Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

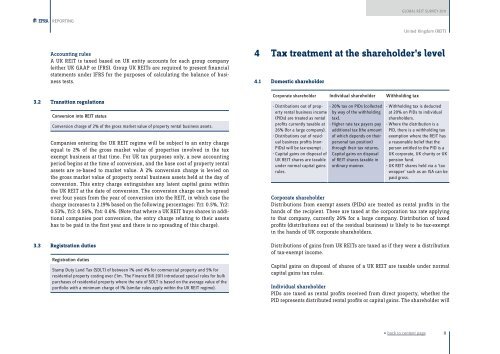

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGUnited Kingdom (<strong>REIT</strong>)Accounting rulesA UK <strong>REIT</strong> is taxed based on UK entity accounts for each group company(either UK GAAP or IFRS). Group UK <strong>REIT</strong>s are required to present financialstatements under IFRS for the purposes of calculating the balance of businesstests.3.2 Transition regulationsConversion into <strong>REIT</strong> statusConversion charge of 2% of the gross market value of property rental business assets.Companies entering the UK <strong>REIT</strong> regime will be subject to an entry chargeequal to 2% of the gross market value of properties involved in the taxexempt business at that time. For UK tax purposes only, a new accountingperiod begins at the time of conversion, and the base cost of property rentalassets are re-based to market value. A 2% conversion charge is levied onthe gross market value of property rental business assets held at the day ofconversion. This entry charge extinguishes any latent capital gains withinthe UK <strong>REIT</strong> at the date of conversion. The conversion charge can be spreadover four years from the year of conversion into the <strong>REIT</strong>, in which case thecharge increases to 2.19% based on the following percentages: Yr1: 0.5%, Yr2:0.53%, Yr3: 0.56%, Yr4: 0.6%. (Note that where a UK <strong>REIT</strong> buys shares in additionalcompanies post conversion, the entry charge relating to their assetshas to be paid in the first year and there is no spreading of this charge).3.3 Registration dutiesRegistration dutiesStamp Duty Land Tax (SDLT) of between 1% and 4% for commercial property and 5% forresidential property costing over £1m. The Finance Bill <strong>2011</strong> introduced special rules for bulkpurchases of residential property where the rate of SDLT is based on the average value of theportfolio with a minimum charge of 1% (similar rules apply within the UK <strong>REIT</strong> regime).4 Tax treatment at the shareholder’s level4.1 Domestic shareholderCorporate shareholder Individual shareholder Withholding tax- Distributions out of propertyrental business income(PIDs) are treated as rentalprofits currently taxable at26% (for a large company).- Distributions out of residualbusiness profits (non-PIDs) will be tax-exempt .- Capital gains on disposal ofUK <strong>REIT</strong> shares are taxableunder normal capital gainsrules.- 20% tax on PIDs (collectedby way of the withholdingtax).- Higher rate tax payers payadditional tax (the amountof which depends on theirpersonal tax position)through their tax returns.Capital gains on disposalof <strong>REIT</strong> shares taxable inordinary manner.- Withholding tax is deductedat 20% on PIDs to individualshareholders.- Where the distribution is aPID, there is a withholding taxexemption where the <strong>REIT</strong> hasa reasonable belief that theperson entitled to the PID is aUK corporate, UK charity or UKpension fund.- UK <strong>REIT</strong> shares held via a ‘taxwrapper’ such as an ISA can bepaid gross.Corporate shareholderDistributions from exempt assets (PIDs) are treated as rental profits in thehands of the recipient. These are taxed at the corporation tax rate applyingto that company, currently 26% for a large company. Distribution of taxedprofits (distributions out of the residual business) is likely to be tax-exemptin the hands of UK corporate shareholders.Distributions of gains from UK <strong>REIT</strong>s are taxed as if they were a distributionof tax-exempt income.Capital gains on disposal of shares of a UK <strong>REIT</strong> are taxable under normalcapital gains tax rules.Individual shareholderPIDs are taxed as rental profits received from direct property, whether thePID represents distributed rental profits or capital gains. The shareholder will« back to content page8