Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Report<br />

Management Report (CONTINUED)<br />

the region was down from 7.0% in 2009 to 5.4% in <strong>2010</strong>, with a<br />

further decline to 4.7% expected for the current year. Public debt will<br />

remain below 40% <strong>of</strong> GDP in 2011. The adjustment had, and still<br />

has, an adverse impact on domestic demand, which means that<br />

there is no risk <strong>of</strong> the economy overheating. Yet the risk <strong>of</strong> inflation<br />

has increased. Commodity prices have gone up, partly as a result <strong>of</strong><br />

geopolitical crises; food prices have also inceased, partly as a consequence<br />

<strong>of</strong> natural disasters (such as the drought in Russia); and<br />

excise duties have been raised. All <strong>of</strong> these factors point to accelerating<br />

inflation: we expect the average inflation rate for the CIS region<br />

to rise to over 7% after 6.4% in 2009, with particularly high rates in<br />

Ukraine (11%) and Kazakhstan (7%), Serbia (9.4%) and Russia<br />

(9.1%) – the latter mainly because <strong>of</strong> excessive growth <strong>of</strong> the money<br />

supply. The interest rate environment will thus become more restric-<br />

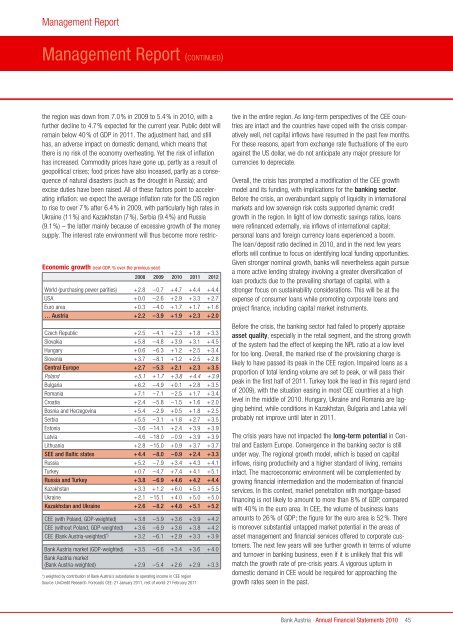

Economic growth (real GDP, % over the previous year)<br />

2008 2009 <strong>2010</strong> 2011 2012<br />

World (purchasing power parities) +2.8 –0.7 +4.7 +4.4 +4.4<br />

USA +0.0 –2.6 +2.9 +3.3 +2.7<br />

Euro area +0.3 –4.0 +1.7 +1.7 +1.6<br />

… <strong>Austria</strong> +2.2 –3.9 +1.9 +2.3 +2.0<br />

Czech Republic +2.5 –4.1 +2.3 +1.8 +3.3<br />

Slovakia +5.8 –4.8 +3.9 +3.1 +4.5<br />

Hungary +0.6 –6.3 +1.2 +2.5 +3.4<br />

Slovenia +3.7 –8.1 +1.2 +2.5 +2.8<br />

Central Europe +2.7 –5.3 +2.1 +2.3 +3.5<br />

Poland +5.1 +1.7 +3.8 +4.4 +3.9<br />

Bulgaria +6.2 –4.9 +0.1 +2.8 +3.5<br />

Romania +7.1 –7.1 –2.5 +1.7 +3.4<br />

Croatia +2.4 –5.8 –1.5 +1.6 +2.0<br />

Bosnia and Herzegovina +5.4 –2.9 +0.5 +1.8 +2.5<br />

Serbia +5.5 –3.1 +1.8 +2.7 +3.5<br />

Estonia –3.6 –14.1 +2.4 +3.9 +3.9<br />

Latvia –4.6 –18.0 –0.9 +3.9 +3.9<br />

Lithuania +2.8 –15.0 +0.9 +3.7 +3.7<br />

SEE and Baltic states +4.4 –8.0 –0.9 +2.4 +3.3<br />

Russia +5.2 –7.9 +3.4 +4.3 +4.1<br />

Turkey +0.7 –4.7 +7.4 +4.1 +5.1<br />

russia and turkey +3.8 –6.9 +4.6 +4.2 +4.4<br />

Kazakhstan +3.3 +1.2 +6.0 +5.3 +5.5<br />

Ukraine +2.1 –15.1 +4.0 +5.0 +5.0<br />

kazakhstan and Ukraine +2.6 –8.2 +4.8 +5.1 +5.2<br />

CEE (with Poland, GDP-weighted) +3.8 –5.9 +3.6 +3.9 +4.2<br />

CEE (without Poland, GDP-weighted) +3.6 –6.9 +3.6 +3.8 +4.2<br />

CEE (<strong>Bank</strong> <strong>Austria</strong>-weighted) *) +3.2 –6.1 +2.9 +3.3 +3.9<br />

<strong>Bank</strong> <strong>Austria</strong> market (GDP-weighted) +3.5 –6.6 +3.4 +3.6 +4.0<br />

<strong>Bank</strong> <strong>Austria</strong> market<br />

(<strong>Bank</strong> <strong>Austria</strong>-weighted) +2.9 –5.4 +2.6 +2.9 +3.3<br />

*) weighted by contribution <strong>of</strong> <strong>Bank</strong> <strong>Austria</strong>’s subsidiaries to operating income in CEE region<br />

Source: UniCredit Research. Forecasts CEE: 21 January 2011, rest <strong>of</strong> world: 21 February 2011<br />

tive in the entire region. As long-term perspectives <strong>of</strong> the CEE countries<br />

are intact and the countries have coped with the crisis comparatively<br />

well, net capital inflows have resumed in the past few months.<br />

For these reasons, apart from exchange rate fluctuations <strong>of</strong> the euro<br />

against the US dollar, we do not anticipate any major pressure for<br />

currencies to depreciate.<br />

Overall, the crisis has prompted a modification <strong>of</strong> the CEE growth<br />

model and its funding, with implications for the banking sector.<br />

Before the crisis, an overabundant supply <strong>of</strong> liquidity in international<br />

markets and low sovereign risk costs supported dynamic credit<br />

growth in the region. In light <strong>of</strong> low domestic savings ratios, loans<br />

were refinanced externally, via inflows <strong>of</strong> international capital;<br />

personal loans and foreign currency loans experienced a boom.<br />

The loan/deposit ratio declined in <strong>2010</strong>, and in the next few years<br />

efforts will continue to focus on identifying local funding opportunities.<br />

Given stronger nominal growth, banks will nevertheless again pursue<br />

a more active lending strategy involving a greater diversification <strong>of</strong><br />

loan products due to the prevailing shortage <strong>of</strong> capital, with a<br />

stronger focus on sustainability considerations. This will be at the<br />

expense <strong>of</strong> consumer loans while promoting corporate loans and<br />

project finance, including capital market instruments.<br />

Before the crisis, the banking sector had failed to properly appraise<br />

asset quality, especially in the retail segment, and the strong growth<br />

<strong>of</strong> the system had the effect <strong>of</strong> keeping the NPL ratio at a low level<br />

for too long. Overall, the marked rise <strong>of</strong> the provisioning charge is<br />

likely to have passed its peak in the CEE region. Impaired loans as a<br />

proportion <strong>of</strong> total lending volume are set to peak, or will pass their<br />

peak in the first half <strong>of</strong> 2011. Turkey took the lead in this regard (end<br />

<strong>of</strong> 2009), with the situation easing in most CEE countries at a high<br />

level in the middle <strong>of</strong> <strong>2010</strong>. Hungary, Ukraine and Romania are lagging<br />

behind, while conditions in Kazakhstan, Bulgaria and Latvia will<br />

probably not improve until later in 2011.<br />

The crisis years have not impacted the long-term potential in Central<br />

and Eastern Europe. Convergence in the banking sector is still<br />

under way. The regional growth model, which is based on capital<br />

inflows, rising productivity and a higher standard <strong>of</strong> living, remains<br />

intact. The macroeconomic environment will be complemented by<br />

growing financial intermediation and the modernisation <strong>of</strong> financial<br />

services. In this context, market penetration with mortgage-based<br />

financing is not likely to amount to more than 8% <strong>of</strong> GDP, compared<br />

with 40% in the euro area. In CEE, the volume <strong>of</strong> business loans<br />

amounts to 26% <strong>of</strong> GDP; the figure for the euro area is 52%. There<br />

is moreover substantial untapped market potential in the areas <strong>of</strong><br />

asset management and financial services <strong>of</strong>fered to corporate customers.<br />

The next few years will see further growth in terms <strong>of</strong> volume<br />

and turnover in banking business, even if it is unlikely that this will<br />

match the growth rate <strong>of</strong> pre-crisis years. A vigorous upturn in<br />

domestic demand in CEE would be required for approaching the<br />

growth rates seen in the past.<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

45