Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

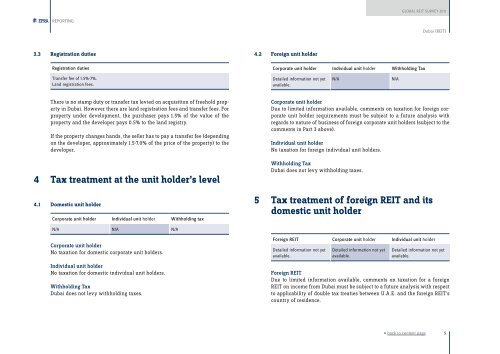

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGDubai (<strong>REIT</strong>)3.3 Registration dutiesRegistration duties4.2 Foreign unit holderCorporate unit holder Individual unit holder Withholding TaxTransfer fee of 1.5%-7%.Land registration fees.Detailed information not yetavailable.N/AN/AThere is no stamp duty or transfer tax levied on acquisition of freehold propertyin Dubai. However there are land registration fees and transfer fees. Forproperty under development, the purchaser pays 1.5% of the value of theproperty and the developer pays 0.5% to the land registry.If the property changes hands, the seller has to pay a transfer fee (dependingon the developer, approximately 1.5-7.0% of the price of the property) to thedeveloper.4 Tax treatment at the unit holder’s level4.1 Domestic unit holderCorporate unit holder Individual unit holder Withholding taxCorporate unit holderDue to limited information available, comments on taxation for foreign corporateunit holder requirements must be subject to a future analysis withregards to nature of business of foreign corporate unit holders (subject to thecomments in Part 3 above).Individual unit holderNo taxation for foreign individual unit holders.Withholding TaxDubai does not levy withholding taxes.5 Tax treatment of foreign <strong>REIT</strong> and itsdomestic unit holderN/A N/A N/ACorporate unit holderNo taxation for domestic corporate unit holders.Individual unit holderNo taxation for domestic individual unit holders.Withholding TaxDubai does not levy withholding taxes.Foreign <strong>REIT</strong> Corporate unit holder Individual unit holderDetailed information not yetavailable.Detailed information not yetavailable.Detailed information not yetavailable.Foreign <strong>REIT</strong>Due to limited information available, comments on taxation for a foreign<strong>REIT</strong> on income from Dubai must be subject to a future analysis with respectto applicability of double tax treaties between U.A.E. and the foreign <strong>REIT</strong>’scountry of residence.« back to content page5