Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

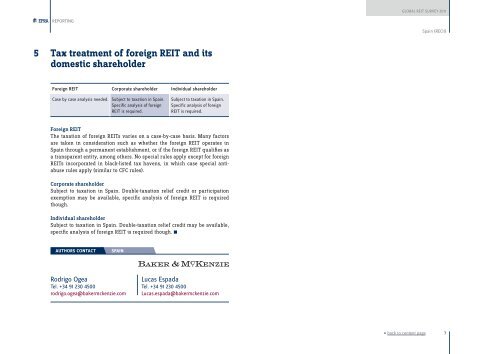

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGSpain (RECII)5 Tax treatment of foreign <strong>REIT</strong> and itsdomestic shareholderForeign <strong>REIT</strong> Corporate shareholder Individual shareholderCase by case analysis needed. Subject to taxation in Spain.Specific analysis of foreign<strong>REIT</strong> is required.Subject to taxation in Spain.Specific analysis of foreign<strong>REIT</strong> is required.Foreign <strong>REIT</strong>The taxation of foreign <strong>REIT</strong>s varies on a case-by-case basis. Many factorsare taken in consideration such as whether the foreign <strong>REIT</strong> operates inSpain through a permanent establishment, or if the foreign <strong>REIT</strong> qualifies asa transparent entity, among others. No special rules apply except for foreign<strong>REIT</strong>s incorporated in black-listed tax havens, in which case special antiabuserules apply (similar to CFC rules).Corporate shareholderSubject to taxation in Spain. Double-taxation relief credit or participationexemption may be available, specific analysis of foreign <strong>REIT</strong> is requiredthough.Individual shareholderSubject to taxation in Spain. Double-taxation relief credit may be available,specific analysis of foreign <strong>REIT</strong> is required though. nAUTHORS CONTACTSpainRodrigo OgeaTel. +34 91 230 4500rodrigo.ogea@bakermckenzie.comLucas EspadaTel. +34 91 230 4500Lucas.espada@bakermckenzie.com« back to content page7