ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

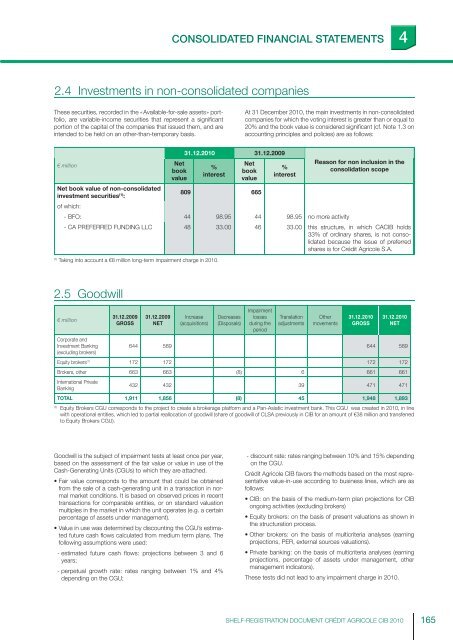

CONSOLIDATED FINANCIAL STATEMENTS 42.4 Investments in non-consolidated companiesThese securities, recorded in the « Available-for-sale assets » portfolio,are variable-income securities that represent a signifi cantportion of the capital of the companies that issued them, and areintended to be held on an other-than-temporary basis.At 31 December 2010, the main investments in non-consolidatedcompanies for which the voting interest is greater than or equal to20% and the book value is considered signifi cant (cf. Note 1.3 onaccounting principles and policies) are as follows:€ millionNetbookvalue31.12.2010 31.12.2009%interestNetbookvalue%interestReason for non inclusion in theconsolidation scopeNet book value of non-consolidatedinvestment securities (1) :809 665of which:- BFO: 44 98.95 44 98.95 no more activity- CA PREFERRED FUNDING LLC 48 33.00 46 33.00 this structure, in which CA<strong>CIB</strong> holds33% of ordinary shares, is not consolidatedbecause the issue of preferredshares is for <strong>Crédit</strong> <strong>Agricole</strong> S.A.(1)Taking into account a €8 million long-term impairment charge in 2010.2.5 Goodwill€ millionCorporate andInvestment Banking(excluding brokers)31.12.2009GROSS31.12.2009NETIncrease(acquisitions)Decreases(Disposals)Impairmentlossesduring theperiodTranslationadjustmentsOthermovements31.12.2010GROSS31.12.2010NET644 589 644 589Equity brokers (1) 172 172 172 172Brokers, other 663 663 (8) 6 661 661International PrivateBanking432 432 39 471 471TOTAL 1,911 1,856 (8) 45 1,948 1,893(1)Equity Brokers CGU corresponds to the project to create a brokerage platform and a Pan-Asiatic investment bank. This CGU was created in 2010, in linewith operational entities, which led to partial reallocation of goodwill (share of goodwill of CLSA previously in <strong>CIB</strong> for an amount of €38 million and transferredto Equity Brokers CGU).Goodwill is the subject of impairment tests at least once per year,based on the assessment of the fair value or value in use of theCash-Generating Units (CGUs) to which they are attached.• Fair value corresponds to the amount that could be obtainedfrom the sale of a cash-generating unit in a transaction in normalmarket conditions. It is based on observed prices in recenttransactions for comparable entities, or on standard valuationmultiples in the market in which the unit operates (e.g. a certainpercentage of assets under management).• Value in use was determined by discounting the CGU’s estimatedfuture cash fl ows calculated from medium term plans. Thefollowing assumptions were used:- estimated future cash fl ows: projections between 3 and 6years;- perpetual growth rate: rates ranging between 1% and 4%depending on the CGU;- discount rate: rates ranging between 10% and 15% dependingon the CGU.<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> favors the methods based on the most representativevalue-in-use according to business lines, which are asfollows:• <strong>CIB</strong>: on the basis of the medium-term plan projections for <strong>CIB</strong>ongoing activities (excluding brokers)• Equity brokers: on the basis of present valuations as shown inthe structuration process.• Other brokers: on the basis of multicriteria analyses (earningprojections, PER, external sources valuations).• Private banking: on the basis of multicriteria analyses (earningprojections, percentage of assets under management, othermanagement indicators).These tests did not lead to any impairment charge in 2010.SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010 165