Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

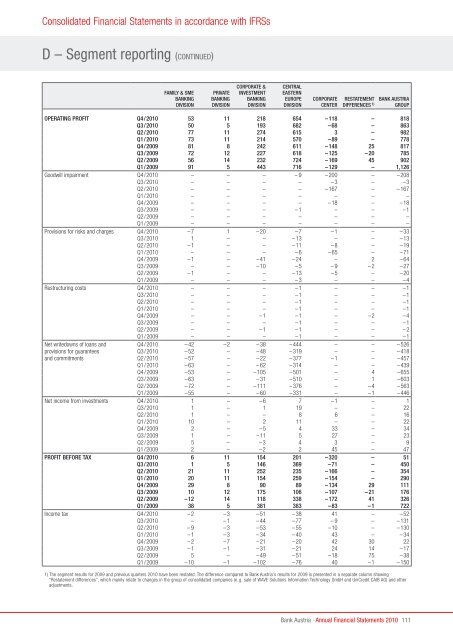

Consolidated <strong>Financial</strong> <strong>Statements</strong> in accordance with IFRSs<br />

D – Segment reporting (CoNTINuED)<br />

family & sme<br />

baNKiNg<br />

diVisiON<br />

priVate<br />

baNKiNg<br />

diVisiON<br />

cOrpOrate &<br />

iNVestmeNt<br />

baNKiNg<br />

diVisiON<br />

ceNtral<br />

easterN<br />

eurOpe<br />

diVisiON<br />

cOrpOrate<br />

ceNter<br />

restatemeNt<br />

differeNces 1)<br />

baNK austria<br />

grOup<br />

OperatiNg prOfit q4/<strong>2010</strong> 53 11 218 654 –118 – 818<br />

q3/<strong>2010</strong> 50 5 193 682 –68 – 863<br />

q2/<strong>2010</strong> 77 11 274 615 3 – 982<br />

q1/<strong>2010</strong> 73 11 214 570 –89 – 778<br />

q4/2009 81 8 242 611 –148 25 817<br />

q3/2009 72 12 227 618 –125 –20 785<br />

q2/2009 56 14 232 724 –169 45 902<br />

q1/2009 91 5 443 716 –129 – 1,126<br />

Goodwill impairment Q4/<strong>2010</strong> – – – –9 –200 – –208<br />

Q3/<strong>2010</strong> – – – – –3 – –3<br />

Q2/<strong>2010</strong> – – – – –167 – –167<br />

Q1/<strong>2010</strong> – – – – – – –<br />

Q4/2009 – – – – –18 – –18<br />

Q3/2009 – – – –1 – – –1<br />

Q2/2009 – – – – – – –<br />

Q1/2009 – – – – – – –<br />

Provisions for risks and charges Q4/<strong>2010</strong> –7 1 –20 –7 –1 – –33<br />

Q3/<strong>2010</strong> 1 – – –13 – – –13<br />

Q2/<strong>2010</strong> –1 – – –11 –8 – –19<br />

Q1/<strong>2010</strong> – – – –6 –65 – –71<br />

Q4/2009 –1 – –41 –24 – 2 –64<br />

Q3/2009 – – –10 –5 –9 –2 –27<br />

Q2/2009 –1 – – –13 –5 – –20<br />

Q1/2009 – – – –3 – – –4<br />

Restructuring costs Q4/<strong>2010</strong> – – – –1 – – –1<br />

Q3/<strong>2010</strong> – – – –1 – – –1<br />

Q2/<strong>2010</strong> – – – –1 – – –1<br />

Q1/<strong>2010</strong> – – – –1 – – –1<br />

Q4/2009 – – –1 –1 – –2 –4<br />

Q3/2009 – – – –1 – – –1<br />

Q2/2009 – – –1 –1 – – –2<br />

Q1/2009 – – – –1 – – –1<br />

Net writedowns <strong>of</strong> loans and Q4/<strong>2010</strong> –42 –2 –38 –444 – – –526<br />

provisions for guarantees Q3/<strong>2010</strong> –52 – –48 –319 – – –418<br />

and commitments Q2/<strong>2010</strong> –57 – –22 –377 –1 – –457<br />

Q1/<strong>2010</strong> –63 – –62 –314 – – –439<br />

Q4/2009 –53 – –105 –501 – 4 –655<br />

Q3/2009 –63 – –31 –510 – 1 –603<br />

Q2/2009 –72 – –111 –376 – –4 –563<br />

Q1/2009 –55 – –60 –331 – –1 –446<br />

Net income from investments Q4/<strong>2010</strong> 1 – –6 7 –1 – 1<br />

Q3/<strong>2010</strong> 1 – 1 19 – – 22<br />

Q2/<strong>2010</strong> 1 – – 8 6 – 16<br />

Q1/<strong>2010</strong> 10 – 2 11 – – 22<br />

Q4/2009 2 – –5 4 33 – 34<br />

Q3/2009 1 – –11 5 27 – 23<br />

Q2/2009 5 – –3 4 3 – 9<br />

Q1/2009 2 – –2 2 45 – 47<br />

prOfit befOre tax q4/<strong>2010</strong> 6 11 154 201 –320 – 51<br />

q3/<strong>2010</strong> 1 5 146 369 –71 – 450<br />

q2/<strong>2010</strong> 21 11 252 235 –166 – 354<br />

q1/<strong>2010</strong> 20 11 154 259 –154 – 290<br />

q4/2009 29 8 90 89 –134 29 111<br />

q3/2009 10 12 175 106 –107 –21 176<br />

q2/2009 –12 14 118 338 –172 41 326<br />

q1/2009 38 5 381 383 –83 –1 722<br />

Income tax Q4/<strong>2010</strong> –2 –3 –51 –38 41 – –52<br />

Q3/<strong>2010</strong> – –1 –44 –77 –9 – –131<br />

Q2/<strong>2010</strong> –9 –3 –53 –55 –10 – –130<br />

Q1/<strong>2010</strong> –1 –3 –34 –40 43 – –34<br />

Q4/2009 –2 –7 –21 –20 42 30 22<br />

Q3/2009 –1 –1 –31 –21 24 14 –17<br />

Q2/2009 5 – –49 –51 –18 75 –38<br />

Q1/2009 –10 –1 –102 –76 40 –1 –150<br />

1) The segment results for 2009 and previous quarters <strong>2010</strong> have been restated. The difference compared to <strong>Bank</strong> <strong>Austria</strong>’s results for 2009 is presented in a separate column showing<br />

“Restatement differences”, which mainly relate to changes in the group <strong>of</strong> consolidated companies (e.g. sale <strong>of</strong> WAVE Solutions Information Technology GmbH and UniCredit CAIB AG) and other<br />

adjustments.<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

111