OHFA Annual Plan - Ohio Housing Finance Agency

OHFA Annual Plan - Ohio Housing Finance Agency

OHFA Annual Plan - Ohio Housing Finance Agency

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

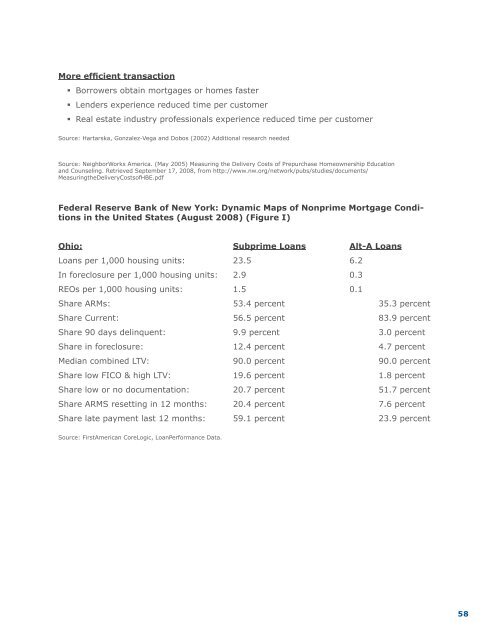

More efficient transaction• Borrowers obtain mortgages or homes faster• Lenders experience reduced time per customer• Real estate industry professionals experience reduced time per customerSource: Hartarska, Gonzalez-Vega and Dobos (2002) Additional research neededSource: NeighborWorks America. (May 2005) Measuring the Delivery Costs of Prepurchase Homeownership Educationand Counseling. Retrieved September 17, 2008, from http://www.nw.org/network/pubs/studies/documents/MeasuringtheDeliveryCostsofHBE.pdfFederal Reserve Bank of New York: Dynamic Maps of Nonprime Mortgage Conditionsin the United States (August 2008) (Figure I)<strong>Ohio</strong>: Subprime Loans Alt-A LoansLoans per 1,000 housing units: 23.5 6.2In foreclosure per 1,000 housing units: 2.9 0.3REOs per 1,000 housing units: 1.5 0.1Share ARMs: 53.4 percent 35.3 percentShare Current: 56.5 percent 83.9 percentShare 90 days delinquent: 9.9 percent 3.0 percentShare in foreclosure: 12.4 percent 4.7 percentMedian combined LTV: 90.0 percent 90.0 percentShare low FICO & high LTV: 19.6 percent 1.8 percentShare low or no documentation: 20.7 percent 51.7 percentShare ARMS resetting in 12 months: 20.4 percent 7.6 percentShare late payment last 12 months: 59.1 percent 23.9 percentSource: FirstAmerican CoreLogic, LoanPerformance Data.58