Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated <strong>Financial</strong> <strong>Statements</strong> in accordance with IFRSs<br />

E – Risk report (CoNTINuED)<br />

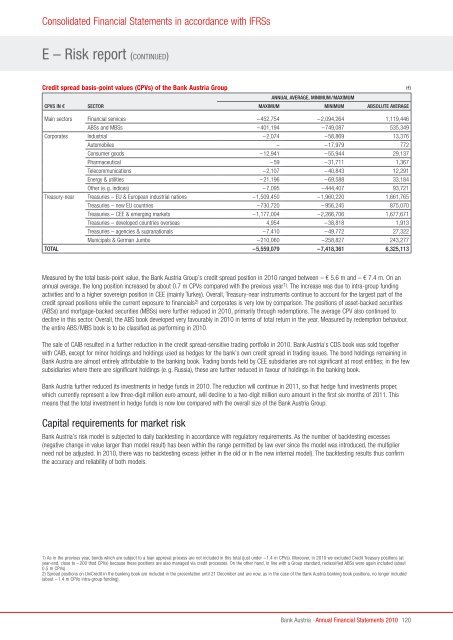

Credit spread basis-point values (CPVs) <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group (€)<br />

aNNual aVerage, miNimum/maximum<br />

cpVs iN € sectOr maximum miNimum absOlute aVerage<br />

Main sectors <strong>Financial</strong> services –452,754 –2,094,264 1,119,446<br />

ABSs and MBSs –401,194 –749,087 535,349<br />

Corporates Industrial –2,074 –58,869 13,376<br />

Automobiles – –17,979 772<br />

Consumer goods –12,941 –55,944 29,137<br />

Pharmaceutical –59 –31,711 1,367<br />

Telecommunications –2,107 –40,843 12,291<br />

Energy & utilities –21,196 –69,588 33,184<br />

Other (e.g. indices) –7,095 –444,407 93,721<br />

Treasury-near Treasuries – EU & European industrial nations –1,509,450 –1,960,220 1,661,765<br />

Treasuries – new EU countries –730,720 – 956,245 875,070<br />

Treasuries – CEE & emerging markets –1,177,004 –2,266,706 1,677,671<br />

Treasuries – developed countries overseas 4,954 –38,818 1,913<br />

Treasuries – agencies & supranationals –7,410 –49,772 27,322<br />

Municipals & German Jumbo –210,060 –258,827 243,277<br />

tOtal –5,559,079 –7,418,361 6,325,113<br />

Measured by the total basis-point value, the <strong>Bank</strong> <strong>Austria</strong> Group’s credit spread position in <strong>2010</strong> ranged between – € 5.6 m and – € 7.4 m. On an<br />

annual average, the long position increased by about 0.7 m CPVs compared with the previous year 1). The increase was due to intra-group funding<br />

activities and to a higher sovereign position in CEE (mainly Turkey). Overall, Treasury-near instruments continue to account for the largest part <strong>of</strong> the<br />

credit spread positions while the current exposure to financials 2) and corporates is very low by comparison. The positions <strong>of</strong> asset-backed securities<br />

(ABSs) and mortgage-backed securities (MBSs) were further reduced in <strong>2010</strong>, primarily through redemptions. The average CPV also continued to<br />

decline in this sector. Overall, the ABS book developed very favourably in <strong>2010</strong> in terms <strong>of</strong> total return in the year. Measured by redemption behaviour,<br />

the entire ABS/MBS book is to be classified as performing in <strong>2010</strong>.<br />

The sale <strong>of</strong> CAIB resulted in a further reduction in the credit spread-sensitive trading portfolio in <strong>2010</strong>. <strong>Bank</strong> <strong>Austria</strong>’s CDS book was sold together<br />

with CAIB, except for minor holdings and holdings used as hedges for the bank’s own credit spread in trading issues. The bond holdings remaining in<br />

<strong>Bank</strong> <strong>Austria</strong> are almost entirely attributable to the banking book. Trading bonds held by CEE subsidiaries are not significant at most entities; in the few<br />

subsidiaries where there are significant holdings (e.g. Russia), these are further reduced in favour <strong>of</strong> holdings in the banking book.<br />

<strong>Bank</strong> <strong>Austria</strong> further reduced its investments in hedge funds in <strong>2010</strong>. The reduction will continue in 2011, so that hedge fund investments proper,<br />

which currently represent a low three-digit million euro amount, will decline to a two-digit million euro amount in the first six months <strong>of</strong> 2011. This<br />

means that the total investment in hedge funds is now low compared with the overall size <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group.<br />

Capital requirements for market risk<br />

<strong>Bank</strong> <strong>Austria</strong>’s risk model is subjected to daily backtesting in accordance with regulatory requirements. As the number <strong>of</strong> backtesting excesses<br />

(negative change in value larger than model result) has been within the range permitted by law ever since the model was introduced, the multiplier<br />

need not be adjusted. In <strong>2010</strong>, there was no backtesting excess (either in the old or in the new internal model). The backtesting results thus confirm<br />

the accuracy and reliability <strong>of</strong> both models.<br />

1) As in the previous year, bonds which are subject to a loan approval process are not included in this total (just under –1.4 m CPVs). Moreover, in <strong>2010</strong> we excluded Credit Treasury positions (at<br />

year-end, close to –200 thsd CPVs) because these positions are also managed via credit processes. On the other hand, in line with a Group standard, reclassified ABSs were again included (about<br />

0.5 m CPVs).<br />

2) Spread positions on UniCredit in the banking book are included in the presentation until 21 December and are now, as in the case <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> banking book positions, no longer included<br />

(about –1.4 m CPVs intra-group funding).<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong><br />

120