ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

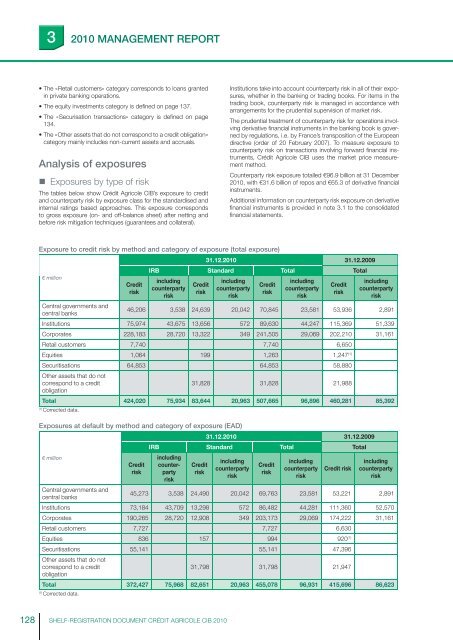

32010 MANAGEMENT REPORT• The « Retail customers« category corresponds to loans grantedin private banking operations.• The equity investments category is defi ned on page 137.• The « Securisation transactions« category is defi ned on page134.• The « Other assets that do not correspond to a credit obligation«category mainly includes non-current assets and accruals.Analysis of exposures• Exposures by type of riskThe tables below show <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong>’s exposure to creditand counterparty risk by exposure class for the standardised andinternal ratings based approaches. This exposure correspondsto gross exposure (on- and off-balance sheet) after netting andbefore risk mitigation techniques (guarantees and collateral).Institutions take into account counterparty risk in all of their exposures,whether in the banking or trading books. For items in thetrading book, counterparty risk is managed in accordance witharrangements for the prudential supervision of market risk.The prudential treatment of counterparty risk for operations involvingderivative fi nancial instruments in the banking book is governedby regulations, i.e. by France’s transposition of the Europeandirective (order of 20 February 2007). To measure exposure tocounterparty risk on transactions involving forward fi nancial instruments,<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> uses the market price measurementmethod.Counterparty risk exposure totalled €96.9 billion at 31 December2010, with €31.6 billion of repos and €65.3 of derivative fi nancialinstruments.Additional information on counterparty risk exposure on derivativefi nancial instruments is provided in note 3.1 to the consolidatedfi nancial statements.Exposure to credit risk by method and category of exposure (total exposure)€ millionCreditrisk31.12.2010 31.12.2009IRB Standard Total TotalincludingcounterpartyriskCreditriskincludingcounterpartyriskCreditriskincludingcounterpartyriskCreditriskincludingcounterpartyriskCentral governments andcentral banks46,206 3,538 24,639 20,042 70,845 23,581 53,936 2,891Institutions 75,974 43,675 13,656 572 89,630 44,247 115,369 51,339Corporates 228,183 28,720 13,322 349 241,505 29,069 202,210 31,161Retail customers 7,740 7,740 6,650Equities 1,064 199 1,263 1,247 (1)Securitisations 64,853 64,853 58,880Other assets that do notcorrespond to a creditobligation31,828 31,828 21,988Total 424,020 75,934 83,644 20,963 507,665 96,896 460,281 85,392(1)Corrected data.Exposures at default by method and category of exposure (EAD)€ millionCreditrisk31.12.2010 31.12.2009IRB Standard Total TotalincludingcounterpartyriskCreditriskincludingcounterpartyriskCreditriskincludingcounterpartyriskCredit riskincludingcounterpartyriskCentral governments andcentral banks45,273 3,538 24,490 20,042 69,763 23,581 53,221 2,891Institutions 73,184 43,709 13,298 572 86,482 44,281 111,360 52,570Corporates 190,265 28,720 12,908 349 203,173 29,069 174,222 31,161Retail customers 7,727 7,727 6,630Equities 836 157 994 920 (1)Securitisations 55,141 55,141 47,396Other assets that do notcorrespond to a creditobligation31,798 31,798 21,947Total 372,427 75,968 82,651 20,963 455,078 96,931 415,696 86,623(1)Corrected data.128SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010