Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

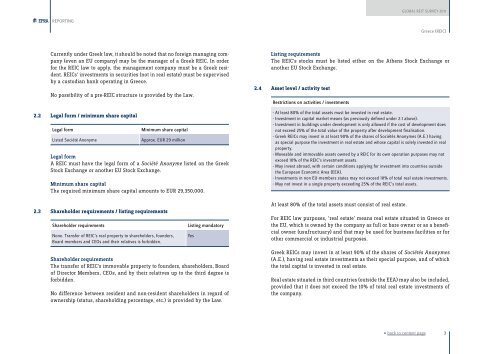

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGGreece (REIC)Currently under Greek law, it should be noted that no foreign managing company(even an EU company) may be the manager of a Greek REIC. In orderfor the REIC law to apply, the management company must be a Greek resident.REICs’ investments in securities (not in real estate) must be supervisedby a custodian bank operating in Greece.No possibility of a pre-REIC structure is provided by the Law.2.2 Legal form / minimum share capitalLegal formListed Société AnonymeMinimum share capitalApprox. EUR 29 millionLegal formA REIC must have the legal form of a Société Anonyme listed on the GreekStock Exchange or another EU Stock Exchange.Minimum share capitalThe required minimum share capital amounts to EUR 29,350,000.Listing requirementsThe REIC’s stocks must be listed either on the Athens Stock Exchange oranother EU Stock Exchange.2.4 Asset level / activity testRestrictions on activities / investments- At least 80% of the total assets must be invested in real estate.- Investment in capital market means (as previously defined under 2.1 above).- Investment in buildings under development is only allowed if the cost of development doesnot exceed 25% of the total value of the property after development finalisation.- Greek REICs may invest in at least 90% of the shares of Sociétés Anonymes (A.E.) havingas special purpose the investment in real estate and whose capital is solely invested in realproperty.- Moveable and immovable assets owned by a REIC for its own operation purposes may notexceed 10% of the REIC’s investment assets.- May invest abroad, with certain conditions applying for investment into countries outsidethe European Economic Area (EEA).- Investments in non EU-members states may not exceed 10% of total real estate investments.- May not invest in a single property exceeding 25% of the REIC’s total assets.2.3 Shareholder requirements / listing requirementsShareholder requirementsNone. Transfer of REIC’s real property to shareholders, founders,Board members and CEOs and their relatives is forbidden.Listing mandatoryYesAt least 80% of the total assets must consist of real estate.For REIC law purposes, ‘real estate’ means real estate situated in Greece orthe EU, which is owned by the company as full or bare owner or as a beneficialowner (usufructuary) and that may be used for business facilities or forother commercial or industrial purposes.Shareholder requirementsThe transfer of REIC’s immovable property to founders, shareholders, Boardof Director Members, CEOs, and by their relatives up to the third degree isforbidden.No difference between resident and non-resident shareholders in regard ofownership (status, shareholding percentage, etc.) is provided by the Law.Greek REICs may invest in at least 90% of the shares of Sociétés Anonymes(A.E.), having real estate investments as their special purpose, and of whichthe total capital is invested in real estate.Real estate situated in third countries (outside the EEA) may also be included,provided that it does not exceed the 10% of total real estate investments ofthe company.« back to content page3