Finance and Administration - Board of Trustees - The University of ...

Finance and Administration - Board of Trustees - The University of ...

Finance and Administration - Board of Trustees - The University of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

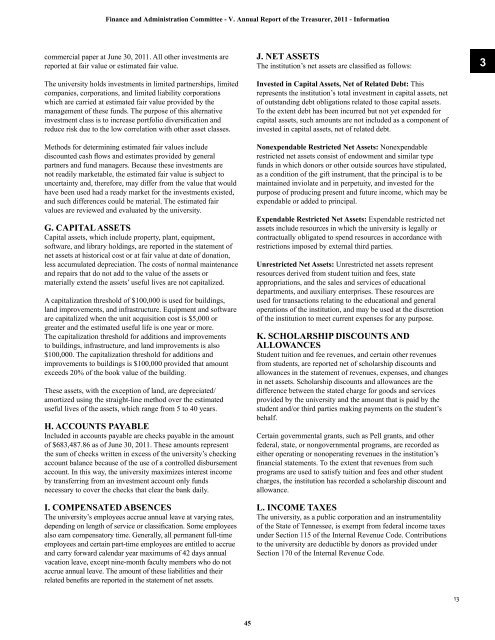

<strong>Finance</strong> <strong>and</strong> <strong>Administration</strong> Committee - V. Annual Report <strong>of</strong> the Treasurer, 2011 - Informationcommercial paper at June 30, 2011. All other investments arereported at fair value or estimated fair value.<strong>The</strong> university holds investments in limited partnerships, limitedcompanies, corporations, <strong>and</strong> limited liability corporationswhich are carried at estimated fair value provided by themanagement <strong>of</strong> these funds. <strong>The</strong> purpose <strong>of</strong> this alternativeinvestment class is to increase portfolio diversification <strong>and</strong>reduce risk due to the low correlation with other asset classes.Methods for determining estimated fair values includediscounted cash flows <strong>and</strong> estimates provided by generalpartners <strong>and</strong> fund managers. Because these investments arenot readily marketable, the estimated fair value is subject touncertainty <strong>and</strong>, therefore, may differ from the value that wouldhave been used had a ready market for the investments existed,<strong>and</strong> such differences could be material. <strong>The</strong> estimated fairvalues are reviewed <strong>and</strong> evaluated by the university.G. CAPITAL ASSETSCapital assets, which include property, plant, equipment,s<strong>of</strong>tware, <strong>and</strong> library holdings, are reported in the statement <strong>of</strong>net assets at historical cost or at fair value at date <strong>of</strong> donation,less accumulated depreciation. <strong>The</strong> costs <strong>of</strong> normal maintenance<strong>and</strong> repairs that do not add to the value <strong>of</strong> the assets ormaterially extend the assets’ useful lives are not capitalized.A capitalization threshold <strong>of</strong> $100,000 is used for buildings,l<strong>and</strong> improvements, <strong>and</strong> infrastructure. Equipment <strong>and</strong> s<strong>of</strong>twareare capitalized when the unit acquisition cost is $5,000 orgreater <strong>and</strong> the estimated useful life is one year or more.<strong>The</strong> capitalization threshold for additions <strong>and</strong> improvementsto buildings, infrastructure, <strong>and</strong> l<strong>and</strong> improvements is also$100,000. <strong>The</strong> capitalization threshold for additions <strong>and</strong>improvements to buildings is $100,000 provided that amountexceeds 20% <strong>of</strong> the book value <strong>of</strong> the building.<strong>The</strong>se assets, with the exception <strong>of</strong> l<strong>and</strong>, are depreciated/amortized using the straight-line method over the estimateduseful lives <strong>of</strong> the assets, which range from 5 to 40 years.H. ACCOUNTS PAYABLEIncluded in accounts payable are checks payable in the amount<strong>of</strong> $683,487.86 as <strong>of</strong> June 30, 2011. <strong>The</strong>se amounts representthe sum <strong>of</strong> checks written in excess <strong>of</strong> the university’s checkingaccount balance because <strong>of</strong> the use <strong>of</strong> a controlled disbursementaccount. In this way, the university maximizes interest incomeby transferring from an investment account only fundsnecessary to cover the checks that clear the bank daily.I. COMPENSATED ABSENCES<strong>The</strong> university’s employees accrue annual leave at varying rates,depending on length <strong>of</strong> service or classification. Some employeesalso earn compensatory time. Generally, all permanent full-timeemployees <strong>and</strong> certain part-time employees are entitled to accrue<strong>and</strong> carry forward calendar year maximums <strong>of</strong> 42 days annualvacation leave, except nine-month faculty members who do notaccrue annual leave. <strong>The</strong> amount <strong>of</strong> these liabilities <strong>and</strong> theirrelated benefits are reported in the statement <strong>of</strong> net assets.J. NET ASSETS<strong>The</strong> institution’s net assets are classified as follows:Invested in Capital Assets, Net <strong>of</strong> Related Debt: Thisrepresents the institution’s total investment in capital assets, net<strong>of</strong> outst<strong>and</strong>ing debt obligations related to those capital assets.To the extent debt has been incurred but not yet expended forcapital assets, such amounts are not included as a component <strong>of</strong>invested in capital assets, net <strong>of</strong> related debt.Nonexpendable Restricted Net Assets: Nonexpendablerestricted net assets consist <strong>of</strong> endowment <strong>and</strong> similar typefunds in which donors or other outside sources have stipulated,as a condition <strong>of</strong> the gift instrument, that the principal is to bemaintained inviolate <strong>and</strong> in perpetuity, <strong>and</strong> invested for thepurpose <strong>of</strong> producing present <strong>and</strong> future income, which may beexpendable or added to principal.Expendable Restricted Net Assets: Expendable restricted netassets include resources in which the university is legally orcontractually obligated to spend resources in accordance withrestrictions imposed by external third parties.Unrestricted Net Assets: Unrestricted net assets representresources derived from student tuition <strong>and</strong> fees, stateappropriations, <strong>and</strong> the sales <strong>and</strong> services <strong>of</strong> educationaldepartments, <strong>and</strong> auxiliary enterprises. <strong>The</strong>se resources areused for transactions relating to the educational <strong>and</strong> generaloperations <strong>of</strong> the institution, <strong>and</strong> may be used at the discretion<strong>of</strong> the institution to meet current expenses for any purpose.K. SCHOLARSHIP DISCOUNTS ANDALLOWANCESStudent tuition <strong>and</strong> fee revenues, <strong>and</strong> certain other revenuesfrom students, are reported net <strong>of</strong> scholarship discounts <strong>and</strong>allowances in the statement <strong>of</strong> revenues, expenses, <strong>and</strong> changesin net assets. Scholarship discounts <strong>and</strong> allowances are thedifference between the stated charge for goods <strong>and</strong> servicesprovided by the university <strong>and</strong> the amount that is paid by thestudent <strong>and</strong>/or third parties making payments on the student’sbehalf.Certain governmental grants, such as Pell grants, <strong>and</strong> otherfederal, state, or nongovernmental programs, are recorded aseither operating or nonoperating revenues in the institution’sfinancial statements. To the extent that revenues from suchprograms are used to satisfy tuition <strong>and</strong> fees <strong>and</strong> other studentcharges, the institution has recorded a scholarship discount <strong>and</strong>allowance.L. INCOME TAXES<strong>The</strong> university, as a public corporation <strong>and</strong> an instrumentality<strong>of</strong> the State <strong>of</strong> Tennessee, is exempt from federal income taxesunder Section 115 <strong>of</strong> the Internal Revenue Code. Contributionsto the university are deductible by donors as provided underSection 170 <strong>of</strong> the Internal Revenue Code.31345