Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

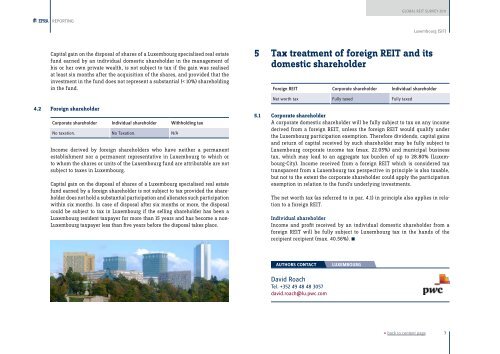

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGLuxembourg (SIF)Capital gain on the disposal of shares of a Luxembourg specialised real estatefund earned by an individual domestic shareholder in the management ofhis or her own private wealth, is not subject to tax if the gain was realisedat least six months after the acquisition of the shares, and provided that theinvestment in the fund does not represent a substantial (< 10%) shareholdingin the fund.5 Tax treatment of foreign <strong>REIT</strong> and itsdomestic shareholderForeign <strong>REIT</strong> Corporate shareholder Individual shareholderNet worth tax Fully taxed Fully taxed4.2 Foreign shareholderCorporate shareholder Individual shareholder Withholding taxNo taxation. No Taxation. n/aIncome derived by foreign shareholders who have neither a permanentestablishment nor a permanent representative in Luxembourg to which orto whom the shares or units of the Luxembourg fund are attributable are notsubject to taxes in Luxembourg.Capital gain on the disposal of shares of a Luxembourg specialised real estatefund earned by a foreign shareholder is not subject to tax provided the shareholderdoes not hold a substantial participation and alienates such participationwithin six months. In case of disposal after six months or more, the disposalcould be subject to tax in Luxembourg if the selling shareholder has been aLuxembourg resident taxpayer for more than 15 years and has become a non-Luxembourg taxpayer less than five years before the disposal takes place.5.1 Corporate shareholderA corporate domestic shareholder will be fully subject to tax on any incomederived from a foreign <strong>REIT</strong>, unless the foreign <strong>REIT</strong> would qualify underthe Luxembourg participation exemption. Therefore dividends, capital gainsand return of capital received by such shareholder may be fully subject toLuxembourg corporate income tax (max. 22.05%) and municipal businesstax, which may lead to an aggregate tax burden of up to 28.80% (Luxembourg-City).Income received from a foreign <strong>REIT</strong> which is considered taxtransparent from a Luxembourg tax perspective in principle is also taxable,but not to the extent the corporate shareholder could apply the participationexemption in relation to the fund’s underlying investments.The net worth tax (as referred to in par. 4.1) in principle also applies in relationto a foreign <strong>REIT</strong>.Individual shareholderIncome and profit received by an individual domestic shareholder from aforeign <strong>REIT</strong> will be fully subject to Luxembourg tax in the hands of therecipient recipient (max. 40.56%). nAUTHORS CONTACTLuxembourgDavid RoachTel. +352 49 48 48 3057david.roach@lu.pwc.com« back to content page7