ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

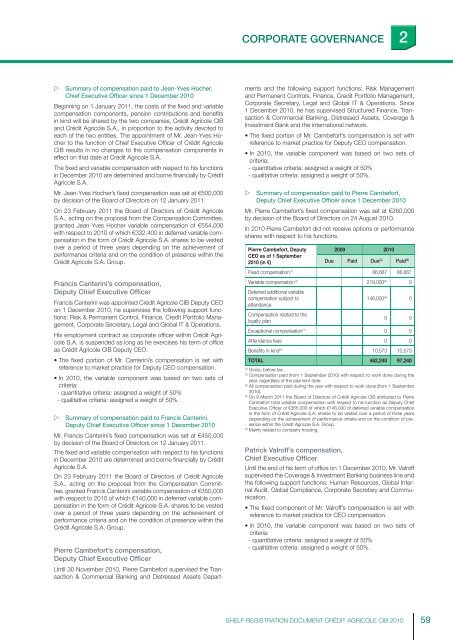

CORPORATE GOVERNANCE 2 Summary of compensation paid to Jean-Yves Hocher,Chief Executive Officer since 1 December 2010Beginning on 1 January 2011, the costs of the fi xed and variablecompensation components, pension contributions and benefi tsin kind will be shared by the two companies, <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong>and <strong>Crédit</strong> <strong>Agricole</strong> S.A., in proportion to the activity devoted toeach of the two entities. The appointment of Mr. Jean-Yves Hocherto the function of Chief Executive Offi cer of <strong>Crédit</strong> <strong>Agricole</strong><strong>CIB</strong> results in no changes to the compensation components ineffect on that date at <strong>Crédit</strong> <strong>Agricole</strong> S.A.The fi xed and variable compensation with respect to his functionsin December 2010 are determined and borne fi nancially by <strong>Crédit</strong><strong>Agricole</strong> S.A.Mr. Jean-Yves Hocher’s fi xed compensation was set at €500,000by decision of the Board of Directors on 12 January 2011.On 23 February 2011 the Board of Directors of <strong>Crédit</strong> <strong>Agricole</strong>S.A., acting on the proposal from the Compensation Committee,granted Jean-Yves Hocher variable compensation of €554,000with respect to 2010 of which €332,400 in deferred variable compensationin the form of <strong>Crédit</strong> <strong>Agricole</strong> S.A. shares to be vestedover a period of three years depending on the achievement ofperformance criteria and on the condition of presence within the<strong>Crédit</strong> <strong>Agricole</strong> S.A. Group.Francis Canterini’s compensation,Deputy Chief Executive OfficerFrancis Canterini was appointed <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> Deputy CEOon 1 December 2010, he supervises the following support functions:Risk & Permanent Control, Finance, Credit Portfolio Management,Corporate Secretary, Legal and Global IT & Operations.His employment contract as corporate offi cer within <strong>Crédit</strong> <strong>Agricole</strong>S.A. is suspended as long as he exercises his term of offi ceas <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> Deputy CEO.• The fi xed portion of Mr. Canterini’s compensation is set withreference to market practice for Deputy CEO compensation.• In 2010, the variable component was based on two sets ofcriteria:- quantitative criteria: assigned a weight of 50%- qualitative criteria: assigned a weight of 50%. Summary of compensation paid to Francis Canterini,Deputy Chief Executive Officer since 1 December 2010Mr. Francis Canterini’s fi xed compensation was set at €450,000by decision of the Board of Directors on 12 January 2011.The fi xed and variable compensation with respect to his functionsin December 2010 are determined and borne fi nancially by <strong>Crédit</strong><strong>Agricole</strong> S.A.On 23 February 2011 the Board of Directors of <strong>Crédit</strong> <strong>Agricole</strong>S.A., acting on the proposal from the Compensation Committee,granted Francis Canterini variable compensation of €350,000with respect to 2010 of which €140,000 in deferred variable compensationin the form of <strong>Crédit</strong> <strong>Agricole</strong> S.A. shares to be vestedover a period of three years depending on the achievement ofperformance criteria and on the condition of presence within the<strong>Crédit</strong> <strong>Agricole</strong> S.A. Group.Pierre Cambefort’s compensation,Deputy Chief Executive OfficerUntil 30 November 2010, Pierre Cambefort supervised the Transaction& Commercial Banking and Distressed Assets Departmentsand the following support functions: Risk Managementand Permanent Controls, Finance, Credit Portfolio Management,Corporate Secretary, Legal and Global IT & Operations. Since1 December 2010, he has supervised Structured Finance, Transaction& Commercial Banking, Distressed Assets, Coverage &Investment Bank and the international network.• The fi xed portion of Mr. Cambefort’s compensation is set withreference to market practice for Deputy CEO compensation.• In 2010, the variable component was based on two sets ofcriteria:- quantitative criteria: assigned a weight of 50%- qualitative criteria: assigned a weight of 50%. Summary of compensation paid to Pierre Cambefort,Deputy Chief Executive Officer since 1 December 2010Mr. Pierre Cambefort’s fi xed compensation was set at €260,000by decision of the Board of Directors on 24 August 2010.In 2010 Pierre Cambefort did not receive options or performanceshares with respect to his functions.Pierre Cambefort, Deputy2009 2010CEO as of 1 September2010 (in €)Due Paid Due (2) Paid (3)Fixed compensation (1) 86,667 86,667Variable compensation (1) 219,000 (4) 0Deferred additional variablecompensation subject toattendance146,000 (4) 0Compensation related to theloyalty plan0 0Exceptional compensation (1) 0 0Attendance fees 0 0Benefi ts in kind (5) 10,573 10,573TOTAL 462,240 97,240(1)Gross, before tax.(2)Compensation paid (from 1 September 2010) with respect to work done during theyear, regardless of the payment date.(3)All compensation paid during the year with respect to work done (from 1 September2010).(4)On 9 March 2011 the Board of Directors of <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> attributed to PierreCambefort total variable compensation with respect to his function as Deputy ChiefExecutive Offi cer of €365,000 of which €146,000 of deferred variable compensationin the form of <strong>Crédit</strong> <strong>Agricole</strong> S.A. shares to be vested over a period of three yearsdepending on the achievement of performance criteria and on the condition of presencewithin the <strong>Crédit</strong> <strong>Agricole</strong> S.A. Group.(5)Mainly related to company housing.Patrick Valroff’s compensation,Chief Executive OfficerUntil the end of his term of offi ce on 1 December 2010, Mr. Valroffsupervised the Coverage & Investment Banking business line andthe following support functions: Human Resources, Global InternalAudit, Global Compliance, Corporate Secretary and Communication.• The fi xed component of Mr. Valroff’s compensation is set withreference to market practice for CEO compensation.• In 2010, the variable component was based on two sets ofcriteria:- quantitative criteria: assigned a weight of 50%- qualitative criteria: assigned a weight of 50%.SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010 59