Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

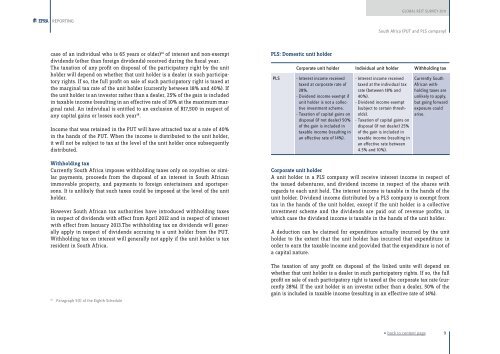

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGSouth Africa (PUT and PLS company)case of an individual who is 65 years or older) 14 of interest and non-exemptdividends (other than foreign dividends) received during the fiscal year.The taxation of any profit on disposal of the participatory right by the unitholder will depend on whether that unit holder is a dealer in such participatoryrights. If so, the full profit on sale of such participatory right is taxed atthe marginal tax rate of the unit holder (currently between 18% and 40%). Ifthe unit holder is an investor rather than a dealer, 25% of the gain is includedin taxable income (resulting in an effective rate of 10% at the maximum marginalrate). An individual is entitled to an exclusion of R17,500 in respect ofany capital gains or losses each year 18 .Income that was retained in the PUT will have attracted tax at a rate of 40%in the hands of the PUT. When the income is distributed to the unit holder,it will not be subject to tax at the level of the unit holder once subsequentlydistributed.Withholding taxCurrently South Africa imposes withholding taxes only on royalties or similarpayments, proceeds from the disposal of an interest in South Africanimmovable property, and payments to foreign entertainers and sportspersons.It is unlikely that such taxes could be imposed at the level of the unitholder.However South African tax authorities have introduced withholding taxesin respect of dividends with effect from April 2012 and in respect of interestwith effect from January 2013.The withholding tax on dividends will generallyapply in respect of dividends accruing to a unit holder from the PUT.Withholding tax on interest will generally not apply if the unit holder is taxresident in South Africa.18Paragraph 5(1) of the Eighth SchedulePLS: Domestic unit holderPLSCorporate unit holder Individual unit holder Withholding tax- Interest income receivedtaxed at corporate rate of28%.- Dividend income exempt ifunit holder is not a collectiveinvestment scheme.- Taxation of capital gains ondisposal (if not dealer) 50%of the gain is included intaxable income (resulting inan effective rate of 14%).- Interest income receivedtaxed at the individual taxrate (between 18% and40%).- Dividend income exempt(subject to certain thresholds).- Taxation of capital gains ondisposal (if not dealer) 25%of the gain is included intaxable income (resulting inan effective rate between4.5% and 10%).Currently SouthAfrican withholdingtaxes areunlikely to apply,but going forwardexposure couldarise.Corporate unit holderA unit holder in a PLS company will receive interest income in respect ofthe issued debentures, and dividend income in respect of the shares withregards to each unit held. The interest income is taxable in the hands of theunit holder. Dividend income distributed by a PLS company is exempt fromtax in the hands of the unit holder, except if the unit holder is a collectiveinvestment scheme and the dividends are paid out of revenue profits, inwhich case the dividend income is taxable in the hands of the unit holder.A deduction can be claimed for expenditure actually incurred by the unitholder to the extent that the unit holder has incurred that expenditure inorder to earn the taxable income and provided that the expenditure is not ofa capital nature.The taxation of any profit on disposal of the linked units will depend onwhether that unit holder is a dealer in such participatory rights. If so, the fullprofit on sale of such participatory right is taxed at the corporate tax rate (currently28%). If the unit holder is an investor rather than a dealer, 50% of thegain is included in taxable income (resulting in an effective rate of 14%).« back to content page9