Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Report<br />

Management Report (CONTINUED)<br />

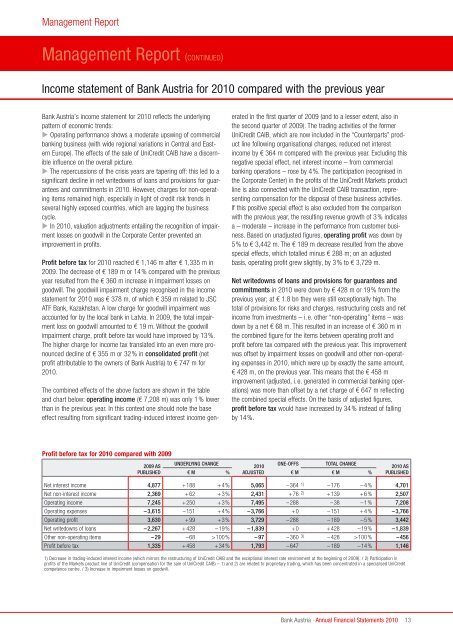

Income statement <strong>of</strong> <strong>Bank</strong> <strong>Austria</strong> for <strong>2010</strong> compared with the previous year<br />

<strong>Bank</strong> <strong>Austria</strong>’s income statement for <strong>2010</strong> reflects the underlying<br />

pattern <strong>of</strong> economic trends:<br />

� Operating performance shows a moderate upswing <strong>of</strong> commercial<br />

banking business (with wide regional variations in Central and Eastern<br />

Europe). The effects <strong>of</strong> the sale <strong>of</strong> UniCredit CAIB have a discernible<br />

influence on the overall picture.<br />

� The repercussions <strong>of</strong> the crisis years are tapering <strong>of</strong>f: this led to a<br />

significant decline in net writedowns <strong>of</strong> loans and provisions for guarantees<br />

and commitments in <strong>2010</strong>. However, charges for non-operating<br />

items remained high, especially in light <strong>of</strong> credit risk trends in<br />

several highly exposed countries, which are lagging the business<br />

cycle.<br />

� In <strong>2010</strong>, valuation adjustments entailing the recognition <strong>of</strong> impairment<br />

losses on goodwill in the Corporate Center prevented an<br />

improvement in pr<strong>of</strong>its.<br />

Pr<strong>of</strong>it before tax for <strong>2010</strong> reached € 1,146 m after € 1,335 m in<br />

2009. The decrease <strong>of</strong> € 189 m or 14% compared with the previous<br />

year resulted from the € 360 m increase in impairment losses on<br />

goodwill. The goodwill impairment charge recognised in the income<br />

statement for <strong>2010</strong> was € 378 m, <strong>of</strong> which € 359 m related to JSC<br />

ATF <strong>Bank</strong>, Kazakhstan. A low charge for goodwill impairment was<br />

accounted for by the local bank in Latvia. In 2009, the total impairment<br />

loss on goodwill amounted to € 19 m. Without the goodwill<br />

impairment charge, pr<strong>of</strong>it before tax would have improved by 13%.<br />

The higher charge for income tax translated into an even more pronounced<br />

decline <strong>of</strong> € 355 m or 32% in consolidated pr<strong>of</strong>it (net<br />

pr<strong>of</strong>it attributable to the owners <strong>of</strong> <strong>Bank</strong> <strong>Austria</strong>) to € 747 m for<br />

<strong>2010</strong>.<br />

The combined effects <strong>of</strong> the above factors are shown in the table<br />

and chart below: operating income (€ 7,208 m) was only 1% lower<br />

than in the previous year. In this context one should note the base<br />

effect resulting from significant trading-induced interest income gen-<br />

Pr<strong>of</strong>it before tax for <strong>2010</strong> compared with 2009<br />

2009 AS<br />

PUBlIShEd<br />

erated in the first quarter <strong>of</strong> 2009 (and to a lesser extent, also in<br />

the second quarter <strong>of</strong> 2009). The trading activities <strong>of</strong> the former<br />

UniCredit CAIB, which are now included in the “Counterparts” product<br />

line following organisational changes, reduced net interest<br />

income by € 364 m compared with the previous year. Excluding this<br />

negative special effect, net interest income – from commercial<br />

banking operations – rose by 4%. The participation (recognised in<br />

the Corporate Center) in the pr<strong>of</strong>its <strong>of</strong> the UniCredit Markets product<br />

line is also connected with the UniCredit CAIB transaction, representing<br />

compensation for the disposal <strong>of</strong> these business activities.<br />

If this positive special effect is also excluded from the comparison<br />

with the previous year, the resulting revenue growth <strong>of</strong> 3% indicates<br />

a – moderate – increase in the performance from customer business.<br />

Based on unadjusted figures, operating pr<strong>of</strong>it was down by<br />

5% to € 3,442 m. The € 189 m decrease resulted from the above<br />

special effects, which totalled minus € 288 m; on an adjusted<br />

basis, operating pr<strong>of</strong>it grew slightly, by 3% to € 3,729 m.<br />

Net writedowns <strong>of</strong> loans and provisions for guarantees and<br />

commitments in <strong>2010</strong> were down by € 428 m or 19% from the<br />

previous year; at € 1.8 bn they were still exceptionally high. The<br />

total <strong>of</strong> provisions for risks and charges, restructuring costs and net<br />

income from investments – i.e. other “non-operating” items – was<br />

down by a net € 68 m. This resulted in an increase <strong>of</strong> € 360 m in<br />

the combined figure for the items between operating pr<strong>of</strong>it and<br />

pr<strong>of</strong>it before tax compared with the previous year. This improvement<br />

was <strong>of</strong>fset by impairment losses on goodwill and other non-operating<br />

expenses in <strong>2010</strong>, which were up by exactly the same amount,<br />

€ 428 m, on the previous year. This means that the € 458 m<br />

improvement (adjusted, i.e. generated in commercial banking operations)<br />

was more than <strong>of</strong>fset by a net charge <strong>of</strong> € 647 m reflecting<br />

the combined special effects. On the basis <strong>of</strong> adjusted figures,<br />

pr<strong>of</strong>it before tax would have increased by 34% instead <strong>of</strong> falling<br />

by 14%.<br />

UNdErlyINg ChANgE<br />

<strong>2010</strong><br />

ONE-OFFS tOtAl ChANgE<br />

€ M % AdjUStEd<br />

€ M € M %<br />

<strong>2010</strong> AS<br />

PUBlIShEd<br />

Net interest income 4,877 +188 +4% 5,065 –364 1) –176 –4% 4,701<br />

Net non-interest income 2,369 +62 +3% 2,431 +76 2) +139 +6% 2,507<br />

Operating income 7,245 +250 +3% 7,495 –288 –38 –1% 7,208<br />

Operating expenses –3,615 –151 +4% –3,766 +0 –151 +4% –3,766<br />

Operating pr<strong>of</strong>it 3,630 +99 +3% 3,729 –288 –189 –5% 3,442<br />

Net writedowns <strong>of</strong> loans –2,267 +428 –19% –1,839 +0 +428 –19% –1,839<br />

Other non-operating items –29 –68 >100% – 97 –360 3) –428 >100% –456<br />

Pr<strong>of</strong>it before tax 1,335 +458 +34% 1,793 –647 –189 –14% 1,146<br />

1) Decrease in trading-induced interest income (which mirrors the restructuring <strong>of</strong> UniCredit CAIB and the exceptional interest rate environment at the beginning <strong>of</strong> 2009). / 2) Participation in<br />

pr<strong>of</strong>its <strong>of</strong> the Markets product line <strong>of</strong> UniCredit (compensation for the sale <strong>of</strong> UniCredit CAIB) – 1) and 2) are related to proprietary trading, which has been concentrated in a specialised UniCredit<br />

competence centre. / 3) Increase in impairment losses on goodwill.<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

13