Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Financial</strong> <strong>Statements</strong> <strong>of</strong> UniCredit <strong>Bank</strong> <strong>Austria</strong> AG<br />

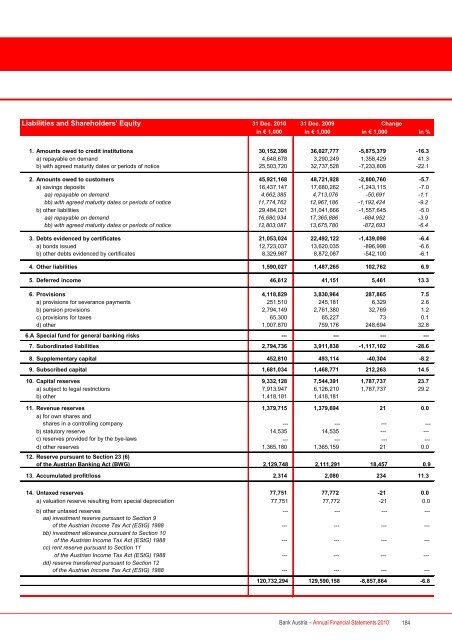

Liabilities and Shareholders' Equity 31 Dec. <strong>2010</strong> 31 Dec. 2009<br />

Change<br />

in € 1,000 in € 1,000 in € 1,000 in %<br />

1. Amounts owed to credit institutions 30,152,398 36,027,777 -5,875,379 -16.3<br />

a) repayable on demand 4,648,678 3,290,249 1,358,429 41.3<br />

b) with agreed maturity dates or periods <strong>of</strong> notice 25,503,720 32,737,528 -7,233,808 -22.1<br />

2. Amounts owed to customers 45,921,168 48,721,928 -2,800,760 -5.7<br />

a) savings deposits 16,437,147 17,680,262 -1,243,115 -7.0<br />

aa) repayable on demand 4,662,385 4,713,076 -50,691 -1.1<br />

bb) with agreed maturity dates or periods <strong>of</strong> notice 11,774,762 12,967,186 -1,192,424 -9.2<br />

b) other liabilities 29,484,021 31,041,666 -1,557,645 -5.0<br />

aa) repayable on demand 16,680,934 17,365,886 -684,952 -3.9<br />

bb) with agreed maturity dates or periods <strong>of</strong> notice 12,803,087 13,675,780 -872,693 -6.4<br />

3. Debts evidenced by certificates 21,053,024 22,492,122 -1,439,098 -6.4<br />

a) bonds issued 12,723,037 13,620,035 -896,998 -6.6<br />

b) other debts evidenced by certificates 8,329,987 8,872,087 -542,100 -6.1<br />

4. Other liabilities 1,590,027 1,487,265 102,762 6.9<br />

5. Deferred income 46,612 41,151 5,461 13.3<br />

6. Provisions 4,118,829 3,830,964 287,865 7.5<br />

a) provisions for severance payments 251,510 245,181 6,329 2.6<br />

b) pension provisions 2,794,149 2,761,380 32,769 1.2<br />

c) provisions for taxes 65,300 65,227 73 0.1<br />

d) other 1,007,870 759,176 248,694 32.8<br />

6.A Special fund for general banking risks --- --- --- ---<br />

7. Subordinated liabilities 2,794,736 3,911,838 -1,117,102 -28.6<br />

8. Supplementary capital 452,810 493,114 -40,304 -8.2<br />

9. Subscribed capital 1,681,034 1,468,771 212,263 14.5<br />

10. Capital reserves 9,332,128 7,544,391 1,787,737 23.7<br />

a) subject to legal restrictions 7,913,947 6,126,210 1,787,737 29.2<br />

b) other 1,418,181 1,418,181<br />

11. Revenue reserves 1,379,715 1,379,694 21 0.0<br />

a) for own shares and<br />

shares in a controlling company --- --- --- --b)<br />

statutory reserve 14,535 14,535 --- --c)<br />

reserves provided for by the bye-laws<br />

--- --- --- --d)<br />

other reserves 1,365,180 1,365,159 21 0.0<br />

12. Reserve pursuant to Section 23 (6)<br />

<strong>of</strong> the <strong>Austria</strong>n <strong>Bank</strong>ing Act (BWG) 2,129,748 2,111,291 18,457 0.9<br />

13. Accumulated pr<strong>of</strong>it/loss 2,314 2,080 234 11.3<br />

14. Untaxed reserves 77,751 77,772 -21 0.0<br />

a) valuation reserve resulting from special depreciation 77,751 77,772 -21 0.0<br />

b) other untaxed reserves --- --- --- --aa)<br />

investment reserve pursuant to Section 9<br />

<strong>of</strong> the <strong>Austria</strong>n Income Tax Act (EStG) 1988 --- --- --- --bb)<br />

investment allowance pursuant to Section 10<br />

<strong>of</strong> the <strong>Austria</strong>n Income Tax Act (EStG) 1988 --- --- --- --cc)<br />

rent reserve pursuant to Section 11<br />

<strong>of</strong> the <strong>Austria</strong>n Income Tax Act (EStG) 1988 --- --- --- --dd)<br />

reserve transferred pursuant to Section 12<br />

<strong>of</strong> the <strong>Austria</strong>n Income Tax Act (EStG) 1988 --- --- --- ---<br />

120,732,294 129,590,158 -8,857,864 -6.8<br />

<strong>Bank</strong> <strong>Austria</strong> – <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong> 184