Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated <strong>Financial</strong> <strong>Statements</strong> in accordance with IFRSs<br />

E – Risk report (CoNTINuED)<br />

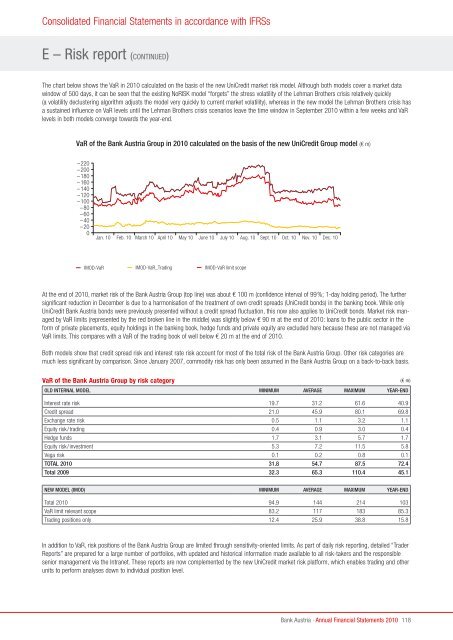

The chart below shows the VaR in <strong>2010</strong> calculated on the basis <strong>of</strong> the new UniCredit market risk model. Although both models cover a market data<br />

window <strong>of</strong> 500 days, it can be seen that the existing NoRISK model “forgets” the stress volatility <strong>of</strong> the Lehman Brothers crisis relatively quickly<br />

(a volatility declustering algorithm adjusts the model very quickly to current market volatility), whereas in the new model the Lehman Brothers crisis has<br />

a sustained influence on VaR levels until the Lehman Brothers crisis scenarios leave the time window in September <strong>2010</strong> within a few weeks and VaR<br />

levels in both models converge towards the year-end.<br />

VaR <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group in <strong>2010</strong> calculated on the basis <strong>of</strong> the new UniCredit Group model (€ m)<br />

–220<br />

–200<br />

–180<br />

–160<br />

–140<br />

–120<br />

–100<br />

–80<br />

–60<br />

–40<br />

–20<br />

0<br />

IMOD-VaR<br />

Jan. 10 Feb. 10 March 10 April 10 May 10 June 10 July 10 Aug. 10 Sept. 10 Oct. 10 Nov. 10 Dec. 10<br />

IMOD-VaR_Trading<br />

IMOD-VaR limit scope<br />

At the end <strong>of</strong> <strong>2010</strong>, market risk <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group (top line) was about € 100 m (confidence interval <strong>of</strong> 99%; 1-day holding period). The further<br />

significant reduction in December is due to a harmonisation <strong>of</strong> the treatment <strong>of</strong> own credit spreads (UniCredit bonds) in the banking book. While only<br />

UniCredit <strong>Bank</strong> <strong>Austria</strong> bonds were previously presented without a credit spread fluctuation, this now also applies to UniCredit bonds. Market risk managed<br />

by VaR limits (represented by the red broken line in the middle) was slightly below € 90 m at the end <strong>of</strong> <strong>2010</strong>: loans to the public sector in the<br />

form <strong>of</strong> private placements, equity holdings in the banking book, hedge funds and private equity are excluded here because these are not managed via<br />

VaR limits. This compares with a VaR <strong>of</strong> the trading book <strong>of</strong> well below € 20 m at the end <strong>of</strong> <strong>2010</strong>.<br />

Both models show that credit spread risk and interest rate risk account for most <strong>of</strong> the total risk <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group. Other risk categories are<br />

much less significant by comparison. Since January 2007, commodity risk has only been assumed in the <strong>Bank</strong> <strong>Austria</strong> Group on a back-to-back basis.<br />

VaR <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group by risk category (€ m)<br />

Old iNterNal mOdel miNimum aVerage maximum year-eNd<br />

Interest rate risk 19.7 31.2 61.6 40.9<br />

Credit spread 21.0 45.9 80.1 69.8<br />

Exchange rate risk 0.5 1.1 3.2 1.1<br />

Equity risk/trading 0.4 0.9 3.0 0.4<br />

Hedge funds 1.7 3.1 5.7 1.7<br />

Equity risk/investment 5.3 7.2 11.5 5.8<br />

Vega risk 0.1 0.2 0.8 0.1<br />

tOtal <strong>2010</strong> 31.8 54.7 87.5 72.4<br />

total 2009 32.3 65.3 110.4 45.1<br />

NeW mOdel (imOd) miNimum aVerage maximum year-eNd<br />

Total <strong>2010</strong> 94.9 144 214 103<br />

VaR limit relevant scope 83.2 117 183 85.3<br />

Trading positions only 12.4 25.9 38.8 15.8<br />

In addition to VaR, risk positions <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group are limited through sensitivity-oriented limits. As part <strong>of</strong> daily risk reporting, detailed “Trader<br />

Reports” are prepared for a large number <strong>of</strong> portfolios, with updated and historical information made available to all risk-takers and the responsible<br />

senior management via the Intranet. These reports are now complemented by the new UniCredit market risk platform, which enables trading and other<br />

units to perform analyses down to individual position level.<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

118