Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated <strong>Financial</strong> <strong>Statements</strong> in accordance with IFRSs<br />

A – Accounting policies (CoNTINuED)<br />

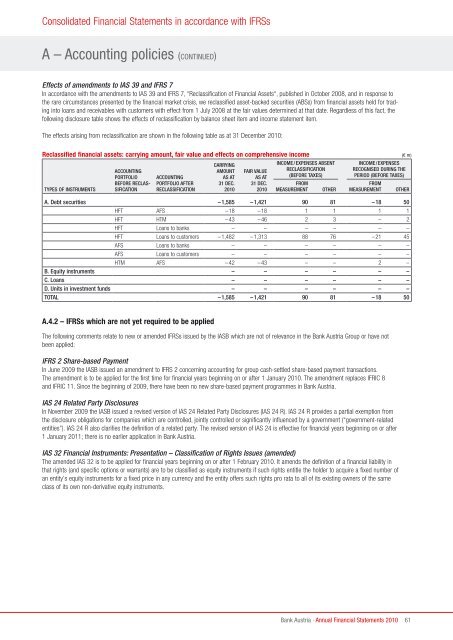

Effects <strong>of</strong> amendments to IAS 39 and IFRS 7<br />

In accordance with the amendments to IAS 39 and IFRS 7, “Reclassification <strong>of</strong> <strong>Financial</strong> Assets“, published in October 2008, and in response to<br />

the rare circumstances presented by the financial market crisis, we reclassified asset-backed securities (ABSs) from financial assets held for trading<br />

into loans and receivables with customers with effect from 1 July 2008 at the fair values determined at that date. Regardless <strong>of</strong> this fact, the<br />

following disclosure table shows the effects <strong>of</strong> reclassification by balance sheet item and income statement item.<br />

The effects arising from reclassification are shown in the following table as at 31 December <strong>2010</strong>:<br />

Reclassified financial assets: carrying amount, fair value and effects on comprehensive income (€ m)<br />

types Of iNstrumeNts<br />

accOuNtiNg<br />

pOrtfOliO<br />

befOre reclassificatiON<br />

accOuNtiNg<br />

pOrtfOliO after<br />

reclassificatiON<br />

carryiNg<br />

amOuNt<br />

as at<br />

31 dec.<br />

<strong>2010</strong><br />

fair Value<br />

as at<br />

31 dec.<br />

<strong>2010</strong><br />

iNcOme/expeNses abseNt<br />

reclassificatiON<br />

(befOre taxes)<br />

frOm<br />

measuremeNt Other<br />

iNcOme/expeNses<br />

recOgNised duriNg the<br />

periOd (befOre taxes)<br />

frOm<br />

measuremeNt Other<br />

a. debt securities –1,585 –1,421 90 81 –18 50<br />

HFT AFS –18 –18 1 1 1 1<br />

HFT HTM –43 –46 2 3 – 2<br />

HFT Loans to banks – – – – – –<br />

HFT Loans to customers –1,482 –1,313 88 76 –21 45<br />

AFS Loans to banks – – – – – –<br />

AFS Loans to customers – – – – – –<br />

HTM AFS –42 –43 – – 2 –<br />

b. equity instruments – – – – – –<br />

c. loans – – – – – –<br />

d. units in investment funds – – – – – –<br />

tOtal –1,585 –1,421 90 81 –18 50<br />

A.4.2 – IFRSs which are not yet required to be applied<br />

The following comments relate to new or amended IFRSs issued by the IASB which are not <strong>of</strong> relevance in the <strong>Bank</strong> <strong>Austria</strong> Group or have not<br />

been applied:<br />

IFRS 2 Share-based Payment<br />

In June 2009 the IASB issued an amendment to IFRS 2 concerning accounting for group cash-settled share-based payment transactions.<br />

The amendment is to be applied for the first time for financial years beginning on or after 1 January <strong>2010</strong>. The amendment replaces IFRIC 8<br />

and IFRIC 11. Since the beginning <strong>of</strong> 2009, there have been no new share-based payment programmes in <strong>Bank</strong> <strong>Austria</strong>.<br />

IAS 24 Related Party Disclosures<br />

In November 2009 the IASB issued a revised version <strong>of</strong> IAS 24 Related Party Disclosures (IAS 24 R). IAS 24 R provides a partial exemption from<br />

the disclosure obligations for companies which are controlled, jointly controlled or significantly influenced by a government (“government-related<br />

entities”). IAS 24 R also clarifies the definition <strong>of</strong> a related party. The revised version <strong>of</strong> IAS 24 is effective for financial years beginning on or after<br />

1 January 2011; there is no earlier application in <strong>Bank</strong> <strong>Austria</strong>.<br />

IAS 32 <strong>Financial</strong> Instruments: Presentation – Classification <strong>of</strong> Rights Issues (amended)<br />

The amended IAS 32 is to be applied for financial years beginning on or after 1 February <strong>2010</strong>. It amends the definition <strong>of</strong> a financial liability in<br />

that rights (and specific options or warrants) are to be classified as equity instruments if such rights entitle the holder to acquire a fixed number <strong>of</strong><br />

an entity’s equity instruments for a fixed price in any currency and the entity <strong>of</strong>fers such rights pro rata to all <strong>of</strong> its existing owners <strong>of</strong> the same<br />

class <strong>of</strong> its own non-derivative equity instruments.<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

61