Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Report <strong>of</strong> UniCredit <strong>Bank</strong> <strong>Austria</strong> AG<br />

Development <strong>of</strong> total assets<br />

Overview: As at 31 December <strong>2010</strong>, UniCredit <strong>Bank</strong> <strong>Austria</strong> AG’s<br />

total assets were € 120.7 bn, down by € 8.9 bn or 6.8% from the<br />

level as at 31 December 2009. While customer business was more<br />

or less stable, rising in the course <strong>of</strong> the year, balance sheet<br />

developments were mainly determined by the above-mentioned<br />

reorganisation <strong>of</strong> trading and capital market activities. The sale <strong>of</strong><br />

UniCredit CAIB AG had significant direct and indirect effects on<br />

assets and liabilities. These effects include those in connection with<br />

the handling <strong>of</strong> the transaction itself by the shareholding<br />

management unit, and the fact that UniCredit CAIB AG was no<br />

longer reflected in funding and liquidity management, which was the<br />

main reason for the decline in the balance sheet total. Indirect<br />

effects resulting from the transaction included the following:<br />

UniCredit CAIB AG performed various functions for UniCredit <strong>Bank</strong><br />

<strong>Austria</strong> AG which after the sale had to be performed by the bank<br />

itself, including asset/liability management functions and liquidity<br />

management functions such as the holding <strong>of</strong> securities eligible for<br />

repurchase transactions. A comparison <strong>of</strong> selected balance sheet<br />

items expressed as a percentage <strong>of</strong> the balance sheet total at the<br />

end <strong>of</strong> <strong>2010</strong> and 2009 (see table below) shows that the structural<br />

changes involved a significant reduction <strong>of</strong> interbank business on<br />

both sides <strong>of</strong> the balance sheet, while the proportion <strong>of</strong> customer<br />

business increased. As at 31 December <strong>2010</strong>, loans and advances<br />

to customers accounted for 55.2% <strong>of</strong> total assets, up from 51.5% in<br />

the previous year, and primary funds (i.e. amounts owed to<br />

customers and debts evidenced by certificates) were 55.5% <strong>of</strong> the<br />

balance sheet total, up from 55%. Lending business continued to be<br />

fully covered by primary funds. The bank’s balance sheet structure<br />

and risk-bearing capacity improved further, not least as a result <strong>of</strong><br />

the € 2 bn capital increase carried out in March <strong>2010</strong>. As at<br />

31 December <strong>2010</strong>, capital and reserves (equity) amounted to €<br />

14.5 bn, representing 12.0% <strong>of</strong> the balance sheet total<br />

(31 December 2009: 9.6%). The ratio <strong>of</strong> total assets to equity – i.e.<br />

the leverage ratio – declined from 10.4 to 8.3.<br />

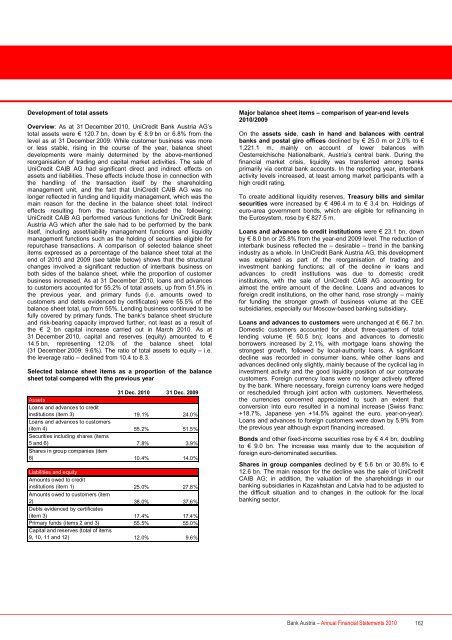

Selected balance sheet items as a proportion <strong>of</strong> the balance<br />

sheet total compared with the previous year<br />

31 Dec. <strong>2010</strong> 31 Dec. 2009<br />

Assets<br />

Loans and advances to credit<br />

institutions (item 3)<br />

Loans and advances to customers<br />

19.1% 24.0%<br />

(item 4)<br />

Securities including shares (items<br />

55.2% 51.5%<br />

5 and 6)<br />

Shares in group companies (item<br />

7.8% 3.9%<br />

8) 10.4% 14.0%<br />

Liabilities and equity<br />

Amounts owed to credit<br />

institutions (item 1) 25.0% 27.8%<br />

Amounts owed to customers (item<br />

2) 38.0% 37.6%<br />

Debts evidenced by certificates<br />

(item 3) 17.4% 17.4%<br />

Primary funds (items 2 and 3) 55.5% 55.0%<br />

Capital and reserves (total <strong>of</strong> items<br />

9, 10, 11 and 12) 12.0% 9.6%<br />

Major balance sheet items – comparison <strong>of</strong> year-end levels<br />

<strong>2010</strong>/2009<br />

On the assets side, cash in hand and balances with central<br />

banks and postal giro <strong>of</strong>fices declined by € 25.0 m or 2.0% to €<br />

1,221.1 m, mainly on account <strong>of</strong> lower balances with<br />

Oesterreichische Nationalbank, <strong>Austria</strong>’s central bank. During the<br />

financial market crisis, liquidity was transferred among banks<br />

primarily via central bank accounts. In the reporting year, interbank<br />

activity levels increased, at least among market participants with a<br />

high credit rating.<br />

To create additional liquidity reserves, Treasury bills and similar<br />

securities were increased by € 496.4 m to € 3.4 bn. Holdings <strong>of</strong><br />

euro-area government bonds, which are eligible for refinancing in<br />

the Eurosystem, rose by € 827.5 m.<br />

Loans and advances to credit institutions were € 23.1 bn, down<br />

by € 8.0 bn or 25.8% from the year-end 2009 level. The reduction <strong>of</strong><br />

interbank business reflected the – desirable – trend in the banking<br />

industry as a whole. In UniCredit <strong>Bank</strong> <strong>Austria</strong> AG, this development<br />

was explained as part <strong>of</strong> the reorganisation <strong>of</strong> trading and<br />

investment banking functions; all <strong>of</strong> the decline in loans and<br />

advances to credit institutions was due to domestic credit<br />

institutions, with the sale <strong>of</strong> UniCredit CAIB AG accounting for<br />

almost the entire amount <strong>of</strong> the decline. Loans and advances to<br />

foreign credit institutions, on the other hand, rose strongly – mainly<br />

for funding the stronger growth <strong>of</strong> business volume at the CEE<br />

subsidiaries, especially our Moscow-based banking subsidiary.<br />

Loans and advances to customers were unchanged at € 66.7 bn.<br />

Domestic customers accounted for about three-quarters <strong>of</strong> total<br />

lending volume (€ 50.5 bn); loans and advances to domestic<br />

borrowers increased by 2.1%, with mortgage loans showing the<br />

strongest growth, followed by local-authority loans. A significant<br />

decline was recorded in consumer loans, while other loans and<br />

advances declined only slightly, mainly because <strong>of</strong> the cyclical lag in<br />

investment activity and the good liquidity position <strong>of</strong> our corporate<br />

customers. Foreign currency loans were no longer actively <strong>of</strong>fered<br />

by the bank. Where necessary, foreign currency loans were hedged<br />

or rescheduled through joint action with customers. Nevertheless,<br />

the currencies concerned appreciated to such an extent that<br />

conversion into euro resulted in a nominal increase (Swiss franc:<br />

+18.7%, Japanese yen +14.5% against the euro, year-on-year).<br />

Loans and advances to foreign customers were down by 5.9% from<br />

the previous year although export financing increased.<br />

Bonds and other fixed-income securities rose by € 4.4 bn, doubling<br />

to € 9.0 bn. The increase was mainly due to the acquisition <strong>of</strong><br />

foreign euro-denominated securities.<br />

Shares in group companies declined by € 5.6 bn or 30.8% to €<br />

12.6 bn. The main reason for the decline was the sale <strong>of</strong> UniCredit<br />

CAIB AG; in addition, the valuation <strong>of</strong> the shareholdings in our<br />

banking subsidiaries in Kazakhstan and Latvia had to be adjusted to<br />

the difficult situation and to changes in the outlook for the local<br />

banking sector.<br />

<strong>Bank</strong> <strong>Austria</strong> – <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong> 162