Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

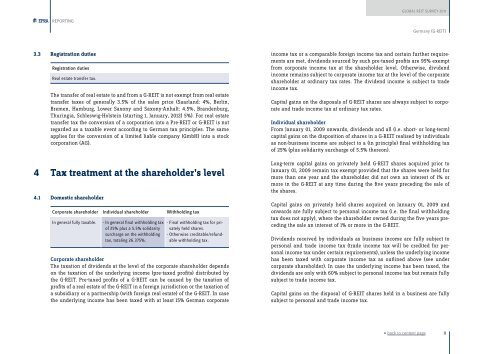

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGGermany (G-<strong>REIT</strong>)3.3 Registration dutiesRegistration dutiesReal estate transfer tax.The transfer of real estate to and from a G-<strong>REIT</strong> is not exempt from real estatetransfer taxes of generally 3.5% of the sales price (Saarland: 4%, Berlin,Bremen, Hamburg, Lower Saxony and Saxony-Anhalt: 4.5%, Brandenburg,Thuringia, Schleswig-Holstein (starting 1, January, 2012) 5%). For real estatetransfer tax the conversion of a corporation into a Pre-<strong>REIT</strong> or G-<strong>REIT</strong> is notregarded as a taxable event according to German tax principles. The sameapplies for the conversion of a limited liable company (GmbH) into a stockcorporation (AG).4 Tax treatment at the shareholder’s level4.1 Domestic shareholderCorporate shareholder Individual shareholder Withholding taxIn general fully taxable.- In general final withholding taxof 25% plus a 5.5% solidaritysurcharge on the withholdingtax, totaling 26.375%.- Final withholding tax for privatelyheld shares.- Otherwise creditable/refundablewithholding tax.Corporate shareholderThe taxation of dividends at the level of the corporate shareholder dependson the taxation of the underlying income (pre-taxed profits) distributed bythe G-<strong>REIT</strong>. Pre-taxed profits of a G-<strong>REIT</strong> can be caused by the taxation ofprofits of a real estate of the G-<strong>REIT</strong> in a foreign jurisdiction or the taxation ofa subsidiary or a partnership (with foreign real estate) of the G-<strong>REIT</strong>. In casethe underlying income has been taxed with at least 15% German corporateincome tax or a comparable foreign income tax and certain further requirementsare met, dividends sourced by such pre-taxed profits are 95% exemptfrom corporate income tax at the shareholder level. Otherwise, dividendincome remains subject to corporate income tax at the level of the corporateshareholder at ordinary tax rates. The dividend income is subject to tradeincome tax.Capital gains on the disposals of G-<strong>REIT</strong> shares are always subject to corporateand trade income tax at ordinary tax rates.Individual shareholderFrom January 01, 2009 onwards, dividends and all (i.e. short- or long-term)capital gains on the disposition of shares in a G-<strong>REIT</strong> realised by individualsas non-business income are subject to a (in principle) final withholding taxof 25% (plus solidarity surcharge of 5.5% thereon).Long-term capital gains on privately held G-<strong>REIT</strong> shares acquired prior toJanuary 01, 2009 remain tax exempt provided that the shares were held formore than one year and the shareholder did not own an interest of 1% ormore in the G-<strong>REIT</strong> at any time during the five years preceding the sale ofthe shares.Capital gains on privately held shares acquired on January 01, 2009 andonwards are fully subject to personal income tax (i.e. the final withholdingtax does not apply), where the shareholder owned during the five years precedingthe sale an interest of 1% or more in the G-<strong>REIT</strong>.Dividends received by individuals as business income are fully subject topersonal and trade income tax (trade income tax will be credited for personalincome tax under certain requirements), unless the underlying incomehas been taxed with corporate income tax as outlined above (see undercorporate shareholder). In case the underlying income has been taxed, thedividends are only with 60% subject to personal income tax but remain fullysubject to trade income tax.Capital gains on the disposal of G-<strong>REIT</strong> shares held in a business are fullysubject to personal and trade income tax.« back to content page8