Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

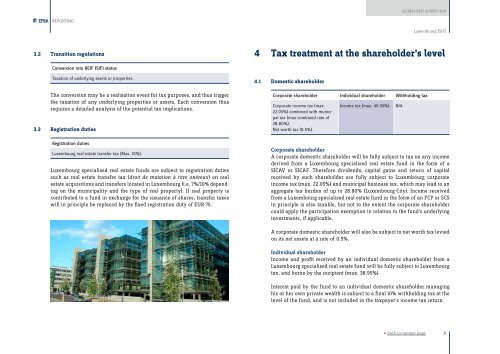

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGLuxembourg (SIF)3.2 Transition regulations4 Tax treatment at the shareholder’s levelConversion into REIF (SIF) statusTaxation of underlying assets or properties.The conversion may be a realisation event for tax purposes, and thus triggerthe taxation of any underlying properties or assets. Each conversion thusrequires a detailed analysis of the potential tax implications.3.3 Registration dutiesRegistration dutiesLuxembourg real estate transfer tax (Max. 10%).Luxembourg specialised real estate funds are subject to registration dutiessuch as real estate transfer tax (droit de mutation à titre onéreux) on realestate acquisitions and transfers located in Luxembourg (i.e. 7%/10% dependingon the municipality and the type of real property). If real property iscontributed to a fund in exchange for the issuance of shares, transfer taxeswill in principle be replaced by the fixed registration duty of EUR 75.4.1 Domestic shareholderCorporate shareholder Individual shareholder Withholding taxCorporate income tax (max.22.05%) combined with municipaltax (max combined rate of28.80%).Net worth tax (0.5%).Income tax (max. 40.56%).Corporate shareholderA corporate domestic shareholder will be fully subject to tax on any incomederived from a Luxembourg specialised real estate fund in the form of aSICAV or SICAF. Therefore dividends, capital gains and return of capitalreceived by such shareholder are fully subject to Luxembourg corporateincome tax (max. 22.05%) and municipal business tax, which may lead to anaggregate tax burden of up to 28.80% (Luxembourg-City). Income receivedfrom a Luxembourg specialised real estate fund in the form of an FCP or SCSin principle is also taxable, but not to the extent the corporate shareholdercould apply the participation exemption in relation to the fund’s underlyinginvestments, if applicable.n/aA corporate domestic shareholder will also be subject to net worth tax leviedon its net assets at a rate of 0.5%.Individual shareholderIncome and profit received by an individual domestic shareholder from aLuxembourg specialised real estate fund will be fully subject to Luxembourgtax, and borne by the recipient (max. 38.95%).Interest paid by the fund to an individual domestic shareholder managinghis or her own private wealth is subject to a final 10% withholding tax at thelevel of the fund, and is not included in the taxpayer’s income tax return.« back to content page6