Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

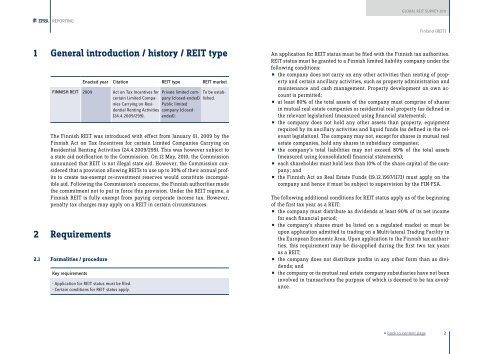

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGFinland (<strong>REIT</strong>)1 General introduction / history / <strong>REIT</strong> typeEnacted year Citation <strong>REIT</strong> type <strong>REIT</strong> marketFINNISH <strong>REIT</strong> 2009 Act on Tax Incentives forcertain Limited CompaniesCarrying on ResidentialRenting Activities(24.4.2009/299).Private limited company(closed-ended)Public limitedcompany (closedended).To be established.The Finnish <strong>REIT</strong> was introduced with effect from January 01, 2009 by theFinnish Act on Tax Incentives for certain Limited Companies Carrying onResidential Renting Activities (24.4.2009/299). This was however subject toa state aid notification to the Commission. On 12 May, 2010, the Commissionannounced that <strong>REIT</strong> is not illegal state aid. However, the Commission consideredthat a provision allowing <strong>REIT</strong>s to use up to 30% of their annual profitsto create tax-exempt re-investment reserves would constitute incompatibleaid. Following the Commission’s concerns, the Finnish authorities madethe commitment not to put in force this provision. Under the <strong>REIT</strong> regime, aFinnish <strong>REIT</strong> is fully exempt from paying corporate income tax. However,penalty tax charges may apply on a <strong>REIT</strong> in certain circumstances.2 Requirements2.1 Formalities / procedureKey requirements- Application for <strong>REIT</strong> status must be filed.- Certain conditions for <strong>REIT</strong> status apply.An application for <strong>REIT</strong> status must be filed with the Finnish tax authorities.<strong>REIT</strong> status must be granted to a Finnish limited liability company under thefollowing conditions:the company does not carry on any other activities than renting of prop-• erty and certain ancillary activities, such as property administration andmaintenance and cash management. Property development on own accountis permitted;at least 80% of the total assets of the company must comprise of shares• in mutual real estate companies or residential real property (as defined inthe relevant legislation) (measured using financial statements);the company does not hold any other assets than property, equipment• required by its ancillary activities and liquid funds (as defined in the relevantlegislation). The company may not, except for shares in mutual realestate companies, hold any shares in subsidiary companies;the company’s total liabilities may not exceed 80% of the total assets• (measured using (consolidated) financial statements);each shareholder must hold less than 10% of the share capital of the com-• pany; andthe Finnish Act on Real Estate Funds (19.12.1997/1173) must apply on the• company and hence it must be subject to supervision by the FIN-FSA.The following additional conditions for <strong>REIT</strong> status apply as of the beginningof the first tax year as a <strong>REIT</strong>:the company must distribute as dividends at least 90% of its net income• for each financial period;the company’s shares must be listed on a regulated market or must be• upon application admitted to trading on a Multi-lateral Trading Facility inthe European Economic Area. Upon application to the Finnish tax authorities,this requirement may be dis-applied during the first two tax yearsas a <strong>REIT</strong>;the company does not distribute profits in any other form than as divi-• dends; andthe company or its mutual real estate company subsidiaries have not been• involved in transactions the purpose of which is deemed to be tax avoidance.« back to content page2