ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

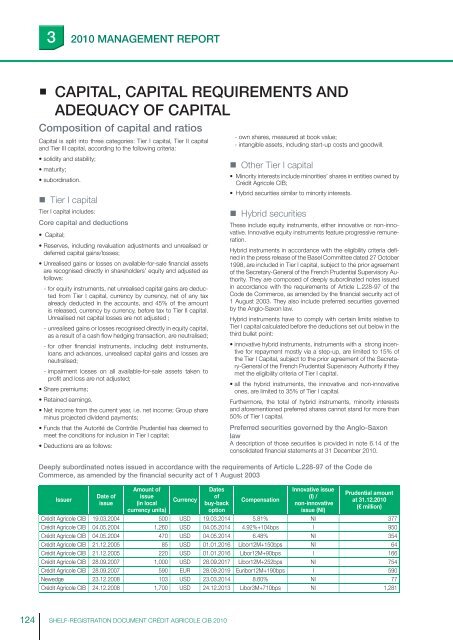

32010 MANAGEMENT REPORT• CAPITAL, CAPITAL REQUIREMENTS ANDADEQUACY OF CAPITALComposition of capital and ratiosCapital is split into three categories: Tier I capital, Tier II capitaland Tier III capital, according to the following criteria:- own shares, measured at book value;- intangible assets, including start-up costs and goodwill.• solidity and stability;• maturity;• subordination.• Tier I capitalTier I capital includes:Core capital and deductions• Capital;• Reserves, including revaluation adjustments and unrealised ordeferred capital gains/losses;• Unrealised gains or losses on available-for-sale fi nancial assetsare recognised directly in shareholders’ equity and adjusted asfollows:- for equity instruments, net unrealised capital gains are deductedfrom Tier I capital, currency by currency, net of any taxalready deducted in the accounts, and 45% of the amountis released, currency by currency, before tax to Tier II capital.Unrealised net capital losses are not adjusted ;- unrealised gains or losses recognised directly in equity capital,as a result of a cash fl ow hedging transaction, are neutralised;- for other fi nancial instruments, including debt instruments,loans and advances, unrealised capital gains and losses areneutralised;- impairment losses on all available-for-sale assets taken toprofi t and loss are not adjusted;• Share premiums;• Retained earnings.• Net income from the current year, i.e. net income; Group shareminus projected dividend payments;• Funds that the Autorité de Contrôle Prudentiel has deemed tomeet the conditions for inclusion in Tier I capital;• Deductions are as follows:• Other Tier I capital• Minority interests include minorities’ shares in entities owned by<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong>;• Hybrid securities similar to minority interests.• Hybrid securitiesThese include equity instruments, either innovative or non-innovative.Innovative equity instruments feature progressive remuneration.Hybrid instruments in accordance with the eligibility criteria defi -ned in the press release of the Basel Committee dated 27 October1998, are included in Tier I capital, subject to the prior agreementof the Secretary-General of the French Prudential Supervisory Authority.They are composed of deeply subordinated notes issuedin accordance with the requirements of Article L.228-97 of theCode de Commerce, as amended by the fi nancial security act of1 August 2003. They also include preferred securities governedby the Anglo-Saxon law.Hybrid instruments have to comply with certain limits relative toTier I capital calculated before the deductions set out below in thethird bullet point:• innovative hybrid instruments, instruments with a strong incentivefor repayment mostly via a step-up, are limited to 15% ofthe Tier I Capital, subject to the prior agreement of the Secretary-Generalof the French Prudential Supervisory Authority if theymet the eligibility criteria of Tier I capital.• all the hybrid instruments, the innovative and non-innovativeones, are limited to 35% of Tier I capital.Furthermore, the total of hybrid instruments, minority interestsand aforementioned preferred shares cannot stand for more than50% of Tier I capital.Preferred securities governed by the Anglo-SaxonlawA description of those securities is provided in note 6.14 of theconsolidated fi nancial statements at 31 December 2010.Deeply subordinated notes issued in accordance with the requirements of Article L.228-97 of the Code deCommerce, as amended by the financial security act of 1 August 2003IssuerDate ofissueAmount ofissue(in localcurrency units)CurrencyDatesofbuy-backoptionCompensationInnovative issue(I) /non-innovativeissue (NI)Prudential amountat 31.12.2010(€ million)<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 19.03.2004 500 USD 19.03.2014 5.81% NI 377<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 04.05.2004 1,260 USD 04.05.2014 4.92%+104bps I 950<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 04.05.2004 470 USD 04.05.2014 6.48% NI 354<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 21.12.2005 85 USD 01.01.2016 Libor12M+150bps NI 64<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 21.12.2005 220 USD 01.01.2016 Libor12M+90bps I 166<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 28.09.2007 1,000 USD 28.09.2017 Libor12M+252bps NI 754<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 28.09.2007 590 EUR 28.09.2019 Euribor12M+190bps I 590Newedge 23.12.2008 103 USD 23.03.2014 8.60% NI 77<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 24.12.2008 1,700 USD 24.12.2013 Libor3M+710bps NI 1,281124SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010