Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

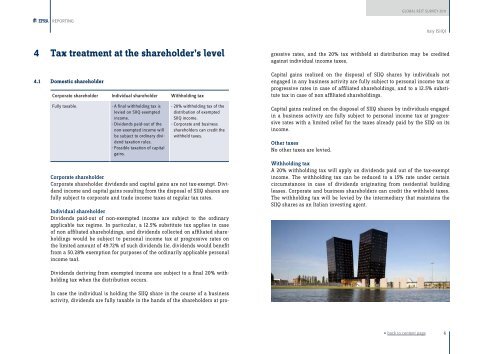

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGItaly (SIIQ)4 Tax treatment at the shareholder’s level4.1 Domestic shareholderCorporate shareholder Individual shareholder Withholding taxFully taxable.- A final withholding tax islevied on SIIQ exemptedincome.- Dividends paid-out of thenon-exempted income willbe subject to ordinary dividendtaxation rules.- Possible taxation of capitalgains.- 20% withholding tax of thedistribution of exemptedSIIQ income.- Corporate and businessshareholders can credit thewithheld taxes.Corporate shareholderCorporate shareholder dividends and capital gains are not tax-exempt. Dividendincome and capital gains resulting from the disposal of SIIQ shares arefully subject to corporate and trade income taxes at regular tax rates.Individual shareholderDividends paid-out of non-exempted income are subject to the ordinaryapplicable tax regime. In particular, a 12.5% substitute tax applies in caseof non affiliated shareholdings, and dividends collected on affiliated shareholdingswould be subject to personal income tax at progressive rates onthe limited amount of 49.72% of such dividends (ie, dividends would benefitfrom a 50.28% exemption for purposes of the ordinarily applicable personalincome tax).In case the individual is holding the SIIQ share in the course of a businessactivity, dividends are fully taxable in the hands of the shareholders at progressiverates, and the 20% tax withheld at distribution may be creditedagainst individual income taxes.Capital gains realized on the disposal of SIIQ shares by individuals notengaged in any business activity are fully subject to personal income tax atprogressive rates in case of affiliated shareholdings, and to a 12.5% substitutetax in case of non affiliated shareholdings.Capital gains realized on the disposal of SIIQ shares by individuals engagedin a business activity are fully subject to personal income tax at progressiverates with a limited relief for the taxes already paid by the SIIQ on itsincome.Other taxesNo other taxes are levied.Withholding taxA 20% withholding tax will apply on dividends paid out of the tax-exemptincome. The withholding tax can be reduced to a 15% rate under certaincircumstances in case of dividends originating from residential buildingleases. Corporate and business shareholders can credit the withheld taxes.The withholding tax will be levied by the intermediary that maintains theSIIQ shares as an Italian investing agent.Dividends deriving from exempted income are subject to a final 20% withholdingtax when the distribution occurs.« back to content page6