Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

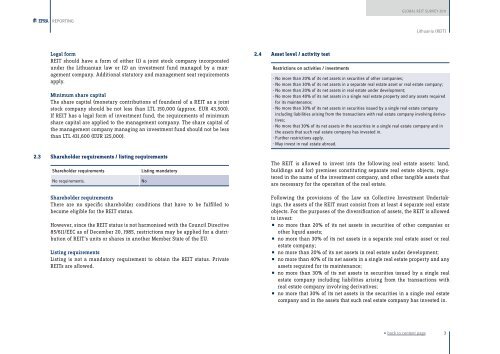

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGLithuania (<strong>REIT</strong>)Legal form<strong>REIT</strong> should have a form of either (1) a joint stock company incorporatedunder the Lithuanian law or (2) an investment fund managed by a managementcompany. Additional statutory and management seat requirementsapply.Minimum share capitalThe share capital (monetary contributions of founders) of a <strong>REIT</strong> as a jointstock company should be not less than LTL 150,000 (approx. EUR 43,500).If <strong>REIT</strong> has a legal form of investment fund, the requirements of minimumshare capital are applied to the management company. The share capital ofthe management company managing an investment fund should not be lessthan LTL 431,600 (EUR 125,000).2.3 Shareholder requirements / listing requirementsShareholder requirementsNo requirements.Listing mandatoryShareholder requirementsThere are no specific shareholder conditions that have to be fulfilled tobecome eligible for the <strong>REIT</strong> status.However, since the <strong>REIT</strong> status is not harmonised with the Council Directive85/611/EEC as of December 20, 1985, restrictions may be applied for a distributionof <strong>REIT</strong>’s units or shares in another Member State of the EU.Listing requirementsListing is not a mandatory requirement to obtain the <strong>REIT</strong> status. Private<strong>REIT</strong>s are allowed.No2.4 Asset level / activity testRestrictions on activities / investments- No more than 20% of its net assets in securities of other companies;- No more than 30% of its net assets in a separate real estate asset or real estate company;- No more than 20% of its net assets in real estate under development;- No more than 40% of its net assets in a single real estate property and any assets requiredfor its maintenance;- No more than 30% of its net assets in securities issued by a single real estate companyincluding liabilities arising from the transactions with real estate company involving derivatives;- No more that 30% of its net assets in the securities in a single real estate company and inthe assets that such real estate company has invested in.- Further restrictions apply.- May invest in real estate abroad.The <strong>REIT</strong> is allowed to invest into the following real estate assets: land,buildings and (or) premises constituting separate real estate objects, registeredin the name of the investment company, and other tangible assets thatare necessary for the operation of the real estate.Following the provisions of the Law on Collective Investment Undertakings,the assets of the <strong>REIT</strong> must consist from at least 4 separate real estateobjects. For the purposes of the diversification of assets, the <strong>REIT</strong> is allowedto invest:no more than 20% of its net assets in securities of other companies or• other liquid assets;no more than 30% of its net assets in a separate real estate asset or real• estate company;no more than 20% of its net assets in real estate under development;• no more than 40% of its net assets in a single real estate property and anyassets required for its maintenance;no more than 30% of its net assets in securities issued by a single real• estate company including liabilities arising from the transactions withreal estate company involving derivatives;no more that 30% of its net assets in the securities in a single real estate• company and in the assets that such real estate company has invested in.« back to content page3