Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

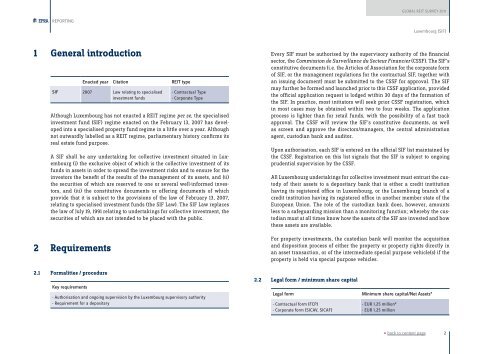

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGLuxembourg (SIF)1 General introductionEnacted year Citation <strong>REIT</strong> typeSIF 2007 Law relating to specialisedinvestment funds- Contractual Type- Corporate TypeAlthough Luxembourg has not enacted a <strong>REIT</strong> regime per se, the specialisedinvestment fund (SIF) regime enacted on the February 13, 2007 has developedinto a specialised property fund regime in a little over a year. Althoughnot outwardly labelled as a <strong>REIT</strong> regime, parliamentary history confirms itsreal estate fund purpose.A SIF shall be any undertaking for collective investment situated in Luxembourg(i) the exclusive object of which is the collective investment of itsfunds in assets in order to spread the investment risks and to ensure for theinvestors the benefit of the results of the management of its assets, and (ii)the securities of which are reserved to one or several well-informed investors,and (iii) the constitutive documents or offering documents of whichprovide that it is subject to the provisions of the law of February 13, 2007,relating to specialised investment funds (the SIF Law). The SIF Law replacesthe law of July 19, 1991 relating to undertakings for collective investment, thesecurities of which are not intended to be placed with the public.2 RequirementsEvery SIF must be authorised by the supervisory authority of the financialsector, the Commission de Surveillance du Secteur Financier (CSSF). The SIF’sconstitutive documents (i.e. the Articles of Association for the corporate formof SIF, or the management regulations for the contractual SIF, together withan issuing document) must be submitted to the CSSF for approval. The SIFmay further be formed and launched prior to this CSSF application, providedthe official application request is lodged within 30 days of the formation ofthe SIF. In practice, most initiators will seek prior CSSF registration, whichin most cases may be obtained within two to four weeks. The applicationprocess is lighter than for retail funds, with the possibility of a fast trackapproval. The CSSF will review the SIF’s constitutive documents, as wellas screen and approve the directors/managers, the central administrationagent, custodian bank and auditor.Upon authorisation, each SIF is entered on the official SIF list maintained bythe CSSF. Registration on this list signals that the SIF is subject to ongoingprudential supervision by the CSSF.All Luxembourg undertakings for collective investment must entrust the custodyof their assets to a depositary bank that is either a credit institutionhaving its registered office in Luxembourg, or the Luxembourg branch of acredit institution having its registered office in another member state of theEuropean Union. The role of the custodian bank does, however, amountsless to a safeguarding mission than a monitoring function; whereby the custodianmust at all times know how the assets of the SIF are invested and howthese assets are available.For property investments, the custodian bank will monitor the acquisitionand disposition process of either the property or property rights directly inan asset transaction, or of the intermediate special purpose vehicle(s) if theproperty is held via special purpose vehicles.2.1 Formalities / procedureKey requirements- Authorisation and ongoing supervision by the Luxembourg supervisory authority- Requirement for a depositary2.2 Legal form / minimum share capitalLegal form- Contractual form (FCP)- Corporate form (SICAV, SICAF)Minimum share capital/Net Assets*- EUR 1.25 million*- EUR 1.25 million« back to content page2