ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

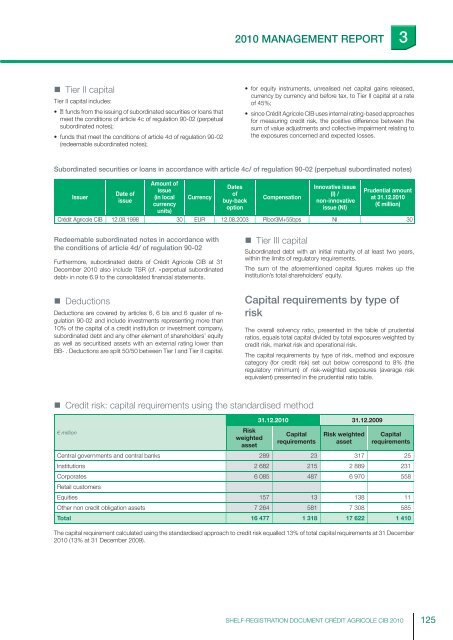

2010 MANAGEMENT REPORT 3• Tier II capitalTier II capital includes:• funds from the issuing of subordinated securities or loans thatmeet the conditions of article 4c of regulation 90-02 (perpetualsubordinated notes);• funds that meet the conditions of article 4d of regulation 90-02(redeemable subordinated notes);• for equity instruments, unrealised net capital gains released,currency by currency and before tax, to Tier II capital at a rateof 45%;• since <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> uses internal rating-based approachesfor measuring credit risk, the positive difference between thesum of value adjustments and collective impairment relating tothe exposures concerned and expected losses.Subordinated securities or loans in accordance with article 4c/ of regulation 90-02 (perpetual subordinated notes)IssuerDate ofissueAmount ofissue(in localcurrencyunits)CurrencyDatesofbuy-backoptionCompensationInnovative issue(I) /non-innovativeissue (NI)Prudential amountat 31.12.2010(€ million)<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> 12.08.1998 30 EUR 12.08.2003 Pibor3M+55bps NI 30Redeemable subordinated notes in accordance withthe conditions of article 4d/ of regulation 90-02Furthermore, subordinated debts of <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> at 31December 2010 also include TSR (cf. « perpetual subordinateddebt« in note 6.9 to the consolidated fi nancial statements.• Tier III capitalSubordinated debt with an initial maturity of at least two years,within the limits of regulatory requirements.The sum of the aforementioned capital fi gures makes up theinstitution’s total shareholders’ equity.• DeductionsDeductions are covered by articles 6, 6 bis and 6 quater of regulation90-02 and include investments representing more than10% of the capital of a credit institution or investment company,subordinated debt and any other element of shareholders’ equityas well as securitised assets with an external rating lower thanBB- . Deductions are split 50/50 between Tier I and Tier II capital.Capital requirements by type ofriskThe overall solvency ratio, presented in the table of prudentialratios, equals total capital divided by total exposures weighted bycredit risk, market risk and operational risk.The capital requirements by type of risk, method and exposurecategory (for credit risk) set out below correspond to 8% (theregulatory minimum) of risk-weighted exposures (average riskequivalent) presented in the prudential ratio table.• Credit risk: capital requirements using the standardised method31.12.2010 31.12.2009€ millionRiskweightedassetCapitalrequirementsRisk weightedassetCapitalrequirementsCentral governments and central banks 289 23 317 25Institutions 2 682 215 2 889 231Corporates 6 085 487 6 970 558Retail customersEquities 157 13 138 11Other non credit obligation assets 7 264 581 7 308 585Total 16 477 1 318 17 622 1 410The capital requirement calculated using the standardised approach to credit risk equalled 13% of total capital requirements at 31 December2010 (13% at 31 December 2009).SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010 125