ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

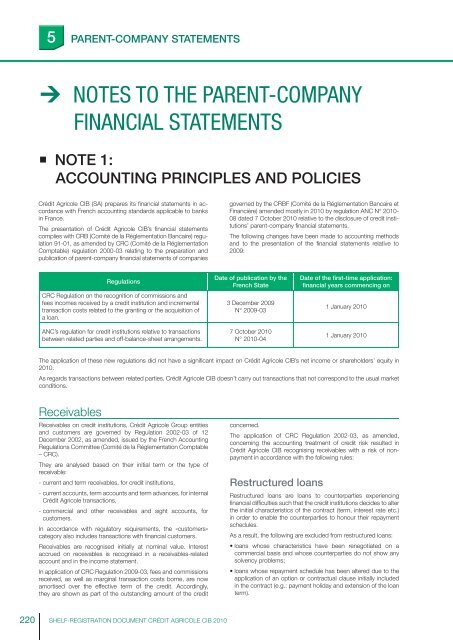

5PARENT-COMPANY STATEMENTS NOTES TO THE PARENT-COMPANYFINANCIAL STATEMENTS• NOTE 1:ACCOUNTING PRINCIPLES AND POLICIES<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> (SA) prepares its fi nancial statements in accordancewith French accounting standards applicable to banksin France.The presentation of <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong>’s fi nancial statementscomplies with CRB (Comité de la Réglementation Bancaire) regulation91-01, as amended by CRC (Comité de la RéglementationComptable) regulation 2000-03 relating to the preparation andpublication of parent-company fi nancial statements of companiesgoverned by the CRBF (Comité de la Réglementation Bancaire etFinancière) amended mostly in 2010 by regulation ANC N° 2010-08 dated 7 October 2010 relative to the disclosure of credit institutions’parent-company fi nancial statements.The following changes have been made to accounting methodsand to the presentation of the fi nancial statements relative to2009:RegulationsCRC Regulation on the recognition of commissions andfees incomes received by a credit institution and incrementaltransaction costs related to the granting or the acquisition ofa loan.ANC’s regulation for credit institutions relative to transactionsbetween related parties and off-balance-sheet arrangements.Date of publication by theFrench State3 December 2009N° 2009-037 October 2010N° 2010-04Date of the first-time application:financial years commencing on1 January 20101 January 2010The application of these new regulations did not have a signifi cant impact on <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong>’s net income or shareholders’ equity in2010.As regards transactions between related parties, <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> doesn’t carry out transactions that not correspond to the usual marketconditions.ReceivablesReceivables on credit institutions, <strong>Crédit</strong> <strong>Agricole</strong> Group entitiesand customers are governed by Regulation 2002-03 of 12December 2002, as amended, issued by the French AccountingRegulations Committee (Comité de la Réglementation Comptable– CRC).They are analysed based on their initial term or the type ofreceivable:- current and term receivables, for credit institutions,- current accounts, term accounts and term advances, for internal<strong>Crédit</strong> <strong>Agricole</strong> transactions,- commercial and other receivables and sight accounts, forcustomers.In accordance with regulatory requirements, the «customers«category also includes transactions with fi nancial customers.Receivables are recognised initially at nominal value. Interestaccrued on receivables is recognised in a receivables-relatedaccount and in the income statement.In application of CRC Regulation 2009-03, fees and commissionsreceived, as well as marginal transaction costs borne, are nowamortised over the effective term of the credit. Accordingly,they are shown as part of the outstanding amount of the creditconcerned.The application of CRC Regulation 2002-03, as amended,concerning the accounting treatment of credit risk resulted in<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> recognising receivables with a risk of nonpaymentin accordance with the following rules:Restructured loansRestructured loans are loans to counterparties experiencingfi nancial diffi culties such that the credit institutions decides to alterthe initial characteristics of the contract (term, interest rate etc.)in order to enable the counterparties to honour their repaymentschedules.As a result, the following are excluded from restructured loans:• loans whose characteristics have been renegotiated on acommercial basis and whose counterparties do not show anysolvency problems;• loans whose repayment schedule has been altered due to theapplication of an option or contractual clause initially includedin the contract (e.g.: payment holiday and extension of the loanterm).220SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010