Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

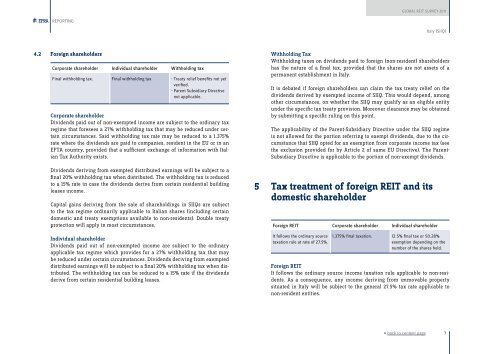

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGItaly (SIIQ)4.2 Foreign shareholdersCorporate shareholder Individual shareholder Withholding taxFinal withholding tax. Final withholding tax. - Treaty relief benefits not yetverified.- Parent Subsidiary Directivenot applicable.Corporate shareholderDividends paid out of non-exempted income are subject to the ordinary taxregime that foresees a 27% withholding tax that may be reduced under certaincircumstances. Said withholding tax rate may be reduced to a 1.375%rate where the dividends are paid to companies, resident in the EU or in anEFTA country, provided that a sufficient exchange of information with ItalianTax Authority exists.Dividends deriving from exempted distributed earnings will be subject to afinal 20% withholding tax when distributed. The withholding tax is reducedto a 15% rate in case the dividends derive from certain residential buildingleases income.Capital gains deriving from the sale of shareholdings in SIIQs are subjectto the tax regime ordinarily applicable to Italian shares (including certaindomestic and treaty exemptions available to non-residents). Double treatyprotection will apply in most circumstances.Individual shareholderDividends paid out of non-exempted income are subject to the ordinaryapplicable tax regime which provides for a 27% withholding tax that maybe reduced under certain circumstances. Dividends deriving from exempteddistributed earnings will be subject to a final 20% withholding tax when distributed.The withholding tax can be reduced to a 15% rate if the dividendsderive from certain residential building leases.Withholding TaxWithholding taxes on dividends paid to foreign (non-resident) shareholdershas the nature of a final tax, provided that the shares are not assets of apermanent establishment in Italy.It is debated if foreign shareholders can claim the tax treaty relief on thedividends derived by exempted income of SIIQ. This would depend, amongother circumstances, on whether the SIIQ may qualify as an eligible entityunder the specific tax treaty provision. Moreover clearance may be obtainedby submitting a specific ruling on this point.The applicability of the Parent-Subsidiary Directive under the SIIQ regimeis not allowed for the portion referring to exempt dividends, due to the circumstancethat SIIQ opted for an exemption from corporate income tax (seethe exclusion provided for by Article 2 of same EU Directive). The Parent-Subsidiary Directive is applicable to the portion of non-exempt dividends.5 Tax treatment of foreign <strong>REIT</strong> and itsdomestic shareholderForeign <strong>REIT</strong> Corporate shareholder Individual shareholderIt follows the ordinary sourcetaxation rule at rate of 27.5%.1.375% final taxation. 12.5% final tax or 50.28%exemption depending on thenumber of the shares held.Foreign <strong>REIT</strong>It follows the ordinary source income taxation rule applicable to non-residents.As a consequence, any income deriving from immovable propertysituated in Italy will be subject to the general 27.5% tax rate applicable tonon-resident entities.« back to content page7