ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

ourexpertise - Crédit Agricole CIB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

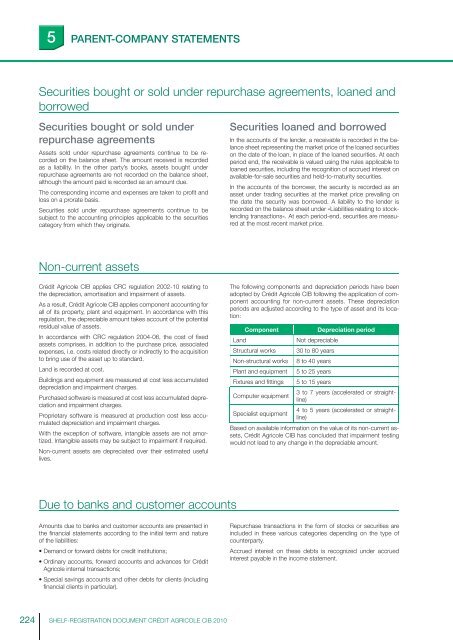

5PARENT-COMPANY STATEMENTSSecurities bought or sold under repurchase agreements, loaned andborrowedSecurities bought or sold underrepurchase agreementsAssets sold under repurchase agreements continue to be recordedon the balance sheet. The amount received is recordedas a liability. In the other party’s books, assets bought underrepurchase agreements are not recorded on the balance sheet,although the amount paid is recorded as an amount due.The corresponding income and expenses are taken to profi t andloss on a prorate basis.Securities sold under repurchase agreements continue to besubject to the accounting principles applicable to the securitiescategory from which they originate.Securities loaned and borrowedIn the accounts of the lender, a receivable is recorded in the balancesheet representing the market price of the loaned securitieson the date of the loan, in place of the loaned securities. At eachperiod end, the receivable is valued using the rules applicable toloaned securities, including the recognition of accrued interest onavailable-for-sale securities and held-to-maturity securities.In the accounts of the borrower, the security is recorded as anasset under trading securities at the market price prevailing onthe date the security was borrowed. A liability to the lender isrecorded on the balance sheet under «Liabilities relating to stocklendingtransactions«. At each period-end, securities are measuredat the most recent market price.Non-current assets<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> applies CRC regulation 2002-10 relating tothe depreciation, amortisation and impairment of assets.As a result, <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> applies component accounting forall of its property, plant and equipment. In accordance with thisregulation, the depreciable amount takes account of the potentialresidual value of assets.In accordance with CRC regulation 2004-06, the cost of fi xedassets comprises, in addition to the purchase price, associatedexpenses, i.e. costs related directly or indirectly to the acquisitionto bring use of the asset up to standard.Land is recorded at cost.Buildings and equipment are measured at cost less accumulateddepreciation and impairment charges.Purchased software is measured at cost less accumulated depreciationand impairment charges.Proprietary software is measured at production cost less accumulateddepreciation and impairment charges.With the exception of software, intangible assets are not amortized.Intangible assets may be subject to impairment if required.Non-current assets are depreciated over their estimated usefullives.The following components and depreciation periods have beenadopted by <strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> following the application of componentaccounting for non-current assets. These depreciationperiods are adjusted according to the type of asset and its location:ComponentLandStructural worksNon-structural worksPlant and equipmentFixtures and fi ttingsComputer equipmentDepreciation periodNot depreciable30 to 80 years8 to 40 years5 to 25 years5 to 15 years3 to 7 years (accelerated or straightline)4 to 5 years (accelerated or straightline)Specialist equipmentBased on available information on the value of its non-current assets,<strong>Crédit</strong> <strong>Agricole</strong> <strong>CIB</strong> has concluded that impairment testingwould not lead to any change in the depreciable amount.Due to banks and customer accountsAmounts due to banks and customer accounts are presented inthe fi nancial statements according to the initial term and natureof the liabilities:• Demand or forward debts for credit institutions;• Ordinary accounts, forward accounts and advances for <strong>Crédit</strong><strong>Agricole</strong> internal transactions;• Special savings accounts and other debts for clients (includingfi nancial clients in particular).Repurchase transactions in the form of stocks or securities areincluded in these various categories depending on the type ofcounterparty.Accrued interest on these debts is recognized under accruedinterest payable in the income statement.224SHELF-REGISTRATION DOCUMENT CRÉDIT AGRICOLE <strong>CIB</strong> 2010