ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

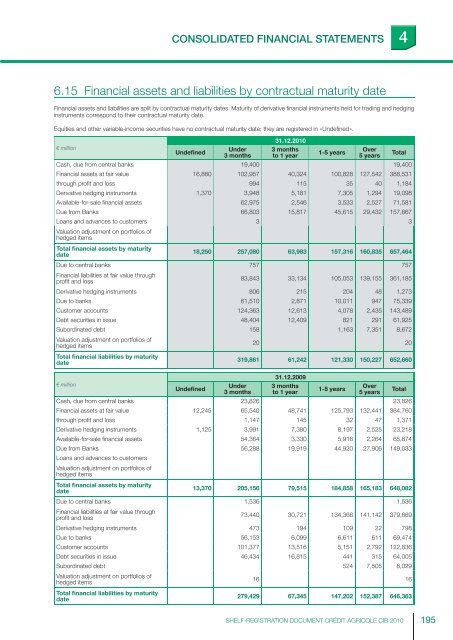

CONSOLIDATED FINANCIAL STATEMENTS 46.15 Financial assets and liabilities by contractual maturity dateFinancial assets and liabilities are split by contractual maturity dates. Maturity of derivative fi nancial instruments held for trading and hedginginstruments correspond to their contractual maturity date.Equities and other variable-income securities have no contractual maturity date; they are registered in « Undefi ned ».31.12.2010€ millionUndefinedUnder 3 months3 months to 1 year1-5 yearsOver5 yearsTotalCash, due from central banks 19,400 19,400Financial assets at fair value 16,880 102,957 40,324 100,828 127,542 388,531through profi t and loss 994 115 35 40 1,184Derivative hedging instruments 1,370 3,948 5,181 7,305 1,294 19,098Available-for-sale fi nancial assets 62,975 2,546 3,533 2,527 71,581Due from Banks 66,803 15,817 45,615 29,432 157,667Loans and advances to customers 3 3Valuation adjustment on portfolios ofhedged itemsTotal financial assets by maturitydate18,250 257,080 63,983 157,316 160,835 657,464Due to central banks 757 757Financial liabilities at fair value throughprofi t and loss83,843 33,134 105,053 139,155 361,185Derivative hedging instruments 806 215 204 48 1,273Due to banks 61,510 2,871 10,011 947 75,339Customer accounts 124,363 12,613 4,078 2,435 143,489Debt securities in issue 48,404 12,409 821 291 61,925Subordinated debt 158 1,163 7,351 8,672Valuation adjustment on portfolios ofhedged items20 20Total financial liabilities by maturitydate319,861 61,242 121,330 150,227 652,66031.12.2009€ millionUndefinedUnder 3 months3 months to 1 year1-5 yearsOver5 yearsTotalCash, due from central banks 23,826 23,826Financial assets at fair value 12,245 65,540 48,741 125,793 132,441 384,760through profi t and loss 1,147 145 32 47 1,371Derivative hedging instruments 1,125 3,991 7,380 8,197 2,525 23,218Available-for-sale fi nancial assets 54,364 3,330 5,916 2,264 65,874Due from Banks 56,288 19,919 44,920 27,906 149,033Loans and advances to customersValuation adjustment on portfolios ofhedged itemsTotal financial assets by maturitydate13,370 205,156 79,515 184,858 165,183 648,082Due to central banks 1,536 1,536Financial liabilities at fair value throughprofi t and loss73,440 30,721 134,366 141,142 379,669Derivative hedging instruments 473 194 109 22 798Due to banks 56,153 6,099 6,611 611 69,474Customer accounts 101,377 13,516 5,151 2,792 122,836Debt securities in issue 46,434 16,815 441 315 64,005Subordinated debt 524 7,505 8,029Valuation adjustment on portfolios ofhedged items16 16Total financial liabilities by maturitydate279,429 67,345 147,202 152,387 646,363SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010 195