Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

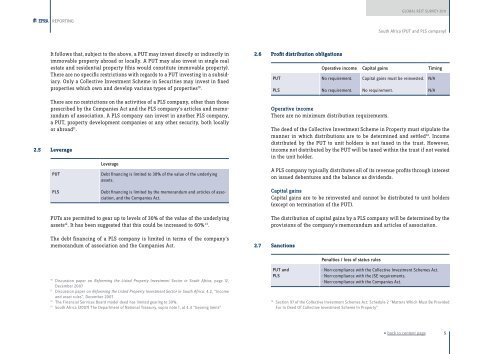

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGSouth Africa (PUT and PLS company)It follows that, subject to the above, a PUT may invest directly or indirectly inimmovable property abroad or locally. A PUT may also invest in single realestate and residential property (this would constitute immovable property).There are no specific restrictions with regards to a PUT investing in a subsidiary.Only a Collective Investment Scheme in Securities may invest in fixedproperties which own and develop various types of properties 10 .There are no restrictions on the activities of a PLS company, other than thoseprescribed by the Companies Act and the PLS company’s articles and memorandumof association. A PLS company can invest in another PLS company,a PUT, property development companies or any other security, both locallyor abroad 11 .2.5 LeveragePUTLeverageDebt financing is limited to 30% of the value of the underlyingassets.2.6 Profit distribution obligationsPUTPLSOperative income Capital gains TimingNo requirement.No requirement.Capital gains must be reinvested.No requirement.Operative incomeThere are no minimum distribution requirements.The deed of the Collective Investment Scheme in Property must stipulate themanner in which distributions are to be determined and settled 14 . Incomedistributed by the PUT to unit holders is not taxed in the trust. However,income not distributed by the PUT will be taxed within the trust if not vestedin the unit holder.A PLS company typically distributes all of its revenue profits through intereston issued debentures and the balance as dividends.N/AN/APLSDebt financing is limited by the memorandum and articles of association,and the Companies Act.Capital gainsCapital gains are to be reinvested and cannot be distributed to unit holders(except on termination of the PUT).PUTs are permitted to gear up to levels of 30% of the value of the underlyingassets 12 . It has been suggested that this could be increased to 60% 13 .The debt financing of a PLS company is limited in terms of the company’smemorandum of association and the Companies Act.The distribution of capital gains by a PLS company will be determined by theprovisions of the company’s memorandum and articles of association.2.7 SanctionsPenalties / loss of status rules10Discussion paper on Reforming the Listed Property Investment Sector in South Africa, page 12,December 200711Discussion paper on Reforming the Listed Property Investment Sector in South Africa: 4.2, “Incomeand asset rules”, December 200712The Financial Services Board model deed has limited gearing to 30%.13South Africa (2007) The Department of National Treasury, supra note 1, at 4.4 “Gearing limits”PUT andPLS- Non-compliance with the Collective Investment Schemes Act.- Non-compliance with the JSE requirements.- Non-compliance with the Companies Act.14Section 97 of the Collective Investment Schemes Act: Schedule 2 “Matters Which Must Be ProvidedFor In Deed Of Collective Investment Scheme In Property”« back to content page5