Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

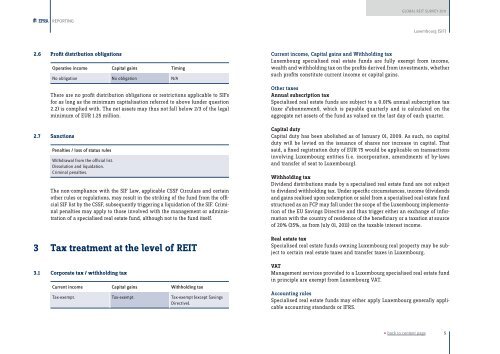

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGLuxembourg (SIF)2.6 Profit distribution obligationsOperative income Capital gains TimingNo obligation No obligation N/AThere are no profit distribution obligations or restrictions applicable to SIFsfor as long as the minimum capitalisation referred to above (under question2.2) is complied with. The net assets may thus not fall below 2/3 of the legalminimum of EUR 1.25 million.2.7 SanctionsPenalties / loss of status rulesWithdrawal from the official list.Dissolution and liquidation.Criminal penalties.The non-compliance with the SIF Law, applicable CSSF Circulars and certainother rules or regulations, may result in the striking of the fund from the officialSIF list by the CSSF, subsequently triggering a liquidation of the SIF. Criminalpenalties may apply to those involved with the management or administrationof a specialised real estate fund, although not to the fund itself.3 Tax treatment at the level of <strong>REIT</strong>3.1 Corporate tax / withholding taxCurrent income Capital gains Withholding taxTax-exempt. Tax-exempt. Tax-exempt (except SavingsDirective).Current income, Capital gains and Withholding taxLuxembourg specialised real estate funds are fully exempt from income,wealth and withholding tax on the profits derived from investments, whethersuch profits constitute current income or capital gains.Other taxesAnnual subscription taxSpecialised real estate funds are subject to a 0.01% annual subscription tax(taxe d’abonnement), which is payable quarterly and is calculated on theaggregate net assets of the fund as valued on the last day of each quarter.Capital dutyCapital duty has been abolished as of January 01, 2009. As such, no capitalduty will be levied on the issuance of shares nor increase in capital. Thatsaid, a fixed registration duty of EUR 75 would be applicable on transactionsinvolving Luxembourg entities (i.e. incorporation, amendments of by-lawsand transfer of seat to Luxembourg).Withholding taxDividend distributions made by a specialised real estate fund are not subjectto dividend withholding tax. Under specific circumstances, income (dividendsand gains realised upon redemption or sale) from a specialised real estate fundstructured as an FCP may fall under the scope of the Luxembourg implementationof the EU Savings Directive and thus trigger either an exchange of informationwith the country of residence of the beneficiary or a taxation at sourceof 20% (35%, as from July 01, <strong>2011</strong>) on the taxable interest income.Real estate taxSpecialised real estate funds owning Luxembourg real property may be subjectto certain real estate taxes and transfer taxes in Luxembourg.VATManagement services provided to a Luxembourg specialised real estate fundin principle are exempt from Luxembourg VAT.Accounting rulesSpecialised real estate funds may either apply Luxembourg generally applicableaccounting standards or IFRS.« back to content page5