Annual Report 2012 - National Savings Bank

Annual Report 2012 - National Savings Bank

Annual Report 2012 - National Savings Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

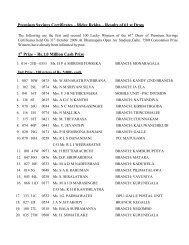

224THE RESULTS OF A CHALLENGING YEARNOTES TO THE FINANCIAL STATEMENTS15. Analysis of Financial Instruments by Measurement Basis15. a. <strong>Bank</strong> - <strong>2012</strong>HFT HTM AmortisedAFS FVTPL Hedging TotalcostRs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000ASSETSCash and cash equivalents - - 1,465,542 - - - 1,465,542Balances with central banks - - - - - - -Placement with banks - - 5,973,585 - - - 5,973,585Derivative financial instruments - - - - - 9,401 9,401Other financial assets held for trading 10,823,874 - - - - - 10,823,874Other financial assets at fair valuethrough profit or loss - - - - - - -Loans and receivable to banks - - 13,374,007 - - - 13,374,007Loans and receivable to other customers - - 155,245,236 - - - 155,245,236Financial investments - 309,595,845 - 2,978,800 - - 312,574,645Total financial assets 10,823,874 309,595,845 176,058,369 2,978,800 - 9,401 499,466,289HFT Designated atFair valueAmortizedcostFVTPL Hedging TotalRs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000LIABILITIESDue to banks - - 337,014 - - 337,014Derivative financial instruments - - - - - -Other financial liabilities at fair valuethrough profit or loss - - - - - -Due to other customers - - 457,650,387 - - 457,650,387Other borrowings - - 22,620,945 - - 22,620,945Debt securities issued - - - - - -Total financial liabilities - - 480,608,345 - - 480,608,345Held for trading - HFTDesignated at fair value through profit or loss - Designated at fair value - FVTPLLoans and receivables/deposits at amortized cost - Amortized costHeld-to-maturity - HTMAvailable-for-sale - AFSInstruments of fair value and cash flow hedging - HedgingNATIONAL SAVINGS BANK . ANNUAL REPORT <strong>2012</strong>