Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Annual Financial Statements 2010 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Financial</strong> <strong>Statements</strong><br />

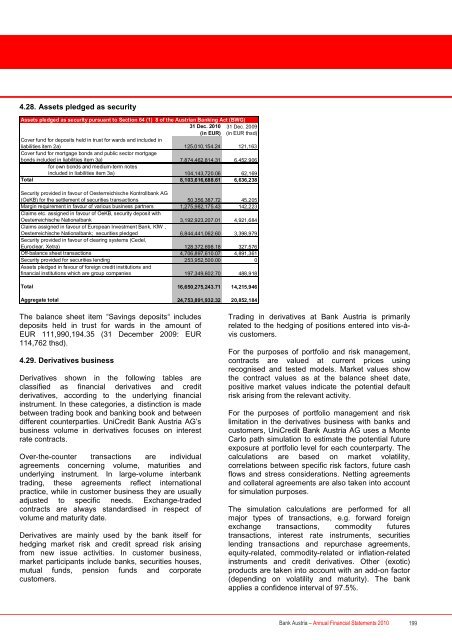

4.28. Assets pledged as security<br />

Assets pledged as security pursuant to Section 64 (1) 8 <strong>of</strong> the <strong>Austria</strong>n <strong>Bank</strong>ing Act (BWG)<br />

31 Dec. <strong>2010</strong> 31 Dec. 2009<br />

(in EUR) (in EUR thsd)<br />

Cover fund for deposits held in trust for wards and included in<br />

liabilities item 2a) 125,010,154.24 121,163<br />

Cover fund for mortgage bonds and public sector mortgage<br />

bonds included in liabilities item 3a) 7,874,462,814.31 6,452,906<br />

for own bonds and medium-term notes<br />

included in liabilities item 3a) 104,143,720.06 62,169<br />

Total 8,103,616,688.61 6,636,238<br />

Security provided in favour <strong>of</strong> Oesterreichische Kontrollbank AG<br />

(OeKB) for the settlement <strong>of</strong> securities transactions 50,356,387.72 45,205<br />

Margin requirement in favour <strong>of</strong> various business partners 1,275,982,175.43 142,223<br />

Claims etc. assigned in favour <strong>of</strong> OeKB, security deposit with<br />

Oesterreichische Nationalbank 3,192,923,207.01 4,921,684<br />

Claims assigned in favour <strong>of</strong> European Investment <strong>Bank</strong>, KfW ,<br />

Oesterreichische Nationalbank; securities pledged 6,844,441,062.60 3,398,979<br />

Security provided in favour <strong>of</strong> clearing systems (Cedel,<br />

Euroclear, Xetra) 128,372,698.18 327,576<br />

Off-balance sheet transactions 4,706,897,610.07 4,891,361<br />

Security provided for securities lending 253,952,500.00 0<br />

Assets pledged in favour <strong>of</strong> foreign credit institutions and<br />

financial institutions which are group companies 197,349,602.70 488,918<br />

Total 16,650,275,243.71 14,215,946<br />

Aggregate total 24,753,891,932.32 20,852,184<br />

The balance sheet item “Savings deposits“ includes<br />

deposits held in trust for wards in the amount <strong>of</strong><br />

EUR 111,990,194.35 (31 December 2009: EUR<br />

114,762 thsd).<br />

4.29. Derivatives business<br />

Derivatives shown in the following tables are<br />

classified as financial derivatives and credit<br />

derivatives, according to the underlying financial<br />

instrument. In these categories, a distinction is made<br />

between trading book and banking book and between<br />

different counterparties. UniCredit <strong>Bank</strong> <strong>Austria</strong> AG’s<br />

business volume in derivatives focuses on interest<br />

rate contracts.<br />

Over-the-counter transactions are individual<br />

agreements concerning volume, maturities and<br />

underlying instrument. In large-volume interbank<br />

trading, these agreements reflect international<br />

practice, while in customer business they are usually<br />

adjusted to specific needs. Exchange-traded<br />

contracts are always standardised in respect <strong>of</strong><br />

volume and maturity date.<br />

Derivatives are mainly used by the bank itself for<br />

hedging market risk and credit spread risk arising<br />

from new issue activities. In customer business,<br />

market participants include banks, securities houses,<br />

mutual funds, pension funds and corporate<br />

customers.<br />

Trading in derivatives at <strong>Bank</strong> <strong>Austria</strong> is primarily<br />

related to the hedging <strong>of</strong> positions entered into vis-àvis<br />

customers.<br />

For the purposes <strong>of</strong> portfolio and risk management,<br />

contracts are valued at current prices using<br />

recognised and tested models. Market values show<br />

the contract values as at the balance sheet date,<br />

positive market values indicate the potential default<br />

risk arising from the relevant activity.<br />

For the purposes <strong>of</strong> portfolio management and risk<br />

limitation in the derivatives business with banks and<br />

customers, UniCredit <strong>Bank</strong> <strong>Austria</strong> AG uses a Monte<br />

Carlo path simulation to estimate the potential future<br />

exposure at portfolio level for each counterparty. The<br />

calculations are based on market volatility,<br />

correlations between specific risk factors, future cash<br />

flows and stress considerations. Netting agreements<br />

and collateral agreements are also taken into account<br />

for simulation purposes.<br />

The simulation calculations are performed for all<br />

major types <strong>of</strong> transactions, e.g. forward foreign<br />

exchange transactions, commodity futures<br />

transactions, interest rate instruments, securities<br />

lending transactions and repurchase agreements,<br />

equity-related, commodity-related or inflation-related<br />

instruments and credit derivatives. Other (exotic)<br />

products are taken into account with an add-on factor<br />

(depending on volatility and maturity). The bank<br />

applies a confidence interval <strong>of</strong> 97.5%.<br />

<strong>Bank</strong> <strong>Austria</strong> – <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2010</strong> 199