Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report<br />

Management Report (CONTINUED)<br />

<strong>Financial</strong> and non-financial performance indicators<br />

Volume and pr<strong>of</strong>itability<br />

� Average loans and receivables with customers (net <strong>of</strong> loan loss<br />

provisions, stated at € 127.5 m in the statement <strong>of</strong> financial position),<br />

were only slightly above the level <strong>of</strong> 2009 (+0.3%) despite a<br />

vigorous upturn from quarter to quarter (Q4 <strong>2010</strong>/Q4 2009 +4.1%).<br />

The development in <strong>Austria</strong> and CEE reflects the U-shaped trend<br />

already referred to in this report. In <strong>Austria</strong>, lending volume almost<br />

matched the previous year’s figure in a comparison <strong>of</strong> Q4 <strong>2010</strong> with<br />

Q4 2009 (–0.9%), but the average figure for <strong>2010</strong> as a whole was<br />

still 2.8% lower than in 2009. In CEE (supported by the appreciation<br />

<strong>of</strong> CEE currencies in recent months), lending volume expanded from<br />

quarter to quarter (Q4 <strong>2010</strong>/Q4 2009 +9.6%) to exceed the previous<br />

year’s level in annual average terms (+3.4%). The bank’s<br />

unweighted lending volume is <strong>of</strong> more or less equal significance in<br />

both <strong>of</strong> its key regions, <strong>Austria</strong> and CEE.<br />

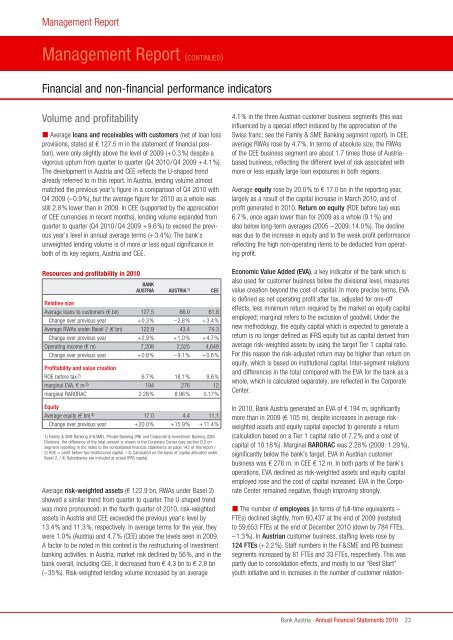

Resources and pr<strong>of</strong>itability in <strong>2010</strong><br />

BANk<br />

AUStrIA AUStrIA 1) CEE<br />

relative size<br />

Average loans to customers (€ bn) 127.5 66.0 61.8<br />

Change over previous year +0.3% –2.8% +3.4%<br />

Average RWAs under Basel 2 (€ bn) 122.9 43.4 74.3<br />

Change over previous year +2.9% +1.0% +4.7%<br />

Operating income (€ m) 7,208 2,525 4,649<br />

Change over previous year +0.8% – 9.1% +0.6%<br />

Pr<strong>of</strong>itability and value creation<br />

ROE before tax 2) 6.7% 18.1% 9.6%<br />

marginal EVA, € m 3) 194 276 12<br />

marginal RARORAC 2.28% 8.96% 0.17%<br />

Equity<br />

Average equity (€ bn) 4) 17.0 4.4 11.1<br />

Change over previous year +20.0% +15.9% +11.4%<br />

1) Family & SME <strong>Bank</strong>ing (F&SME), Private <strong>Bank</strong>ing (PB) and Corporate & Investment <strong>Bank</strong>ing (CIB)<br />

Divisions; the difference <strong>of</strong> the total amount is shown in the Corporate Center (see section D.2 on<br />

segment reporting in the notes to the consolidated financial statements on page 142 <strong>of</strong> this report /<br />

2) ROE = pr<strong>of</strong>it before tax/institutional capital. / 3) Calculated on the basis <strong>of</strong> capital allocated under<br />

Basel 2. / 4) Subsidiaries are included at actual IFRS capital.<br />

Average risk-weighted assets (€ 122.9 bn, RWAs under Basel 2)<br />

showed a similar trend from quarter to quarter. The U-shaped trend<br />

was more pronounced: in the fourth quarter <strong>of</strong> <strong>2010</strong>, risk-weighted<br />

assets in <strong>Austria</strong> and CEE exceeded the previous year’s level by<br />

13.4% and 11.3%, respectively. In average terms for the year, they<br />

were 1.0% (<strong>Austria</strong>) and 4.7% (CEE) above the levels seen in 2009.<br />

A factor to be noted in this context is the restructuring <strong>of</strong> investment<br />

banking activities: in <strong>Austria</strong>, market risk declined by 56%, and in the<br />

bank overall, including CEE, it decreased from € 4.3 bn to € 2.8 bn<br />

(–35%). Risk-weighted lending volume increased by an average<br />

4.1% in the three <strong>Austria</strong>n customer business segments (this was<br />

influenced by a special effect induced by the appreciation <strong>of</strong> the<br />

Swiss franc; see the Family & SME <strong>Bank</strong>ing segment report). In CEE,<br />

average RWAs rose by 4.7%. In terms <strong>of</strong> absolute size, the RWAs<br />

<strong>of</strong> the CEE business segment are about 1.7 times those <strong>of</strong> <strong>Austria</strong>based<br />

business, reflecting the different level <strong>of</strong> risk associated with<br />

more or less equally large loan exposures in both regions.<br />

Average equity rose by 20.0% to € 17.0 bn in the reporting year,<br />

largely as a result <strong>of</strong> the capital increase in March <strong>2010</strong>, and <strong>of</strong><br />

pr<strong>of</strong>it generated in <strong>2010</strong>. return on equity (ROE before tax) was<br />

6.7%, once again lower than for 2009 as a whole (9.1%) and<br />

also below long-term averages (2005 –2009: 14.0%). The decline<br />

was due to the increase in equity and to the weak pr<strong>of</strong>it performance<br />

reflecting the high non-operating items to be deducted from operating<br />

pr<strong>of</strong>it.<br />

Economic Value Added (EVA), a key indicator <strong>of</strong> the bank which is<br />

also used for customer business below the divisional level, measures<br />

value creation beyond the cost <strong>of</strong> capital. In more precise terms, EVA<br />

is defined as net operating pr<strong>of</strong>it after tax, adjusted for one-<strong>of</strong>f<br />

effects, less minimum return required by the market on equity capital<br />

employed; marginal refers to the exclusion <strong>of</strong> goodwill. Under the<br />

new methodology, the equity capital which is expected to generate a<br />

return is no longer defined as IFRS equity but as capital derived from<br />

average risk-weighted assets by using the target Tier 1 capital ratio.<br />

For this reason the risk-adjusted return may be higher than return on<br />

equity, which is based on institutional capital. Inter-segment relations<br />

and differences in the total compared with the EVA for the bank as a<br />

whole, which is calculated separately, are reflected in the Corporate<br />

Center.<br />

In <strong>2010</strong>, <strong>Bank</strong> <strong>Austria</strong> generated an EVA <strong>of</strong> € 194 m, significantly<br />

more than in 2009 (€ 105 m), despite increases in average riskweighted<br />

assets and equity capital expected to generate a return<br />

(calculation based on a Tier 1 capital ratio <strong>of</strong> 7.2% and a cost <strong>of</strong><br />

capital <strong>of</strong> 10.18%). Marginal rArOrAC was 2.28% (2009: 1.29%),<br />

significantly below the bank’s target. EVA in <strong>Austria</strong>n customer<br />

business was € 276 m, in CEE € 12 m. In both parts <strong>of</strong> the bank’s<br />

operations, EVA declined as risk-weighted assets and equity capital<br />

employed rose and the cost <strong>of</strong> capital increased. EVA in the Corporate<br />

Center remained negative, though improving strongly.<br />

� The number <strong>of</strong> employees (in terms <strong>of</strong> full-time equivalents –<br />

FTEs) declined slightly, from 60,437 at the end <strong>of</strong> 2009 (restated)<br />

to 59,653 FTEs at the end <strong>of</strong> December <strong>2010</strong> (down by 784 FTEs,<br />

–1.3%). In <strong>Austria</strong>n customer business, staffing levels rose by<br />

124 FtEs (+2.2%). Staff numbers in the F&SME and PB business<br />

segments increased by 81 FTEs and 33 FTEs, respectively. This was<br />

partly due to consolidation effects, and mostly to our “Best Start”<br />

youth initiative and in increases in the number <strong>of</strong> customer relation-<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

23