies<br />

restructured<br />

expOsures past-due<br />

Other<br />

assets impaired Other tOtal<br />

<strong>Financial</strong> assets held for trading 10 – – – 4,286 – 8 4,304<br />

Available-for-sale financial assets 3 13 – 17 16,999 – 512 17,544<br />

Held-to-maturity financial instruments – – – – 4,446 – – 4,446<br />

Loans and receivables with banks 2 16 – – 19,703 – 29 19,749<br />

Loans and receivables with customers 2,378 3,587 276 197 123,608 – 47 130,093<br />

<strong>Financial</strong> assets at fair value through pr<strong>of</strong>it or loss – – – – 304 – – 304<br />

<strong>Financial</strong> instruments classified as held for sale – – – – – – – –<br />

Hedging instruments – – – – 2,449 – – 2,449<br />

tOtal 31 december <strong>2010</strong> 2,393 3,616 276 214 171,794 – 595 178,888<br />

Breakdown <strong>of</strong> financial assets by portfolio and credit quality (gross and net values) (€ m)<br />

pOrtfOliO/quality<br />

grOss<br />

expOsure<br />

impaired assets perfOrmiNg<br />

specific<br />

WritedOWNs<br />

Net<br />

expOsure<br />

grOss<br />

expOsure<br />

pOrtfOliO<br />

adJustmeNts<br />

Net<br />

expOsure<br />

tOtal (Net<br />

expOsure)<br />

<strong>Financial</strong> assets held for trading 10 – 10 X X 4,294 4,304<br />

Available-for-sale financial assets 40 7 33 17,512 1 17,511 17,544<br />

Held-to-maturity financial instruments – – – 4,446 – 4,446 4,446<br />

Loans and receivables with banks 79 61 18 19,731 – 19,731 19,749<br />

Loans and receivables with customers 12,478 6,040 6,438 124,552 896 123,655 130,093<br />

<strong>Financial</strong> assets at fair value<br />

through pr<strong>of</strong>it or loss – – – X X 304 304<br />

<strong>Financial</strong> instruments classified<br />

as held for sale – – – – – – –<br />

Hedging instruments – – – X X 2,449 2,449<br />

tOtal 31 december <strong>2010</strong> 12,607 6,108 6,499 166,241 897 172,389 178,888<br />

On-balance sheet and <strong>of</strong>f-balance sheet exposure to banks: gross and net values (€ m)<br />

expOsure types/amOuNts grOss expOsure specific WritedOWNs pOrtfOliO adJustmeNts Net expOsure<br />

On-balance sheet exposure<br />

Non-performing loans 43 39 X 4<br />

Doubtful loans 25 10 X 16<br />

Restructured exposures 12 12 X –<br />

Past due – – X –<br />

Other assets 26,782 X 1 26,781<br />

total 26,863 61 1 26,801<br />

Off-balance sheet exposure<br />

Impaired 27 1 X 25<br />

Other 25,770 X – 25,770<br />

total 25,797 1 – 25,797<br />

tOtal 31 december <strong>2010</strong> 52,660 62 1 52,598<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

125