Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

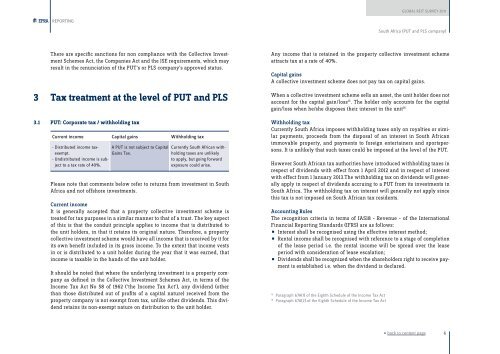

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGSouth Africa (PUT and PLS company)There are specific sanctions for non compliance with the Collective InvestmentSchemes Act, the Companies Act and the JSE requirements, which mayresult in the renunciation of the PUT’s or PLS company’s approved status.3 Tax treatment at the level of PUT and PLS3.1 PUT: Corporate tax / withholding taxCurrent income Capital gains Withholding tax- Distributed income taxexempt.- Undistributed income is subjectto a tax rate of 40%.A PUT is not subject to CapitalGains Tax.Currently South African withholdingtaxes are unlikelyto apply, but going forwardexposure could arise.Please note that comments below refer to returns from investment in SouthAfrica and not offshore investments.Current incomeIt is generally accepted that a property collective investment scheme istreated for tax purposes in a similar manner to that of a trust. The key aspectof this is that the conduit principle applies to income that is distributed tothe unit holders, in that it retains its original nature. Therefore, a propertycollective investment scheme would have all income that is received by it forits own benefit included in its gross income. To the extent that income vestsin or is distributed to a unit holder during the year that it was earned, thatincome is taxable in the hands of the unit holder.It should be noted that where the underlying investment is a property companyas defined in the Collective Investment Schemes Act, in terms of theIncome Tax Act No 58 of 1962 (‘the Income Tax Act’), any dividend (otherthan those distributed out of profits of a capital nature) received from theproperty company is not exempt from tax, unlike other dividends. This dividendretains its non-exempt nature on distribution to the unit holder.Any income that is retained in the property collective investment schemeattracts tax at a rate of 40%.Capital gainsA collective investment scheme does not pay tax on capital gains.When a collective investment scheme sells an asset, the unit holder does notaccount for the capital gain/loss 15 . The holder only accounts for the capitalgain/loss when he/she disposes their interest in the unit 16Withholding taxCurrently South Africa imposes withholding taxes only on royalties or similarpayments, proceeds from the disposal of an interest in South Africanimmovable property, and payments to foreign entertainers and sportspersons.It is unlikely that such taxes could be imposed at the level of the PUT.However South African tax authorities have introduced withholding taxes inrespect of dividends with effect from 1 April 2012 and in respect of interestwith effect from 1 January 2013.The withholding tax on dividends will generallyapply in respect of dividends accruing to a PUT from its investments inSouth Africa. The withholding tax on interest will generally not apply sincethis tax is not imposed on South African tax residents.Accounting RulesThe recognition criteria in terms of IAS18 – Revenue – of the InternationalFinancial Reporting Standards (IFRS) are as follows:Interest shall be recognised using the effective interest method;• Rental income shall be recognised with reference to a stage of completion• of the lease period i.e. the rental income will be spread over the leaseperiod with consideration of lease escalation;Dividends shall be recognized when the shareholders right to receive pay-• ment is established i.e. when the dividend is declared.15Paragraph 67A(1) of the Eighth Schedule of the Income Tax Act16Paragraph 67A(2) of the Eighth Schedule of the Income Tax Act« back to content page6