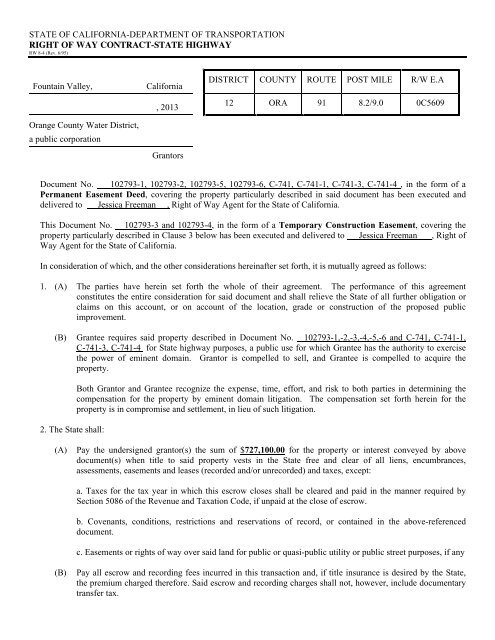

STATE OF CALIFORNIA-DEPARTMENT OF TRANSPORTATIONRIGHT OF WAY CONTRACT-STATE HIGHWAYRW 8-4 (Rev. 6/95)Fountain Valley,Orange County Water District,a public corporationCalifornia, 2013GrantorsDISTRICT COUNTY ROUTE POST MILE R/W E.A12 ORA 91 8.2/9.0 0C5609Document No. 102793-1, 102793-2, 102793-5, 102793-6, C-741, C-741-1, C-741-3, C-741-4 , in the form of aPermanent Easement Deed, covering the property particularly described in said document has been executed anddelivered to Jessica Freeman , Right of Way Agent for the State of California.This Document No. 102793-3 and 102793-4, in the form of a Temporary Construction Easement, covering theproperty particularly described in Clause 3 below has been executed and delivered to Jessica Freeman , Right ofWay Agent for the State of California.In consideration of which, and the other considerations hereinafter set forth, it is mutually agreed as follows:1. (A) The parties have herein set forth the whole of their agreement. The performance of this agreementconstitutes the entire consideration for said document and shall relieve the State of all further obligation orclaims on this account, or on account of the location, grade or construction of the proposed publicimprovement.(B) Grantee requires said property described in Document No. 102793-1,-2,-3,-4,-5,-6 and C-741, C-741-1,C-741-3, C-741-4 for State highway purposes, a public use for which Grantee has the authority to exercisethe power of eminent domain. Grantor is compelled to sell, and Grantee is compelled to acquire theproperty.2. The State shall:Both Grantor and Grantee recognize the expense, time, effort, and risk to both parties in determining thecompensation for the property by eminent domain litigation. The compensation set forth herein for theproperty is in compromise and settlement, in lieu of such litigation.(A) Pay the undersigned grantor(s) the sum of $727,100.00 for the property or interest conveyed by abovedocument(s) when title to said property vests in the State free and clear of all liens, encumbrances,assessments, easements and leases (recorded and/or unrecorded) and taxes, except:a. Taxes for the tax year in which this escrow closes shall be cleared and paid in the manner required bySection 5086 of the Revenue and Taxation Code, if unpaid at the close of escrow.b. Covenants, conditions, restrictions and reservations of record, or contained in the above-referenceddocument.c. Easements or rights of way over said land for public or quasi-public utility or public street purposes, if any(B)Pay all escrow and recording fees incurred in this transaction and, if title insurance is desired by the State,the premium charged therefore. Said escrow and recording charges shall not, however, include documentarytransfer tax.

RIGHT OF WAY CONTRACT - STATE HIGHWAY (Cont.)RW 8-3 (Rev. 6/95)Document No. 102793Page 2 of 4(C)(D)Have the authority to deduct and pay from the amount shown on Clause 2(A) above, any amount necessaryto satisfy any bond demands and delinquent taxes due in any year except the year in which this escrowcloses, together with penalties and interest thereon, and/or delinquent and unpaid nondelinquent assessmentswhich have become a lien at the close of escrow.In addition to the Fair Market Value, it is agreed by and between the parties hereto that the amount in clause2A above includes the sum of $66,100.00 as an incentive to the grantor for the timely signing of this Right ofWay Contract. This incentive payment offer expires sixty (60) days from the Initiation of Negotiations(February 13, 2013).3. Permission is hereby granted to State or its authorized agent to enter upon grantor land where necessary within thatcertain area shown outlined on the map attached hereto and made a part hereof, for the purpose of facilitation ofthe widening of the bridge, construction of the bridge abutments, the piers, columns, and debris noses.It is further understood that the Grantor grants the State or its authorized agent permission to enter upon Grantor’sremaining land, where necessary, to install and remove temporary fencing.4. It is agreed and confirmed by the parties hereto that notwithstanding other provisions in this contract, the rightof possession and use of the subject property by the State, including the right to remove and dispose ofimprovements, if any, shall commence on April 30, 2013 or the close of this escrow controlling thistransaction, whichever occurs first, and that the amount shown in clause 2(A) herein includes, but is notlimited to, full payment for such possession and use, including damages, if any, from said date.5. It is understood and agreed by and between the parties hereto, that payment in Clause 2(A) above includes, butis not limited to, payment for the following items, which are considered to be part of the property and are beingacquired by the State in this transaction: 500 SF of landscaping (small to large trees, close spacing, andautomatic irrigation), 1,098 SF concreted walk/path, 40 LF 6’ chain-link fencing (including installation).6. The undersigned grantor warrants that they are the owner in fee simple of the property affected by this TemporaryEasement, as described in Clause 3 above, and that they have the exclusive right to grant this TemporaryEasement.7. This Temporary Construction Easement shall terminate upon completion of the project known as “add an exitbypass lane on westbound SR-91 at the SR-55 connector in the City of Anaheim.”8. In consideration of the State’s waiving the defects and imperfections in the record title, the undersignedGrantor covenants and agrees to indemnify and hold the State of California harmless from any and all claimsthat other parties may make or assert on the title to the premises. The Grantor’s obligation herein to indemnifythe State shall not exceed the amount paid to the Grantor under this contract.9. State agrees to indemnify and hold harmless the Grantor from any liability arising out of State’s operationsunder this agreement. State further agrees to assume responsibility for any damages proximately caused byreason of State’s operations under this agreement and State, will, at its option, either repair or pay for suchdamage.10. It is understood and agreed that included in the amount payable in Clause 2(A) above is compensation in fullfor the actual possession and use of the Temporary Construction Easements identified as Document No.102793-3 and 102793-4 for a period of Nineteen (19) months. Said period to commence on first entry byState’s contractor and extend to July 1, 2016. At least 48 (forty-eight) hours advance written notice will begiven before any entry on Grantor’s property.

- Page 1 and 2:

AGENDAPROPERTY MANAGEMENT COMMITTEE

- Page 3 and 4:

10. ADDITIONAL DEPOSIT OF FUNDS FOR

- Page 6 and 7:

MINUTES OF THEPROPERTY MANAGEMENT C

- Page 9 and 10:

AGENDA ITEM SUBMITTALMeeting Date:

- Page 11 and 12:

Improvements; and Approving and Aut

- Page 13 and 14:

CONSENT TO SUBLEASETHIS CONSENT TO

- Page 15 and 16:

IN WITNESS WHEREOF, the parties her

- Page 17 and 18:

SUBLEASE:This Sublease ("Sublease")

- Page 19 and 20:

A. Buckets of Range Balls. Range Ba

- Page 21 and 22:

B. Commercial General Liability [ns

- Page 23 and 24:

14. NgJjces. All notices, requests,

- Page 25 and 26:

EXHIBIT "B"MAP OF SUBLEASED PREMISE

- Page 27 and 28:

·'~FU)ATJHG POCK ------~(~ EXTEJ;S

- Page 29:

EXHIBIT"C"IMPROVEMENTSExhibit to be

- Page 32 and 33:

PRIOR BOARD ACTION(S)9/5/12, R12-9-

- Page 34:

License #361248March 13, 2013Mr. Do

- Page 37 and 38:

Committee directed staff to begin t

- Page 39 and 40:

1 INTRODUCTIONOrange County Water D

- Page 41 and 42:

8 PRE-SUBMITTAL ACTIVITIES7.1 Quest

- Page 43 and 44:

maintain policies similar to those

- Page 45 and 46:

2.2 Develop recommendations for lea

- Page 47 and 48:

AGREEMENT NO. ***withfor***This Agr

- Page 49 and 50:

PART II GENERALPROVISIONSSECTION ON

- Page 52 and 53:

Contractor’s insurance and shall

- Page 54 and 55:

indemnify, defend, and hold harmles

- Page 56 and 57:

3.11 Waiver. No delay or omission i

- Page 58 and 59:

To OCWD:Orange County Water Distric

- Page 60 and 61:

PART IVSCOPE OF SERVICESA. Services

- Page 62 and 63:

EXHIBIT COCWD PROPOSAL EVALUATION F

- Page 65 and 66:

AGENDA ITEM SUBMITTALMeeting Date:

- Page 67 and 68:

Location Map

- Page 69 and 70:

RECORDED AT THE REQUEST OF,AND WHEN

- Page 71: Amtliches Mitteilungsblatt der Univ

- Page 74: EXHIBIT "C"PARKWAYPCL. F16801-101IN

- Page 77 and 78: equired environmental compliance; w

- Page 79 and 80: MEMORANDUM OF UNDERSTANDINGBy and B

- Page 81 and 82: 10. The parties hereto agree to neg

- Page 83: Exhibit A

- Page 86 and 87: On March12, 2013, Ray Currie, who p

- Page 88 and 89: Location MapLICENSE AGREEMENTS WEST

- Page 90 and 91: LICENSE AGREEMENT(RAYMOND CURRIE, J

- Page 92 and 93: License Agreement Ray Currie (3-18-

- Page 94 and 95: 2.2.3 Acceptance by OCWD of any del

- Page 96 and 97: equivalent endorsement provided to

- Page 98 and 99: 2.5.2 Indemnification: Irrespective

- Page 100 and 101: 2.6.7 OCWD’s Reservations2.6.7.1

- Page 102 and 103: assumes all responsibility for the

- Page 104 and 105: 2.8.3 Headings: The titles and head

- Page 106 and 107: BY PLACING ITS INITIALS HERE, LICEN

- Page 108: P ART IV[Map of the Premises]-19-

- Page 111 and 112: of the City of Anaheim’s water pi

- Page 113 and 114: PRIOR BOARD ACTION(S)10/3/12, Motio

- Page 115 and 116: Location MapLane Extension and Util

- Page 117 and 118: LOCATION MAPIMPERIAL HIGHWAY PROPER

- Page 119 and 120: STATE OF CALIFORNIA-DEPARTMENT OF T

- Page 121: RIGHT OF WAY CONTRACT - STATE HIGHW

- Page 125: RIGHT OF WAY CONTRACT - STATE HIGHW

- Page 128 and 129: Terms.Original termTerms10 years.Op

- Page 130 and 131: LICENSE AGREEMENT(FREEDOM TELECOMMU

- Page 132 and 133: APPROVED AS TO FORM:RUTAN & TUCKER,

- Page 134 and 135: 2.2.3 Acceptance by OCWD of any del

- Page 136 and 137: equivalent endorsement provided to

- Page 138 and 139: 2.5.2 Indemnification: Irrespective

- Page 140 and 141: 2.6.7 OCWD’s Reservations2.6.7.1

- Page 142 and 143: assumes all responsibility for the

- Page 144 and 145: 2.8.3 Headings: The titles and head

- Page 146 and 147: 2.9.1.1 In the event that Licensee

- Page 148 and 149: Premises, and from the cost of defe

- Page 150: PART IVDescription of Access Area-2

- Page 153 and 154: City has advised staff that the dep

- Page 155 and 156: Staff advised by OCFCD that they ar

- Page 157 and 158: 3/2/11, M11-41 Direct staff to hire

- Page 160 and 161: AGENDA ITEM SUBMITTALMeeting Date:

- Page 162: Location Map

- Page 165 and 166: Summary of Prior Steps TakenJanuary

- Page 167 and 168: DecemberJanuary 2011FebruaryIssued

- Page 169: LOCATION MAPSOUTH STREET PROPERTY A