Finance and Administration - Board of Trustees - The University of ...

Finance and Administration - Board of Trustees - The University of ...

Finance and Administration - Board of Trustees - The University of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

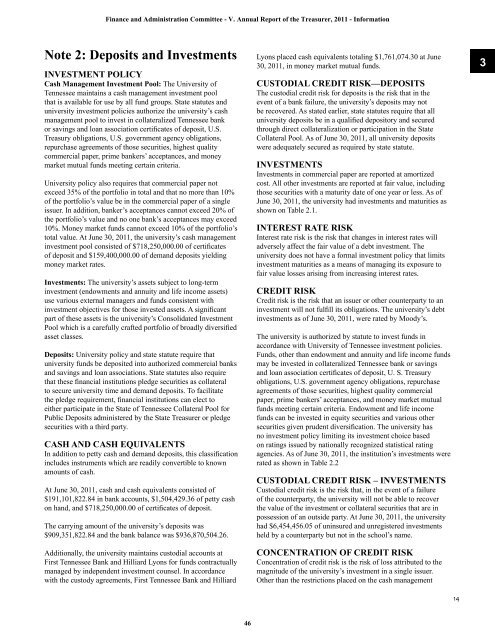

<strong>Finance</strong> <strong>and</strong> <strong>Administration</strong> Committee - V. Annual Report <strong>of</strong> the Treasurer, 2011 - InformationNote 2: Deposits <strong>and</strong> InvestmentsINVESTMENT POLICYCash Management Investment Pool: <strong>The</strong> <strong>University</strong> <strong>of</strong>Tennessee maintains a cash management investment poolthat is available for use by all fund groups. State statutes <strong>and</strong>university investment policies authorize the university’s cashmanagement pool to invest in collateralized Tennessee bankor savings <strong>and</strong> loan association certificates <strong>of</strong> deposit, U.S.Treasury obligations, U.S. government agency obligations,repurchase agreements <strong>of</strong> those securities, highest qualitycommercial paper, prime bankers’ acceptances, <strong>and</strong> moneymarket mutual funds meeting certain criteria.<strong>University</strong> policy also requires that commercial paper notexceed 35% <strong>of</strong> the portfolio in total <strong>and</strong> that no more than 10%<strong>of</strong> the portfolio’s value be in the commercial paper <strong>of</strong> a singleissuer. In addition, banker’s acceptances cannot exceed 20% <strong>of</strong>the portfolio’s value <strong>and</strong> no one bank’s acceptances may exceed10%. Money market funds cannot exceed 10% <strong>of</strong> the portfolio’stotal value. At June 30, 2011, the university’s cash managementinvestment pool consisted <strong>of</strong> $718,250,000.00 <strong>of</strong> certificates<strong>of</strong> deposit <strong>and</strong> $159,400,000.00 <strong>of</strong> dem<strong>and</strong> deposits yieldingmoney market rates.Investments: <strong>The</strong> university’s assets subject to long-terminvestment (endowments <strong>and</strong> annuity <strong>and</strong> life income assets)use various external managers <strong>and</strong> funds consistent withinvestment objectives for those invested assets. A significantpart <strong>of</strong> these assets is the university’s Consolidated InvestmentPool which is a carefully crafted portfolio <strong>of</strong> broadly diversifiedasset classes.Deposits: <strong>University</strong> policy <strong>and</strong> state statute require thatuniversity funds be deposited into authorized commercial banks<strong>and</strong> savings <strong>and</strong> loan associations. State statutes also requirethat these financial institutions pledge securities as collateralto secure university time <strong>and</strong> dem<strong>and</strong> deposits. To facilitatethe pledge requirement, financial institutions can elect toeither participate in the State <strong>of</strong> Tennessee Collateral Pool forPublic Deposits administered by the State Treasurer or pledgesecurities with a third party.CASH AND CASH EQUIVALENTSIn addition to petty cash <strong>and</strong> dem<strong>and</strong> deposits, this classificationincludes instruments which are readily convertible to knownamounts <strong>of</strong> cash.At June 30, 2011, cash <strong>and</strong> cash equivalents consisted <strong>of</strong>$191,101,822.84 in bank accounts, $1,504,429.36 <strong>of</strong> petty cashon h<strong>and</strong>, <strong>and</strong> $718,250,000.00 <strong>of</strong> certificates <strong>of</strong> deposit.<strong>The</strong> carrying amount <strong>of</strong> the university’s deposits was$909,351,822.84 <strong>and</strong> the bank balance was $936,870,504.26.Additionally, the university maintains custodial accounts atFirst Tennessee Bank <strong>and</strong> Hilliard Lyons for funds contractuallymanaged by independent investment counsel. In accordancewith the custody agreements, First Tennessee Bank <strong>and</strong> HilliardLyons placed cash equivalents totaling $1,761,074.30 at June30, 2011, in money market mutual funds.CUSTODIAL CREDIT RISK—DEPOSITS<strong>The</strong> custodial credit risk for deposits is the risk that in theevent <strong>of</strong> a bank failure, the university’s deposits may notbe recovered. As stated earlier, state statutes require that alluniversity deposits be in a qualified depository <strong>and</strong> securedthrough direct collateralization or participation in the StateCollateral Pool. As <strong>of</strong> June 30, 2011, all university depositswere adequately secured as required by state statute.INVESTMENTSInvestments in commercial paper are reported at amortizedcost. All other investments are reported at fair value, includingthose securities with a maturity date <strong>of</strong> one year or less. As <strong>of</strong>June 30, 2011, the university had investments <strong>and</strong> maturities asshown on Table 2.1.INTEREST RATE RISKInterest rate risk is the risk that changes in interest rates willadversely affect the fair value <strong>of</strong> a debt investment. <strong>The</strong>university does not have a formal investment policy that limitsinvestment maturities as a means <strong>of</strong> managing its exposure t<strong>of</strong>air value losses arising from increasing interest rates.CREDIT RISKCredit risk is the risk that an issuer or other counterparty to aninvestment will not fulfill its obligations. <strong>The</strong> university’s debtinvestments as <strong>of</strong> June 30, 2011, were rated by Moody’s.<strong>The</strong> university is authorized by statute to invest funds inaccordance with <strong>University</strong> <strong>of</strong> Tennessee investment policies.Funds, other than endowment <strong>and</strong> annuity <strong>and</strong> life income fundsmay be invested in collateralized Tennessee bank or savings<strong>and</strong> loan association certificates <strong>of</strong> deposit, U. S. Treasuryobligations, U.S. government agency obligations, repurchaseagreements <strong>of</strong> those securities, highest quality commercialpaper, prime bankers’ acceptances, <strong>and</strong> money market mutualfunds meeting certain criteria. Endowment <strong>and</strong> life incomefunds can be invested in equity securities <strong>and</strong> various othersecurities given prudent diversification. <strong>The</strong> university hasno investment policy limiting its investment choice basedon ratings issued by nationally recognized statistical ratingagencies. As <strong>of</strong> June 30, 2011, the institution’s investments wererated as shown in Table 2.2CUSTODIAL CREDIT RISK – INVESTMENTSCustodial credit risk is the risk that, in the event <strong>of</strong> a failure<strong>of</strong> the counterparty, the university will not be able to recoverthe value <strong>of</strong> the investment or collateral securities that are inpossession <strong>of</strong> an outside party. At June 30, 2011, the universityhad $6,454,456.05 <strong>of</strong> uninsured <strong>and</strong> unregistered investmentsheld by a counterparty but not in the school’s name.CONCENTRATION OF CREDIT RISKConcentration <strong>of</strong> credit risk is the risk <strong>of</strong> loss attributed to themagnitude <strong>of</strong> the university’s investment in a single issuer.Other than the restrictions placed on the cash management31446