ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

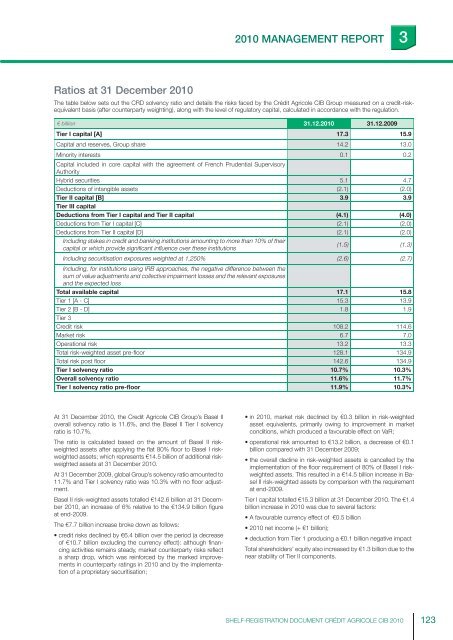

2010 MANAGEMENT REPORT 3Ratios at 31 December 2010The table below sets out the CRD solvency ratio and details the risks faced by the <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> Group measured on a credit-riskequivalentbasis (after counterparty weighting), along with the level of regulatory capital, calculated in accordance with the regulation.€ billion 31.12.2010 31.12.2009Tier I capital [A] 17.3 15.9Capital and reserves, Group share 14.2 13.0Minority interests 0.1 0.2Capital included in core capital with the agreement of French Prudential SupervisoryAuthorityHybrid securities 5.1 4.7Deductions of intangible assets (2.1) (2.0)Tier II capital [B] 3.9 3.9Tier III capitalDeductions from Tier I capital and Tier II capital (4.1) (4.0)Deductions from Tier I capital [C] (2.1) (2.0)Deductions from Tier II capital [D] (2.1) (2.0)Including stakes in credit and banking institutions amounting to more than 10% of theircapital or which provide signifi cant infl uence over these institutions(1.5) (1.3)Including securitisation exposures weighted at 1,250% (2.6) (2.7)Including, for institutions using IRB approaches, the negative difference between thesum of value adjustments and collective impairment losses and the relevant exposuresand the expected lossTotal available capital 17.1 15.8Tier 1 [A - C] 15.3 13.9Tier 2 [B - D] 1.8 1.9Tier 3Credit risk 108.2 114.6Market risk 6.7 7.0Operational risk 13.2 13.3Total risk-weighted asset pre-fl oor 128.1 134.9Total risk post fl oor 142.6 134.9Tier I solvency ratio 10.7% 10.3%Overall solvency ratio 11.6% 11.7%Tier I solvency ratio pre-floor 11.9% 10.3%At 31 December 2010, the Credit <strong>Agricole</strong> <strong>CIB</strong> Group’s Basel IIoverall solvency ratio is 11.6%, and the Basel II Tier I solvencyratio is 10.7%.The ratio is calculated based on the amount of Basel II riskweightedassets after applying the fl at 80% fl oor to Basel I riskweightedassets; which represents €14.5 billion of additional riskweightedassets at 31 December 2010.At 31 December 2009, global Group’s solvency ratio amounted to11.7% and Tier I solvency ratio was 10.3% with no fl oor adjustment.Basel II risk-weighted assets totalled €142.6 billion at 31 December2010, an increase of 6% relative to the €134.9 billion fi gureat end-2009.The €7.7 billion increase broke down as follows:• credit risks declined by €6.4 billion over the period (a decreaseof €10.7 billion excluding the currency effect): although fi nancingactivities remains steady, market counterparty risks refl ecta sharp drop, which was reinforced by the marked improvementsin counterparty ratings in 2010 and by the implementationof a proprietary securitisation;• in 2010, market risk declined by €0.3 billion in risk-weightedasset equivalents, primarily owing to improvement in marketconditions, which produced a favourable effect on VaR;• operational risk amounted to €13.2 billion, a decrease of €0.1billion compared with 31 December 2009;• the overall decline in risk-weighted assets is cancelled by theimplementation of the fl oor requirement of 80% of Basel I riskweightedassets. This resulted in a €14.5 billion increase in BaselII risk-weighted assets by comparison with the requirementat end-2009.Tier I capital totalled €15.3 billion at 31 December 2010. The €1.4billion increase in 2010 was due to several factors:• A favourable currency effect of €0.5 billion• 2010 net income (+ €1 billion);• deduction from Tier 1 producing a €0.1 billion negative impactTotal shareholders’ equity also increased by €1.3 billion due to thenear stability of Tier II components.SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010 123