Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

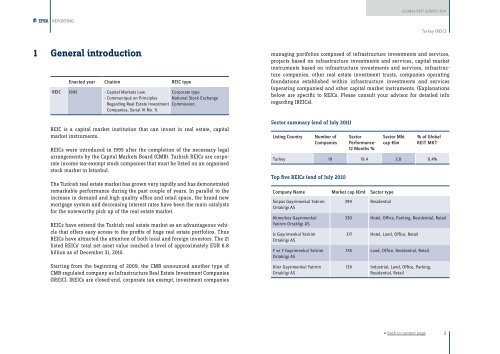

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGTurkey (REIC)1 General introductionEnacted year Citation REIC typeREIC 1995 - Capital Markets Law.- Communiqué on PrinciplesRegarding Real Estate InvestmentCompanies, Serial VI No. 11.Corporate typeNational Stock ExchangeCommission.REIC is a capital market institution that can invest in real estate, capitalmarket instruments.REICs were introduced in 1995 after the completion of the necessary legalarrangements by the Capital Markets Board (CMB). Turkish REICs are corporateincome tax-exempt stock companies that must be listed on an organisedstock market in Istanbul.The Turkish real estate market has grown very rapidly and has demonstratedremarkable performance during the past couple of years. In parallel to theincrease in demand and high quality office and retail space, the brand newmortgage system and decreasing interest rates have been the main catalystsfor the noteworthy pick up of the real estate market.REICs have entered the Turkish real estate market as an advantageous vehiclethat offers easy access to the profits of huge real estate portfolios. ThusREICs have attracted the attention of both local and foreign investors. The 21listed REICs’ total net asset value reached a level of approximately EUR 6.8billion as of December 31, 2010.Starting from the beginning of 2009, the CMB announced another type ofCMB-regulated company as Infrastructure Real Estate Investment Companies(IREIC). IREICs are closed-end, corporate tax exempt, investment companiesmanaging portfolios composed of infrastructure investments and services,projects based on infrastructure investments and services, capital marketinstruments based on infrastructure investments and services, infrastructurecompanies, other real estate investment trusts, companies operatingfoundations established within infrastructure investments and services(operating companies) and other capital market instruments. (Explanationsbelow are specific to REICs. Please consult your advisor for detailed inforegarding IREICs).Sector summary (end of July <strong>2011</strong>)Listing CountryNumber ofCompaniesSectorPerformance-12 Months %Sector Mktcap €bn% of <strong>Global</strong><strong>REIT</strong> MKTTurkey 19 19,4 2,0 0,4%Top five REICs (end of July <strong>2011</strong>)Company Name Market cap (€m) Sector typeSinpas Gayrimenkul YatirimOrtakligi ASAkmerkez GayrimenkulYatirim Ortakligi ASIs Gayrimenkul YatirimOrtakligi ASY ve Y Gayrimenkul YatirimOrtakligi ASKiler Gayrimenkul YatirimOrtakligi AS399 Residential330 Hotel, Office, Parking, Residential, Retail317 Hotel, Land, Office, Retail155 Land, Office, Residential, Retail139 Industrial, Land, Office, Parking,Residential, Retail« back to content page2