Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

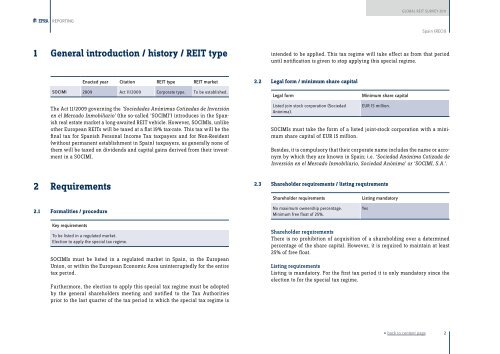

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGSpain (RECII)1 General introduction / history / <strong>REIT</strong> typeintended to be applied. This tax regime will take effect as from that perioduntil notification is given to stop applying this special regime.Enacted year Citation <strong>REIT</strong> type <strong>REIT</strong> market2.2 Legal form / minimum share capitalSOCIMI 2009 Act 11/2009 Corporate type. To be established.Legal formMinimum share capitalThe Act 11/2009 governing the ‘Sociedades Anónimas Cotizadas de Inversiónen el Mercado Inmobiliario’ (the so-called ‘SOCIMI’) introduces in the Spanishreal estate market a long-awaited <strong>REIT</strong> vehicle. However, SOCIMIs, unlikeother European <strong>REIT</strong>s will be taxed at a flat 19% tax-rate. This tax will be thefinal tax for Spanish Personal Income Tax taxpayers and for Non-Resident(without permanent establishment in Spain) taxpayers, as generally none ofthem will be taxed on dividends and capital gains derived from their investmentin a SOCIMI.Listed join stock corporation (SociedadAnónima).EUR 15 million.SOCIMIs must take the form of a listed joint-stock corporation with a minimumshare capital of EUR 15 million.Besides, it is compulsory that their corporate name includes the name or acronymby which they are known in Spain; i.e. ‘Sociedad Anónima Cotizada deInversión en el Mercado Inmobiliario, Sociedad Anónima’ or ‘SOCIMI, S.A.’.2 Requirements2.3 Shareholder requirements / listing requirementsShareholder requirementsListing mandatory2.1 Formalities / procedureNo maximum ownership percentage.Minimum free float of 25%.YesKey requirementsTo be listed in a regulated market.Election to apply the special tax regime.SOCIMIs must be listed in a regulated market in Spain, in the EuropeanUnion, or within the European Economic Area uninterruptedly for the entiretax period.Furthermore, the election to apply this special tax regime must be adoptedby the general shareholders meeting and notified to the Tax Authoritiesprior to the last quarter of the tax period in which the special tax regime isShareholder requirementsThere is no prohibition of acquisition of a shareholding over a determinedpercentage of the share capital. However, it is required to maintain at least25% of free float.Listing requirementsListing is mandatory. For the first tax period it is only mandatory since theelection to for the special tax regime.« back to content page2