Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

2. ACCOUNTING POLICIES (Continued)<br />

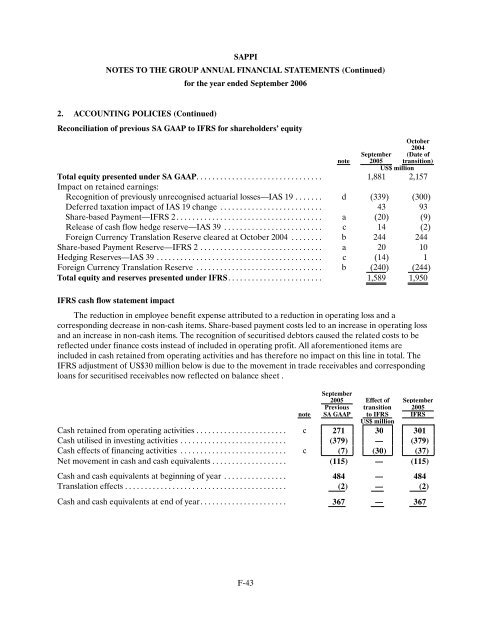

Reconciliation of previous SA GAAP to IFRS for shareholders’ equity<br />

October<br />

<strong>20</strong>04<br />

September (Date of<br />

note <strong>20</strong>05 transition)<br />

US$ million<br />

Total equity presented under SA GAAP................................<br />

Impact on retained earnings:<br />

1,881 2,157<br />

Recognition of previously unrecognised actuarial losses—IAS 19 . . . . . . . d (339 ) (300)<br />

Deferred taxation impact of IAS 19 change .......................... 43 93<br />

Share-based Payment—IFRS 2..................................... a (<strong>20</strong>) (9)<br />

Release of cash flow hedge reserve—IAS 39 ......................... c 14 (2)<br />

Foreign Currency Translation Reserve cleared at October <strong>20</strong>04 . . . . . . . . b 244 244<br />

Share-based Payment Reserve—IFRS 2............................... a <strong>20</strong> 10<br />

Hedging Reserves—IAS 39.......................................... c (14) 1<br />

Foreign Currency Translation Reserve ................................ b (240 ) (244)<br />

Total equity and reserves presented under IFRS........................ 1,589 1,950<br />

IFRS cash flow statement impact<br />

The reduction in employee benefit expense attributed to a reduction in operating loss and a<br />

corresponding decrease in non-cash items. Share-based payment costs led to an increase in operating loss<br />

and an increase in non-cash items. The recognition of securitised debtors caused the related costs to be<br />

reflected under finance costs instead of included in operating profit. All aforementioned items are<br />

included in cash retained from operating activities and has therefore no impact on this line in total. The<br />

IFRS adjustment of US$30 million below is due to the movement in trade receivables and corresponding<br />

loans for securitised receivables now reflected on balance sheet .<br />

September<br />

<strong>20</strong>05 Effect of September<br />

Previous transition <strong>20</strong>05<br />

note SA GAAP to IFRS IFRS<br />

US$ million<br />

Cash retained from operating activities....................... c 271 30 301<br />

Cash utilised in investing activities........................... (379) — (379)<br />

Cash effects of financing activities ........................... c (7) (30 ) (37)<br />

Net movement in cash and cash equivalents................... (115) — (115)<br />

Cash and cash equivalents at beginning of year ................ 484 — 484<br />

Translation effects......................................... (2) — (2)<br />

Cash and cash equivalents at end of year...................... 367 — 367<br />

F-43