Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

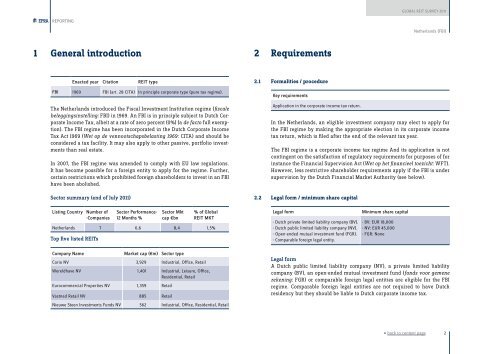

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGNetherlands (FBI)1 General introduction2 RequirementsEnacted year Citation <strong>REIT</strong> typeFBI 1969 FBI (art. 28 CITA) In principle corporate type (pure tax regime).The Netherlands introduced the Fiscal Investment Institution regime (fiscalebeleggingsinstelling: FBI) in 1969. An FBI is in principle subject to Dutch CorporateIncome Tax, albeit at a rate of zero percent (0%) (a de facto full exemption).The FBI regime has been incorporated in the Dutch Corporate IncomeTax Act 1969 (Wet op de vennootschapsbelasting 1969: CITA) and should beconsidered a tax facility. It may also apply to other passive, portfolio investmentsthan real estate.In 2007, the FBI regime was amended to comply with EU law regulations.It has become possible for a foreign entity to apply for the regime. Further,certain restrictions which prohibited foreign shareholders to invest in an FBIhave been abolished.Sector summary (end of July <strong>2011</strong>)Listing Country Number of-CompaniesSector Performance-12 Months %Sector Mktcap €bn% of <strong>Global</strong><strong>REIT</strong> MKTNetherlands 7 6,6 8,4 1,5%Top five listed <strong>REIT</strong>sCompany NameMarket cap (€m) Sector typeCorio NV 3,929 Industrial, Office, RetailWereldhave NV 1,401 Industrial, Leisure, Office,Residential, RetailEurocommercial Properties NV 1,359 RetailVastned Retail NV 885 RetailNieuwe Steen Investments Funds NV 562 Industrial, Office, Residential, Retail2.1 Formalities / procedureKey requirementsApplication in the corporate income tax return.In the Netherlands, an eligible investment company may elect to apply forthe FBI regime by making the appropriate election in its corporate incometax return, which is filed after the end of the relevant tax year.The FBI regime is a corporate income tax regime And its application is notcontingent on the satisfaction of regulatory requirements for purposes of forinstance the Financial Supervision Act (Wet op het financieel toezicht: WFT).However, less restrictive shareholder requirements apply if the FBI is undersupervision by the Dutch Financial Market Authority (see below).2.2 Legal form / minimum share capitalLegal form- Dutch private limited liability company (BV).- Dutch public limited liability company (NV).- Open-ended mutual investment fund (FGR).- Comparable foreign legal entity.Minimum share capital- BV: EUR 18,000- NV: EUR 45,000- FGR: NoneLegal formA Dutch public limited liability company (NV), a private limited liabilitycompany (BV), an open-ended mutual investment fund (fonds voor gemenerekening: FGR) or comparable foreign legal entities are eligible for the FBIregime. Comparable foreign legal entities are not required to have Dutchresidency but they should be liable to Dutch corporate income tax.« back to content page2